- United States

- /

- Consumer Durables

- /

- NYSE:GRBK

Will Texas Exposure Define Green Brick Partners' (GRBK) Competitive Edge or Limiting Factor?

Reviewed by Sasha Jovanovic

- In the past week, an analyst downgraded Green Brick Partners from buy to hold, citing revised forecasts and concerns about its focus on relatively softer Texas markets.

- This shift precedes the company's upcoming third-quarter results, which are expected to offer more detail on performance and market conditions.

- Let's examine how heightened uncertainty about Green Brick's Texas exposure may reshape the company's investment outlook moving forward.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

Green Brick Partners Investment Narrative Recap

Green Brick Partners appeals to investors who believe long-term housing demand in Texas and Georgia will outlast temporary slowdowns, given ongoing demographic shifts and the company’s focus on profitable markets and operational efficiency. The recent analyst downgrade has thrust short-term market conditions into focus, but the biggest immediate catalyst remains the upcoming third-quarter results, which should indicate whether recent softness in Texas is materially impacting earnings, so far, the analyst move has not shifted the most significant risk, which continues to be further margin compression if affordability pressures persist.

Of all recent company updates, the upcoming Q3 2025 earnings report scheduled for October 29 is the most relevant, as it will provide insight into sales pace, margins, and the impact of Green Brick’s geographic concentration. Until these results are released, uncertainty about backlog growth and potential margin pressures, highlighted by analyst concerns, remains at the forefront for investors weighing short-term risks and catalysts.

In contrast, investors should be aware that even with operational strengths, geographic concentration in Texas could amplify swings in financial results if regional housing demand remains...

Read the full narrative on Green Brick Partners (it's free!)

Green Brick Partners' projections indicate $2.0 billion in revenue and $252.1 million in earnings by 2028. This is based on a forecasted annual revenue decline of 2.1% and a decrease in earnings of $95 million from current earnings of $347.1 million.

Uncover how Green Brick Partners' forecasts yield a $62.00 fair value, in line with its current price.

Exploring Other Perspectives

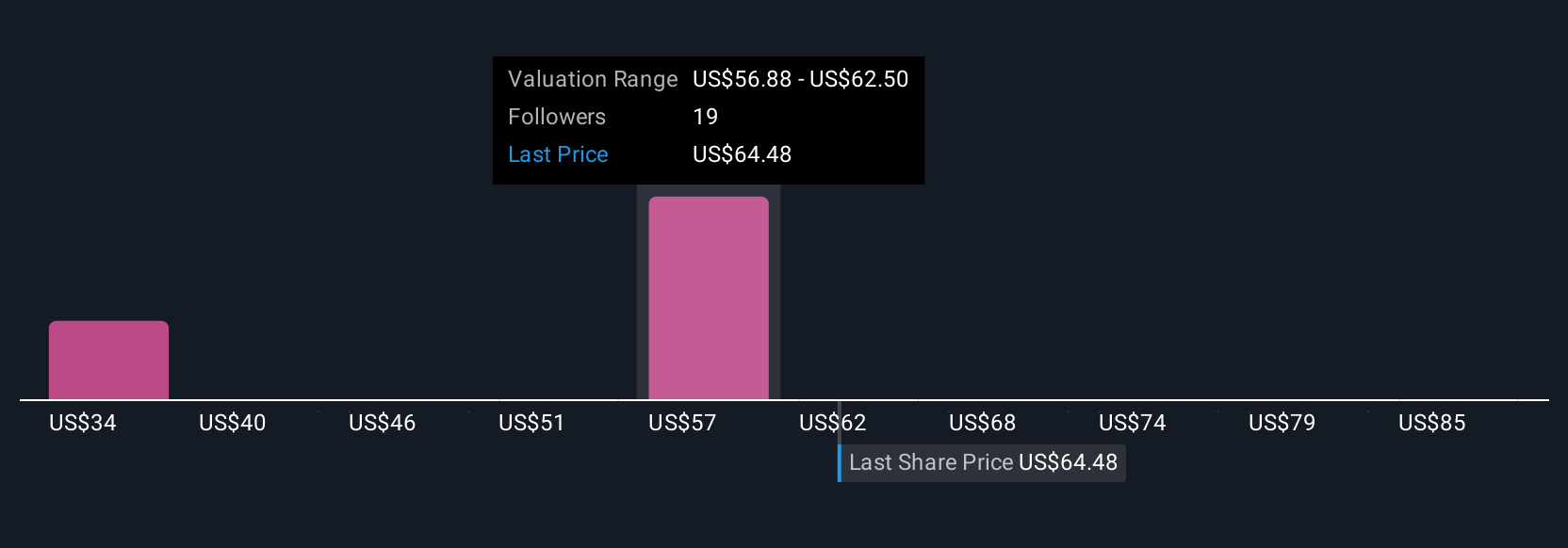

Seven distinct fair value estimates from the Simply Wall St Community span a wide range from US$34 to US$91 per share. While opinions vary, uncertainty around Texas market exposure continues to shape expectations for Green Brick’s future performance, so be sure to consider several viewpoints.

Explore 7 other fair value estimates on Green Brick Partners - why the stock might be worth 46% less than the current price!

Build Your Own Green Brick Partners Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Green Brick Partners research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Green Brick Partners research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Green Brick Partners' overall financial health at a glance.

Ready For A Different Approach?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Rare earth metals are the new gold rush. Find out which 35 stocks are leading the charge.

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GRBK

Green Brick Partners

Green Brick Partners, Inc (NYSE: GRBK), the third largest homebuilder in Dallas-Fort Worth, is a diversified homebuilding and land development company that operates in Texas, Georgia, and Florida.

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives