- United States

- /

- Consumer Durables

- /

- NYSE:GRMN

A Fresh Look at Garmin (GRMN) Valuation After Record Q3 Results and Raised Guidance

Reviewed by Simply Wall St

Garmin (GRMN) just delivered record third-quarter results, reporting nearly $1.8 billion in revenue and notable growth in its fitness, marine, and aviation segments. The company also raised its full-year earnings guidance, reflecting optimism for the upcoming holiday season.

See our latest analysis for Garmin.

After a big run-up this year, Garmin shares have seen a sharp pullback, down nearly 17% in the past month, as investors digested the latest earnings and outlook. Despite the volatility, the stock is still up about 8.5% on a total return basis over the past year and has delivered outstanding 163% total returns over three years. This shows long-term momentum remains intact even as sentiment cools in the near term.

If Garmin’s mix of innovation and strong brand caught your attention, this is the perfect moment to discover fast growing stocks with high insider ownership.

With shares pulling back after a stellar run, and the company posting record results and raising guidance, investors are left to wonder whether Garmin is undervalued at current levels or if future growth is already priced in.

Most Popular Narrative: 7% Undervalued

Garmin's current fair value, as suggested by the most widely followed narrative, sits above the last closing price. This hints at subtle upside given the company's outlook. With the fair value calculated at $231.14 versus the last close at $213.94, attention turns to the assumptions behind this potential bargain.

The launch of the Garmin Connect+ premium service, which offers AI-based health and fitness insights, is likely to boost subscription-based revenue growth and improve overall margins through higher-margin services. The new vívoactive 6 smartwatch release, with advanced features like an AMOLED display and enhanced sports apps, suggests potential revenue growth in the Fitness segment, supported by strong demand for advanced wearables.

Want to know how much recurring revenue matters or why future product launches drive such a high fair value? The narrative is built on ambitious growth plans, margin shifts, and profit expectations that rival leaders in tech. What are the core financial levers driving this price target? See for yourself in the full breakdown.

Result: Fair Value of $231.14 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, shifts in global trade policies or softness in Garmin’s Marine and Outdoor segments could challenge current growth assumptions and valuation optimism.

Find out about the key risks to this Garmin narrative.

Another View: What Do Market Multiples Say?

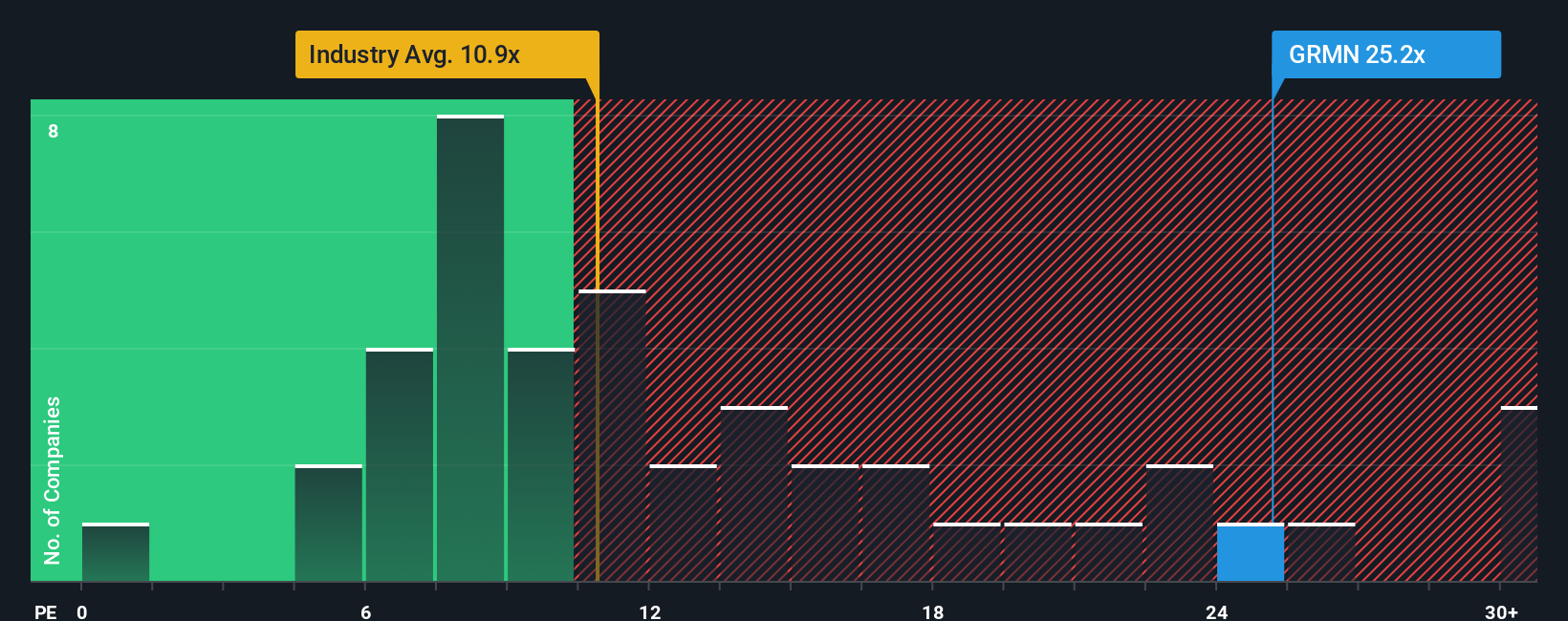

Looking through the lens of market valuation ratios, Garmin shares appear expensive. The company trades at 26.2 times earnings, which is well above both the Consumer Durables industry average of 10.6x and its peer average of 11.8x. Notably, this is also higher than the fair ratio estimated at 18.6x. This gap suggests investors are paying a premium for Garmin's growth and brand. However, does this price leave too little margin for disappointment down the line?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Garmin Narrative

If you think the story here goes deeper or want to dig into the numbers for yourself, you can assemble your own custom narrative in just a few minutes, and Do it your way.

A great starting point for your Garmin research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Opportunities?

Why limit your growth to just one stock? Take charge of your portfolio and seize opportunities most investors overlook using these powerful ideas from Simply Wall Street's screener tools:

- Boost your income potential by checking out these 20 dividend stocks with yields > 3% offering attractive yields above 3%. This is perfect for those prioritizing steady cash flow.

- Be at the forefront of the next tech frontier and uncover these 27 AI penny stocks, which are already shaping artificial intelligence innovation and long-term industry growth.

- Find strong value plays and tap into these 845 undervalued stocks based on cash flows that the market hasn’t fully appreciated yet, putting you ahead of the crowd.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GRMN

Garmin

Designs, develops, manufactures, markets, and distributes a range of wireless devices worldwide.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives