- United States

- /

- Consumer Services

- /

- NYSE:NRDY

3 US Penny Stocks With Market Caps Below $900M

Reviewed by Simply Wall St

As of November 2024, the U.S. stock market is experiencing turbulence, with major indexes recording weekly losses amid a decline in big-tech stocks and ongoing economic uncertainties. In such a volatile environment, investors often look beyond large-cap companies to explore opportunities in smaller or newer firms, where penny stocks—despite their somewhat outdated moniker—remain a relevant area of interest. These stocks can offer intriguing prospects when they are underpinned by solid financial health and potential for long-term growth.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Financial Health Rating |

| BAB (OTCPK:BABB) | $0.8379 | $6.09M | ★★★★★★ |

| RLX Technology (NYSE:RLX) | $1.69 | $2.15B | ★★★★★★ |

| Golden Growers Cooperative (OTCPK:GGRO.U) | $4.50 | $69.71M | ★★★★★★ |

| QuantaSing Group (NasdaqGM:QSG) | $3.08 | $143.12M | ★★★★★★ |

| So-Young International (NasdaqGM:SY) | $1.25 | $90.58M | ★★★★☆☆ |

| LexinFintech Holdings (NasdaqGS:LX) | $3.22 | $529.41M | ★★★★★★ |

| Greenland Technologies Holding (NasdaqCM:GTEC) | $2.20 | $29.91M | ★★★★★★ |

| PHX Minerals (NYSE:PHX) | $3.71 | $139.05M | ★★★★★☆ |

| CBAK Energy Technology (NasdaqCM:CBAT) | $0.942 | $84.72M | ★★★★★☆ |

| Zynerba Pharmaceuticals (NasdaqCM:ZYNE) | $1.30 | $65.6M | ★★★★★☆ |

Click here to see the full list of 747 stocks from our US Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Crown Crafts (NasdaqCM:CRWS)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Crown Crafts, Inc., with a market cap of $47.14 million, operates in the consumer products industry through its subsidiaries, serving both the United States and international markets.

Operations: The company has not reported any specific revenue segments.

Market Cap: $47.14M

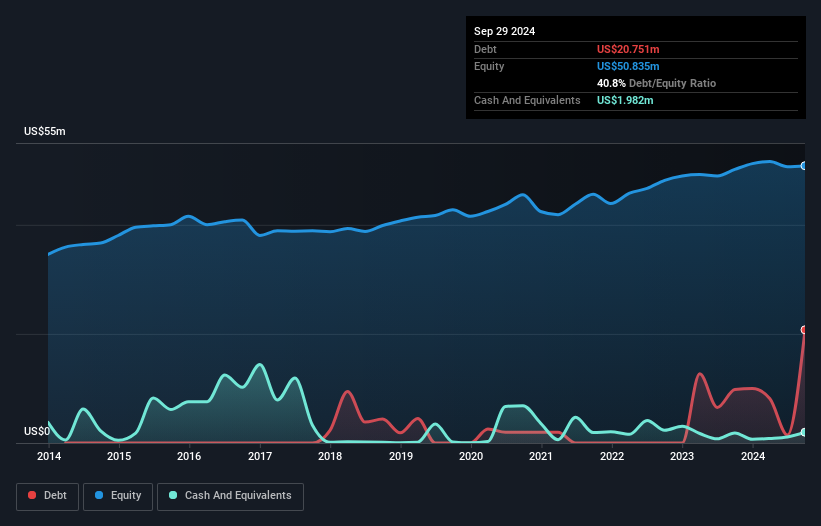

Crown Crafts, Inc., with a market cap of US$47.14 million, faces challenges typical of penny stocks, such as low return on equity (6.4%) and declining net profit margins (3.7% from 5.3% last year). Despite this, its short-term assets exceed both short and long-term liabilities, indicating financial stability. The company's debt is well covered by operating cash flow (42.2%), although the debt-to-equity ratio has increased to 40.8%. Recent earnings show a decline in net income compared to the previous year but maintain stable revenue figures around US$24 million for Q2 2024.

- Jump into the full analysis health report here for a deeper understanding of Crown Crafts.

- Review our historical performance report to gain insights into Crown Crafts' track record.

FIGS (NYSE:FIGS)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: FIGS, Inc. is a direct-to-consumer healthcare apparel and lifestyle company operating in the United States and internationally, with a market cap of approximately $835.47 million.

Operations: The company generates revenue through its online retail segment, totaling $548.64 million.

Market Cap: $835.47M

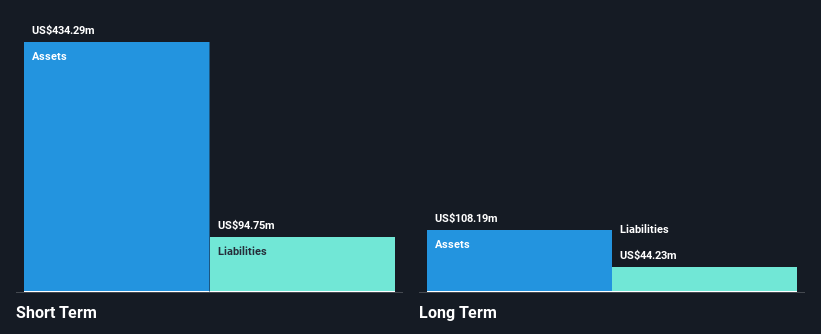

FIGS, Inc., with a market cap of US$835.47 million, navigates the penny stock landscape with mixed financial signals. The company's short-term assets significantly surpass both short and long-term liabilities, indicating solid liquidity. However, FIGS reported a net loss of US$1.7 million for Q3 2024 compared to net income last year, reflecting challenges in profitability despite stable revenue figures around US$140 million for the quarter. The company remains debt-free but faces volatility in its share price and has a relatively inexperienced management team. Recent retail expansion efforts include opening its second Community Hub in Philadelphia to strengthen brand presence among healthcare professionals.

- Get an in-depth perspective on FIGS' performance by reading our balance sheet health report here.

- Explore FIGS' analyst forecasts in our growth report.

Nerdy (NYSE:NRDY)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Nerdy, Inc. operates a platform for live online learning and has a market cap of approximately $172.42 million.

Operations: The company generates revenue from its Educational Services segment, specifically in Education & Training Services, totaling $197.33 million.

Market Cap: $172.42M

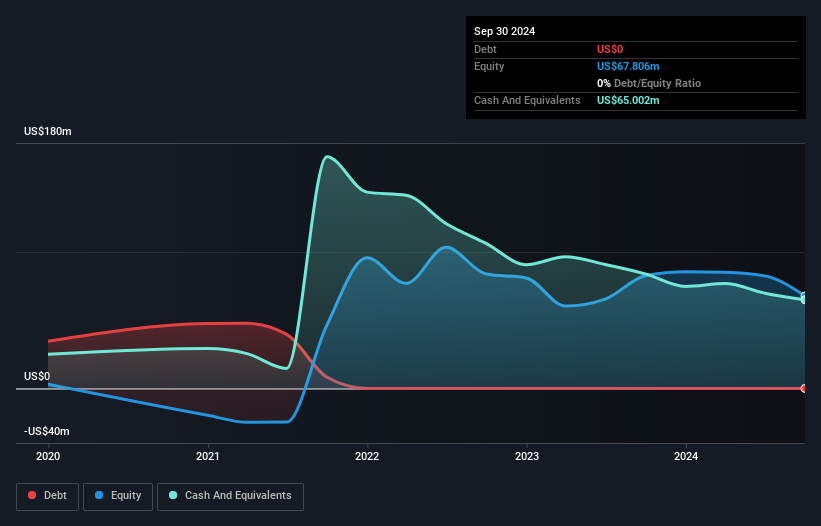

Nerdy, Inc., with a market cap of US$172.42 million, faces challenges typical of penny stocks, including high share price volatility and recent shareholder dilution. Despite generating US$197.33 million in revenue from educational services, the company remains unprofitable with increasing losses over five years. Nerdy's financial stability is supported by US$65 million in cash and no debt, providing liquidity for growth initiatives. However, it received a NYSE notice for non-compliance due to its stock trading below $1.00 per share; potential remedies include a reverse stock split pending shareholder approval to maintain its listing status while continuing business operations uninterrupted.

- Take a closer look at Nerdy's potential here in our financial health report.

- Evaluate Nerdy's prospects by accessing our earnings growth report.

Summing It All Up

- Embark on your investment journey to our 747 US Penny Stocks selection here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nerdy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NRDY

Excellent balance sheet and good value.