- United States

- /

- Consumer Durables

- /

- NYSE:DHI

D.R. Horton (DHI): Exploring Valuation After This Week’s Share Price Surge

Reviewed by Simply Wall St

D.R. Horton (DHI) stock is attracting investor attention this week, and recent trends in both the share price and fundamentals have left some questions about future direction. Let's take a closer look at what is driving the conversation around this builder.

See our latest analysis for D.R. Horton.

The recent surge in D.R. Horton’s share price, up nearly 14% in the past week, suggests renewed optimism after months of muted trading and a modest 1-year total shareholder return of -6.4%. Over the longer term, those who’ve held on since before the pandemic are still sitting on strong gains, with momentum appearing to rebuild.

If the rebound in D.R. Horton’s shares has you wondering what else could be gaining steam, now is the perfect time to broaden your perspective and check out fast growing stocks with high insider ownership

With momentum returning yet fundamentals delivering only modest growth, does D.R. Horton represent an undervalued opportunity, or is the market already pricing in its future prospects for this well-known homebuilder?

Most Popular Narrative: 4.9% Undervalued

With D.R. Horton’s fair value pegged at $164.80, just above the last close of $156.76, the prevailing narrative considers the stock slightly undervalued. This suggests a measured upside based on current projections and underlying company strengths.

The company's continued strategic expansion of entry-level and affordable home offerings enables it to address affordability concerns, tap into a wider buyer pool, and maintain high absorption rates. This helps mitigate cyclical margin compression and sustain revenue even in softer market conditions.

Want to know what bold assumptions drive this valuation? The story involves relentless expansion into new markets, disciplined buybacks, and a future profit profile that may surprise you. Check the full narrative to see all the projections fueling this fair value.

Result: Fair Value of $164.80 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent affordability pressures or unexpectedly high land costs could strain D.R. Horton’s margins. This could potentially challenge the bullish outlook now taking hold.

Find out about the key risks to this D.R. Horton narrative.

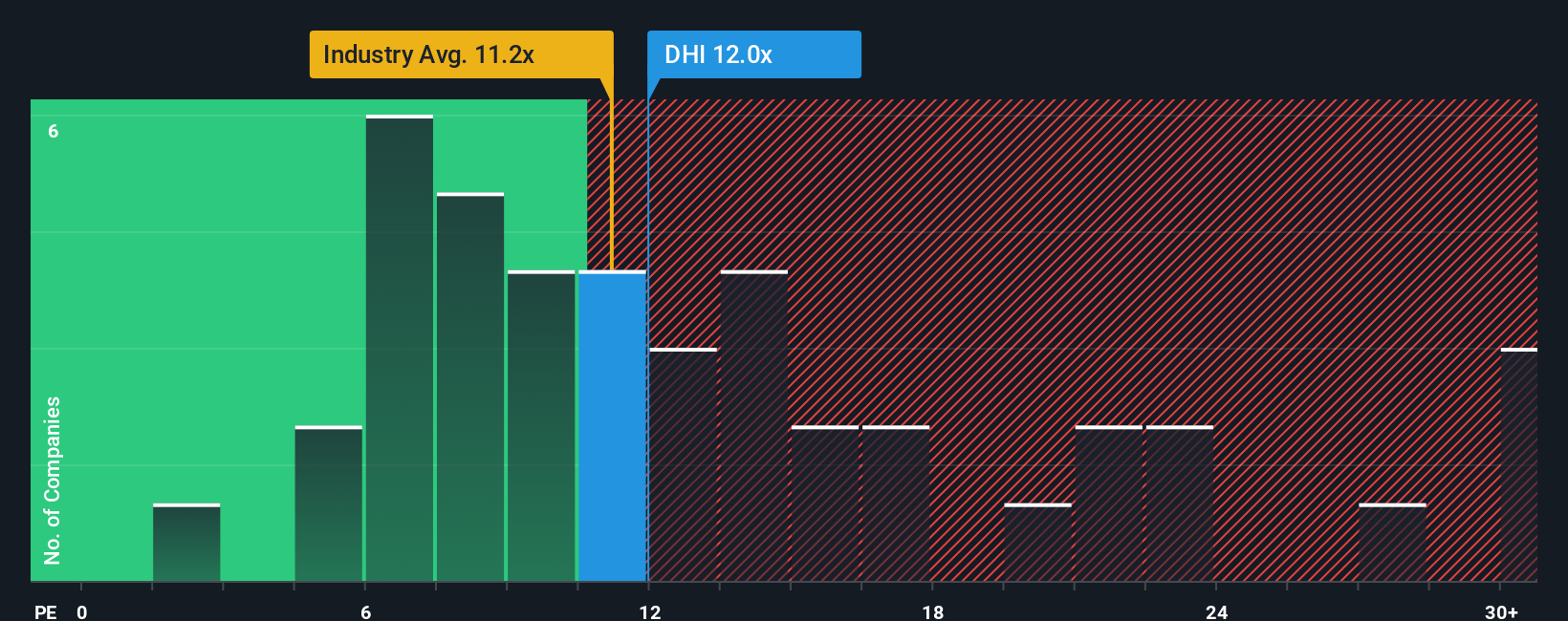

Another View: How Multiples Stack Up

Looking at another common yardstick, D.R. Horton trades at a price-to-earnings ratio of 12.8x. This is above both the industry average (11.6x) and similar peers (11.7x). Compared to its fair ratio of 19.4x, however, the stock still seems reasonably priced. Does this premium signal hidden risk, or could the market eventually move closer to that fair ratio?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own D.R. Horton Narrative

If you see things differently or want to put your own analysis to the test, you can craft a personalized narrative yourself in just a few minutes. Do it your way

A great starting point for your D.R. Horton research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Ideas?

Hundreds of unique opportunities are waiting beyond just D.R. Horton. Let yourself in on the next big moves before others catch on. Start building a watchlist that works as hard as you do.

- Uncover untapped growth as you search for value with these 928 undervalued stocks based on cash flows, revealing stocks the market may be overlooking.

- Capture strong recurring income streams by checking out these 15 dividend stocks with yields > 3%, featuring companies offering yields that could boost your portfolio's cash flow.

- Get ahead of the innovation curve by scoping out these 25 AI penny stocks, where artificial intelligence is powering tomorrow's winners.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DHI

D.R. Horton

Operates as a homebuilding company in East, North, Southeast, South Central, Southwest, and Northwest regions in the United States.

Excellent balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success