- United States

- /

- Luxury

- /

- NYSE:HBI

A Closer Look at Hanesbrands (HBI) Valuation After Recent Share Price Surge

Reviewed by Simply Wall St

See our latest analysis for Hanesbrands.

After a tough start to the year, Hanesbrands’ share price has staged an impressive comeback with a 52% three-month surge. This suggests that market sentiment around its prospects is turning more positive. Despite this recent momentum, the one-year total shareholder return still lags, reflecting longer-term challenges but also highlighting renewed optimism among investors.

If this rebound has you thinking about where else momentum might be building, now is a great time to broaden your search and discover fast growing stocks with high insider ownership

With the stock surging lately, many are asking whether Hanesbrands remains undervalued or if its recent gains now fully reflect the company’s recovery prospects. This raises the question of whether there is little room for further upside.

Most Popular Narrative: Fairly Valued

Hanesbrands' most widely followed narrative puts the fair value at $6.47 per share, just above the last closing price of $6.86, suggesting the stock is trading close to perceived intrinsic value. This proximity between the current valuation and consensus analysis sparks a debate over whether any upside remains for new investors.

Sustained brand reinvestment (doubling prior spending levels) and a focus on innovation (for example, Hanes Moves, expansion into loungewear and scrubs) are increasing brand equity, enabling selective pricing power and premiumization. These factors are likely to support higher net margins and resilience against discount or private label competition.

Want to know which ambitious profit margin leap analysts are betting on? The story hinges on a multi-year transformation driven by surging earnings, new markets, and margin upgrades. But the full roadmap, including the headline assumptions behind that fair value, awaits inside. Dive in to see what could tip the scales.

Result: Fair Value of $6.47 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing softness in core product categories and new competitive pressures could still challenge Hanesbrands' turnaround and broader growth assumptions.

Find out about the key risks to this Hanesbrands narrative.

Another View: How Does Hanesbrands Stack Up on Earnings?

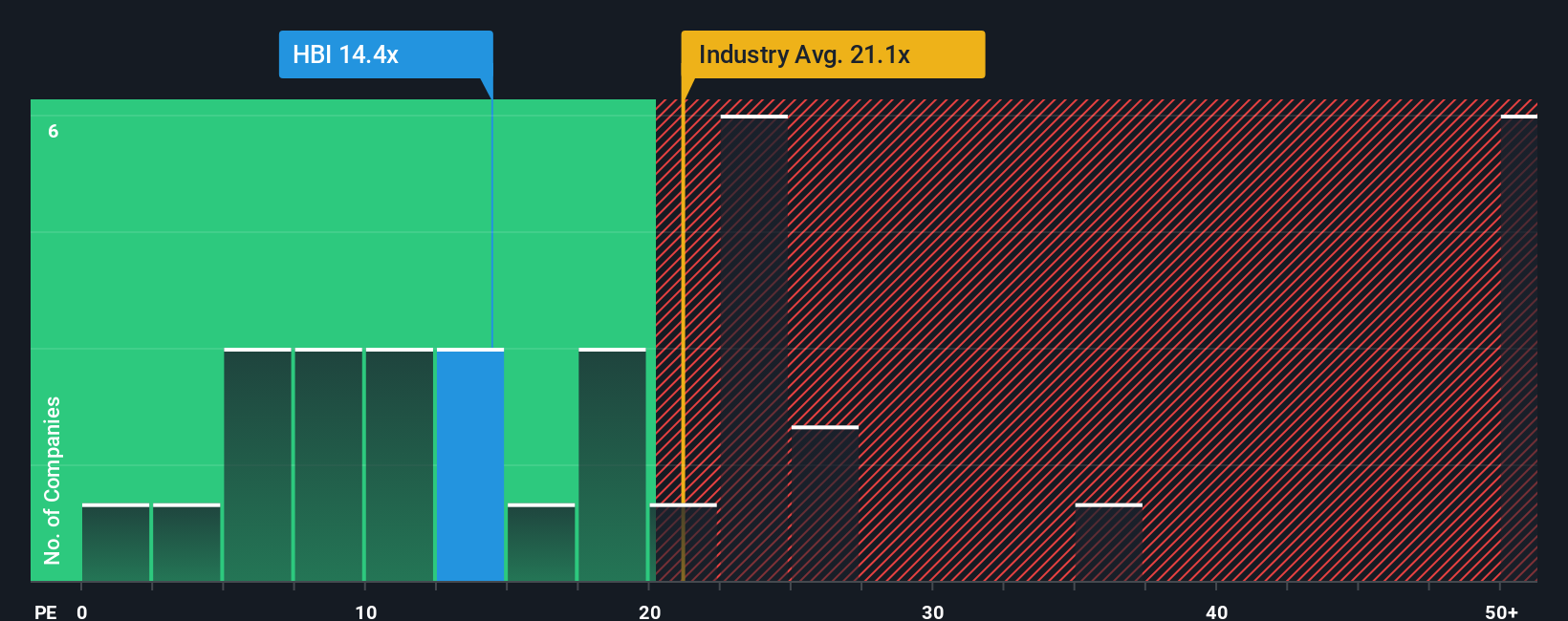

Taking a look at earnings ratios, Hanesbrands trades at about 14.3 times its earnings, which is noticeably cheaper than both its peers (16.5x) and the US Luxury industry average (19.7x). The fair ratio for the stock is estimated at 18.1x, so there is still some potential room for the market’s view to shift upwards as conditions improve. But does this gap signal untapped value, or does it reflect lingering risks that investors should not ignore?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Hanesbrands Narrative

If you want a different perspective or like to verify the analysis yourself, you can easily craft your own Hanesbrands narrative in just a few minutes. Do it your way

A great starting point for your Hanesbrands research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investing Opportunities?

Don’t limit your next move to just one stock. Step up your strategy with powerful stock ideas that might otherwise pass you by on Simply Wall Street.

- Unlock potential with these 877 undervalued stocks based on cash flows showing strong fundamentals and trading below their intrinsic value, which is ideal for bargain hunters seeking real upside.

- Tap into the unstoppable growth of healthcare technology with these 33 healthcare AI stocks as AI-powered innovation enters the medical world and reshapes healthcare as we know it.

- Fuel your portfolio with steady income streams by selecting from these 17 dividend stocks with yields > 3%, a list featuring companies boasting attractive yields over 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hanesbrands might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HBI

Hanesbrands

Designs, manufactures, sources, and sells a range of range of innerwear apparel for men, women, and children in the Americas, Europe, the Asia pacific, and internationally.

Good value with limited growth.

Similar Companies

Market Insights

Community Narratives