- United States

- /

- Consumer Durables

- /

- NYSE:GRMN

A Fresh Look at Garmin (GRMN) Valuation After Recent Share Price Pullback

Reviewed by Simply Wall St

See our latest analysis for Garmin.

Garmin’s share price has taken a sharp turn this past month. However, when looking at the bigger picture, its three- and five-year total shareholder returns are still impressive, up 122.96% and 81.75% respectively. While recent momentum has faded, investors are considering whether this pullback presents new growth potential or signals changing sentiment.

If you’re curious about other market leaders with surprising returns, now is the perfect time to broaden the search and discover fast growing stocks with high insider ownership

With Garmin now trading about 15% below its estimated intrinsic value and nearly 22% under analyst price targets, the question remains: is this a genuine buying opportunity, or are current prices already factoring in future growth?

Most Popular Narrative: 18% Undervalued

The most widely followed narrative assigns Garmin a fair value well above its last close of $189.62. This illustrates that analysts see notable upside from current levels and frames the company’s growth story as far from over.

The launch of the Garmin Connect+ premium service, which offers AI-based health and fitness insights, is likely to boost subscription-based revenue growth and improve overall margins through higher-margin services. The new vívoactive 6 smartwatch release, with advanced features like an AMOLED display and enhanced sports apps, suggests potential revenue growth in the Fitness segment, supported by strong demand for advanced wearables.

Curious how much future success in wearables, innovative rollouts, and premium subscriptions could shift Garmin’s valuation? The big bet here is on surging demand for next-gen devices and new income streams. Want to see how bullish financial assumptions drive this striking upside versus today’s price? Read the full narrative to uncover what sets this fair value apart.

Result: Fair Value of $231.14 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent market softness in Marine and higher operating expenses could compress margins, which may pose real hurdles to Garmin’s bullish projections.

Find out about the key risks to this Garmin narrative.

Another View: Are Shares Still Expensive?

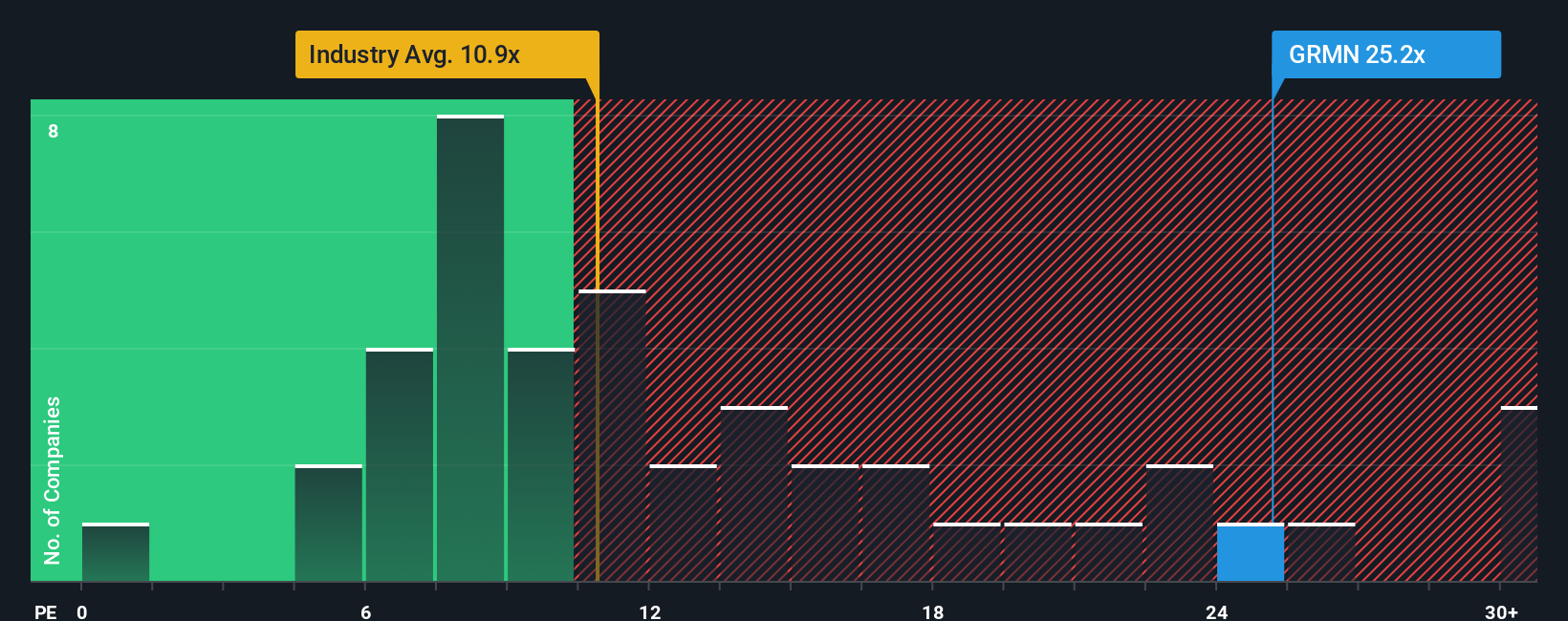

While some see Garmin as undervalued, a closer look at its price-to-earnings ratio tells a different story. Garmin trades at 23.2x earnings, which is noticeably higher than the industry average of 11.1x, its peer average of 21.8x, and the fair ratio of 18.3x. This premium pricing suggests the market is already including a good deal of optimism, increasing the risk that expectations may be set too high. Could this make future growth harder to realize, or is there something the multiples are missing?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Garmin Narrative

If you think the numbers tell a different story or want to dive deeper on your terms, you can shape your own perspective in minutes. Do it your way

A great starting point for your Garmin research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

You could be one smart move away from your next big winner. Turn market momentum in your favour with these powerful stock ideas. Don’t let opportunity pass you by.

- Uncover income potential with these 15 dividend stocks with yields > 3% that boast yields above 3% and reliable financials.

- Catch the AI wave and spot future leaders using these 26 AI penny stocks transforming industries with intelligent innovation.

- Capitalize on emerging mega-trends by checking out these 26 quantum computing stocks that are advancing quantum computing breakthroughs right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GRMN

Garmin

Designs, develops, manufactures, markets, and distributes a range of wireless devices worldwide.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives