- United States

- /

- Consumer Durables

- /

- NYSE:GRBK

Green Brick Partners (GRBK): Assessing Valuation as Margin Pressures and Affordability Challenges Shape Outlook

Reviewed by Kshitija Bhandaru

Green Brick Partners (GRBK) is in the spotlight as investors weigh how rising interest rates and ongoing affordability challenges are shaping the company's margin outlook. The latest responses from management have sparked new questions about future earnings power.

See our latest analysis for Green Brick Partners.

Green Brick Partners has seen its share price climb an impressive 26.7% year-to-date, but the 1-year total shareholder return is down 11%. This is a sign that while short-term price momentum has been strong, many investors remain cautious as operational risks come into sharper focus. Despite the solid gains in recent months, the pullback over the past week reflects increased sensitivity to economic conditions and evolving expectations around the housing market’s outlook.

If your interest in housing stocks has you searching for new growth stories, now might be the perfect moment to broaden your search and discover fast growing stocks with high insider ownership

With shares still hovering above where analysts peg their fair value, yet margin pressures mounting, investors are left to wonder whether the stock’s upside is fully realized or if a real buying opportunity is emerging.

Most Popular Narrative: 13% Overvalued

With Green Brick Partners trading around $70, the most widely followed narrative sees fair value closer to $62. This signals a valuation disconnect that could catch investors off guard.

Geographic concentration in Texas and Georgia heightens exposure to localized economic, regulatory, or inventory risks. This could amplify revenue volatility and earnings risk if Sunbelt migration patterns slow or regional economies soften.

Want to see what’s driving this bold assessment? The narrative’s assumptions hinge on lower projected margins, shrinking top-line growth, and a future profit multiple that demands investor conviction. Which financial levers make or break the case? Dive in to uncover the critical details that shape the analyst consensus and decide whether this potential overvaluation is really justified.

Result: Fair Value of $62 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing demographic shifts into Texas and Atlanta, along with Green Brick's strong margins, could drive upside and challenge the current valuation narrative.

Find out about the key risks to this Green Brick Partners narrative.

Another View: Market Multiples Tell a Different Story

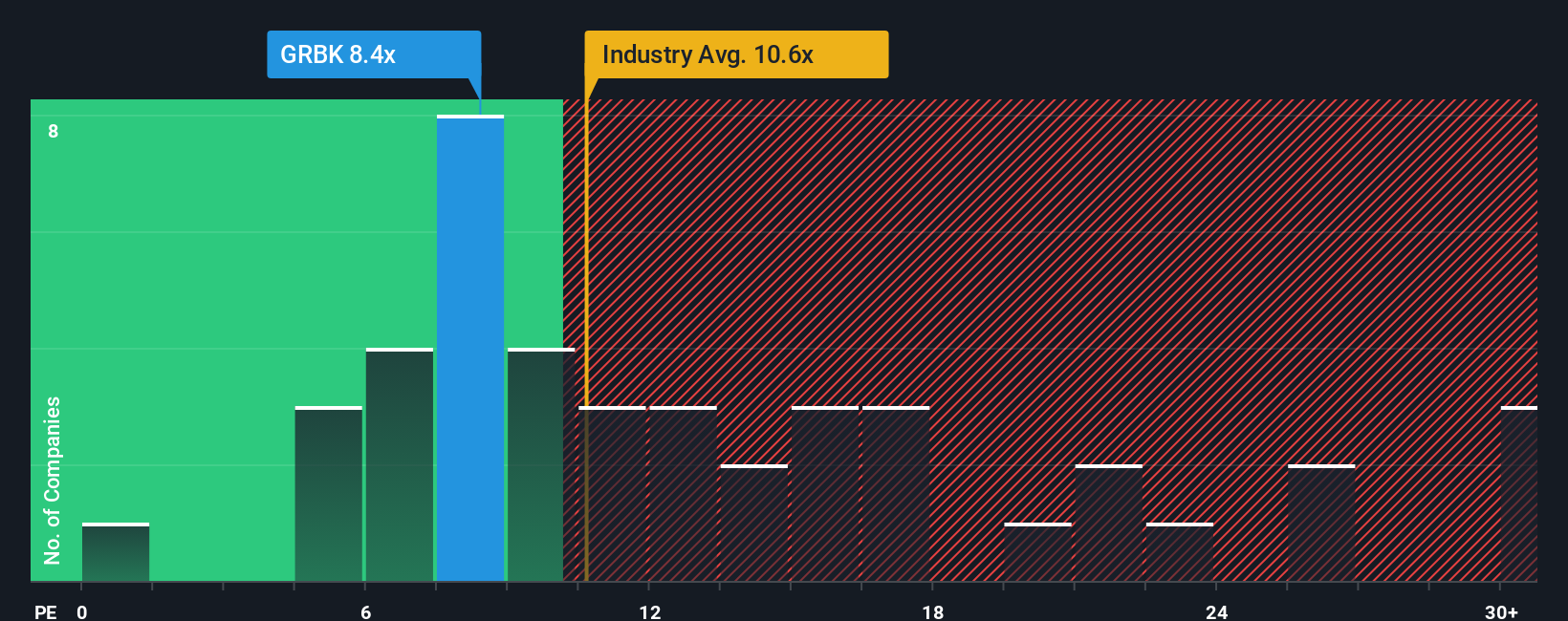

While the fair value scenario relies on analyst forecasts, the market’s preferred price-to-earnings ratio shows a more optimistic perspective. Green Brick Partners trades at 8.8x earnings, which is noticeably below peers at 9.9x and the Consumer Durables industry average of 11.2x. Even the fair ratio is higher at 11.5x. Could this relative discount provide an opportunity for value-seeking investors, or might it signal risks that have not yet been factored in?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Green Brick Partners Narrative

If you see the story differently or want to dig into the numbers yourself, it’s easy to craft your own take in just a few minutes with Do it your way

A great starting point for your Green Brick Partners research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t let tomorrow’s opportunities pass you by. Supercharge your portfolio now with smart picks tailored for today’s market mindset. Here’s where to start:

- Capture growth potential by scanning these 897 undervalued stocks based on cash flows for stocks trading below their intrinsic value and poised for strong gains.

- Target reliable payouts with these 19 dividend stocks with yields > 3% featuring high-yield options to help you build income and financial security.

- Ride the wave of disruption by tapping into game-changing innovation in artificial intelligence with these 25 AI penny stocks right at your fingertips.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GRBK

Green Brick Partners

Green Brick Partners, Inc (NYSE: GRBK), the third largest homebuilder in Dallas-Fort Worth, is a diversified homebuilding and land development company that operates in Texas, Georgia, and Florida.

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives