- United States

- /

- Luxury

- /

- NYSE:FIGS

FIGS’ (FIGS) NYC Store Opening Could Be a Game Changer for Its Retail Expansion Strategy

Reviewed by Sasha Jovanovic

- FIGS recently opened its latest Community Hub store on New York City’s Upper East Side, offering features like a Color Clinic and Customization Station near major healthcare facilities.

- This expansion highlights the company’s effort to grow its physical retail presence and create deeper brand connections in key healthcare markets.

- We’ll explore how FIGS’ move into a prominent New York City location could influence its investment outlook and competitive positioning.

These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

FIGS Investment Narrative Recap

To own a piece of FIGS, an investor should believe that premium healthcare apparel can translate into sustained repeat purchases and margin expansion as the healthcare workforce grows and e-commerce gains share. The latest New York City Community Hub launch may boost FIGS' brand presence short term, but the most important current catalyst remains top-line growth, while tariff exposure and execution around new initiatives still pose the biggest risks. This store opening alone is not a material offset to those factors.

Among recent company updates, the Q3 2025 earnings results stand out: FIGS reported year-on-year revenue growth and returned to net profitability, with sales reaching US$151.66 million and net income of US$8.75 million. Compared to the Community Hub rollout, these results are a better indicator of whether increasing retail exposure will translate into broader customer growth and improved profitability.

However, against this improving operational backdrop, investors should remain attentive to how rising inventory levels and global expansion may amplify risk if...

Read the full narrative on FIGS (it's free!)

FIGS' narrative projects $656.8 million revenue and $37.0 million earnings by 2028. This requires 4.9% yearly revenue growth and a $29.8 million earnings increase from $7.2 million today.

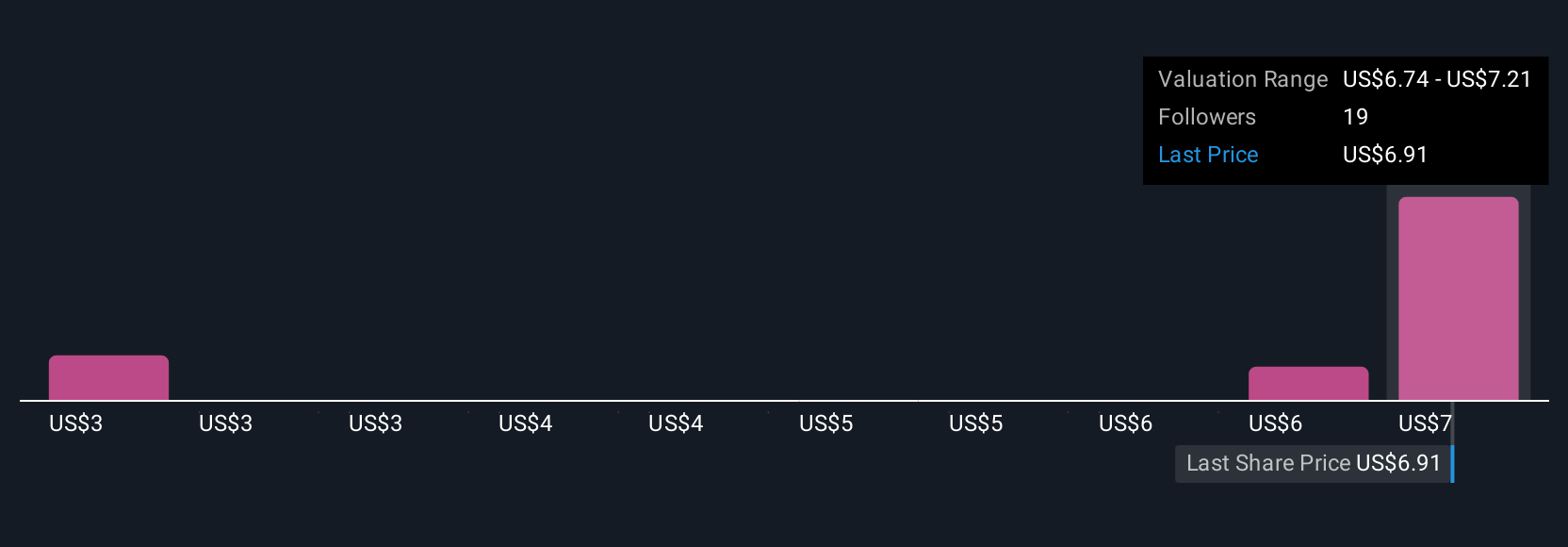

Uncover how FIGS' forecasts yield a $7.74 fair value, a 15% downside to its current price.

Exploring Other Perspectives

You can see four different fair value estimates for FIGS from the Simply Wall St Community, ranging from US$2.37 to US$8.00 per share. While many are watching for further customer and revenue growth, rising execution risk linked to new stores and expansion could have a lasting effect on future outcomes, make sure to compare the full diversity of opinions before making your own assessment.

Explore 4 other fair value estimates on FIGS - why the stock might be worth as much as $8.00!

Build Your Own FIGS Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your FIGS research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free FIGS research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate FIGS' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FIGS

FIGS

Together with its subsidiary, FIGS Canada, Inc., operates as a direct-to-consumer healthcare apparel and lifestyle company in the United States and internationally.

Flawless balance sheet with proven track record.

Market Insights

Community Narratives