- United States

- /

- Consumer Durables

- /

- NYSE:GRMN

How Garmin's (GRMN) Award-Winning Marine Safety Tech Could Shape Its Investment Narrative

Reviewed by Sasha Jovanovic

- Garmin recently announced that its Garmin OnBoard wireless Man Overboard (MOB) and engine cutoff system won the 2025 DAME Design Award in the Safety & Security Aboard category at Metstrade.

- This recognition highlights Garmin's leadership in marine safety technology, featuring wireless tags that enhance on-water safety and comply with U.S. engine cutoff requirements.

- We'll now explore how this award for marine safety innovation could influence Garmin's overall investment narrative and future prospects.

We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Garmin Investment Narrative Recap

To be a Garmin shareholder, you need to believe in the company’s ability to consistently deliver innovation and capture recurring revenue growth across segments like marine, outdoor, and wearables, amid competitive and economic pressures. The recent DAME Design Award for marine safety tech boosts Garmin's reputation for innovation but is unlikely to shift the primary short-term catalyst, which remains the performance of its new subscription-based and wearable offerings. The main risk continues to be margin pressure from persistent softness in marine segment revenue. Among recent developments, the launch of Garmin Connect+, its premium service offering AI-powered insights, stands out as most relevant. This new subscription model is poised to drive higher-margin recurring revenue, addressing key near-term growth catalysts as Garmin navigates shifting market demands and cost challenges. Yet, despite Garmin’s focus on innovation, persistent revenue challenges in the Marine segment remain a critical detail investors should not overlook...

Read the full narrative on Garmin (it's free!)

Garmin's narrative projects $8.5 billion revenue and $1.8 billion earnings by 2028. This requires 7.9% yearly revenue growth and a $0.2 billion earnings increase from $1.6 billion today.

Uncover how Garmin's forecasts yield a $231.14 fair value, a 20% upside to its current price.

Exploring Other Perspectives

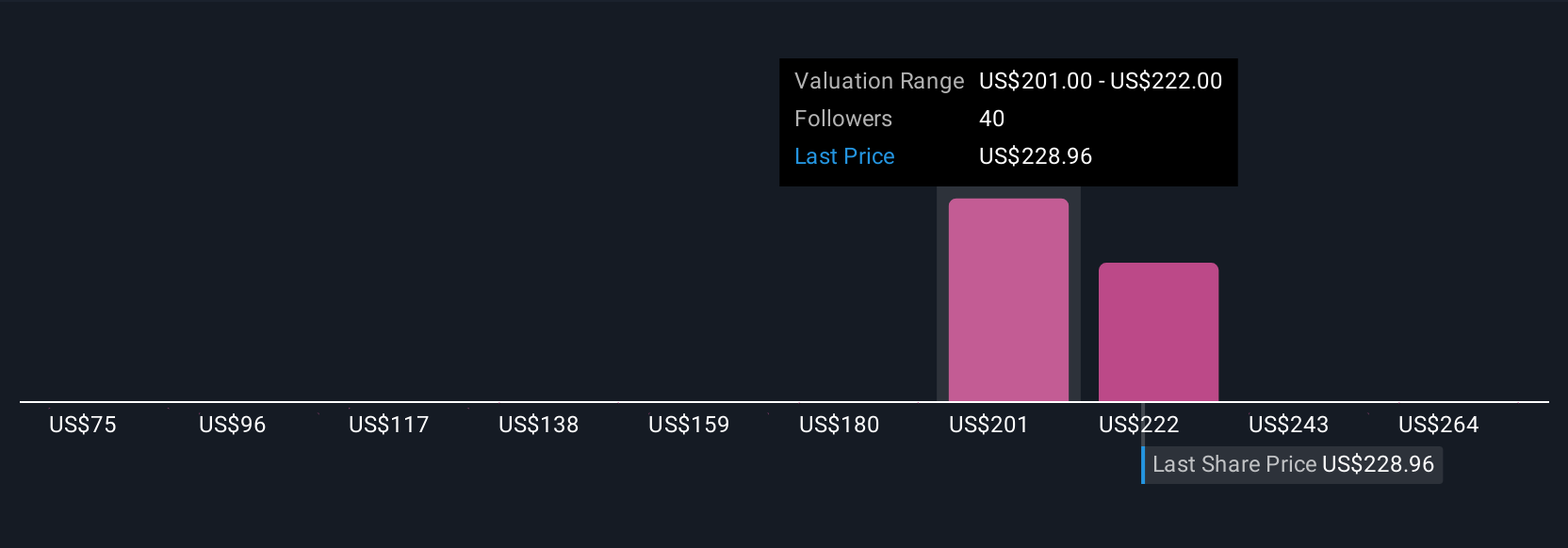

Six fair value estimates from the Simply Wall St Community range widely from US$119 to US$285 per share. While opinions differ, many are watching ongoing softness in marine revenue as a signal for Garmin’s future performance.

Explore 6 other fair value estimates on Garmin - why the stock might be worth as much as 48% more than the current price!

Build Your Own Garmin Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Garmin research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Garmin research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Garmin's overall financial health at a glance.

No Opportunity In Garmin?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GRMN

Garmin

Designs, develops, manufactures, markets, and distributes a range of wireless devices worldwide.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives