- United States

- /

- Consumer Durables

- /

- NYSE:GRMN

Garmin (GRMN) Is Upgraded After Record Q3 and Raised Outlook Is Momentum Sustainable?

Reviewed by Sasha Jovanovic

- Garmin reported record third-quarter results with US$1.77 billion in sales and net income of US$401.62 million, announcing raised full-year guidance for 2025 and continued strong cash generation.

- Robust double-digit revenue growth in the fitness and marine segments, supported by recent innovative product launches, highlighted the company's momentum and positioning ahead of the holiday season.

- We'll examine how Garmin's upgraded earnings outlook and fitness segment momentum influence the company's investment narrative and future expectations.

AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Garmin Investment Narrative Recap

To invest in Garmin, you need to believe in the company's ability to keep driving growth through its leadership in wearables and GPS technology while innovating across multiple segments. The recent record third-quarter results, with robust double-digit fitness and marine revenue growth and an upgraded full-year outlook, bolster the short-term case for strong holiday performance; however, the impact on risks such as margin pressure from rising operating expenses is only partly offset by this momentum.

One announcement that stands out is Garmin's unveiling of the GPSMAP 9000xsv series just ahead of the holiday season. This new marine product aligns closely with recent marine segment growth and supports the company’s near-term catalysts, reinforcing its position in specialized, high-value segments where innovation can underpin sales and margin opportunities.

But in contrast, investors should be aware of the rising operating expenses, particularly if revenue growth were to...

Read the full narrative on Garmin (it's free!)

Garmin's outlook anticipates $8.5 billion in revenue and $1.8 billion in earnings by 2028. This reflects a 7.9% annual revenue growth rate and a $0.2 billion increase in earnings from the current $1.6 billion.

Uncover how Garmin's forecasts yield a $218.33 fair value, in line with its current price.

Exploring Other Perspectives

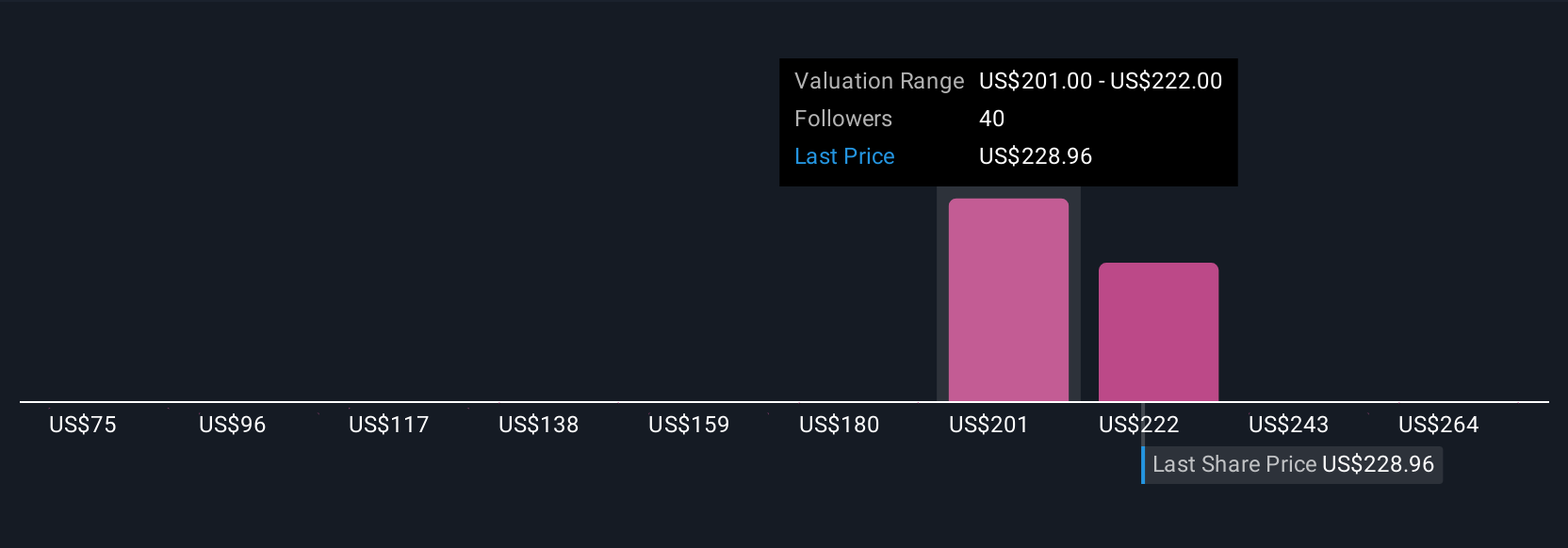

Community members at Simply Wall St assigned fair values for Garmin ranging from US$119 to US$285 based on six distinct analyses. Against this backdrop, the risk of operating expenses climbing faster than revenue highlights why market views and future expectations can vary so widely.

Explore 6 other fair value estimates on Garmin - why the stock might be worth as much as 33% more than the current price!

Build Your Own Garmin Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Garmin research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Garmin research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Garmin's overall financial health at a glance.

Ready For A Different Approach?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Find companies with promising cash flow potential yet trading below their fair value.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GRMN

Garmin

Designs, develops, manufactures, markets, and distributes a range of wireless devices worldwide.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives