- United States

- /

- Consumer Durables

- /

- NYSE:DHI

D.R. Horton (DHI): Examining Valuation as Housing Sector Sentiment Cools

Reviewed by Simply Wall St

D.R. Horton (DHI) shares have edged up in recent trading, rising just under 1% over the past day. Investors seem to be weighing company fundamentals and broader housing sector trends as they consider the stock's next move.

See our latest analysis for D.R. Horton.

D.R. Horton’s share price has cooled alongside housing sector sentiment, sliding over the last month and down nearly 10% in the past 30 days. Momentum has tapered compared to the stellar multi-year run that saw a 73% total return over three years and 96% over five years. Despite the recent dip, long-term holders have still seen substantial gains. This highlights how sentiment shifts can create new opportunities and risks for investors.

If you’re tracking what else is shaping up beyond homebuilders, now’s a great time to broaden your search and discover fast growing stocks with high insider ownership

With shares down from recent peaks but fundamentals still solid, is D.R. Horton set for a rebound or are investors right to wonder if all future growth is already reflected in the current price?

Most Popular Narrative: 16% Undervalued

The most closely followed narrative currently sees D.R. Horton's fair value at $164.80, which is well above the latest close of $138.45. This perspective implies the market could be underestimating the company's earnings power. Here is what drives that view.

Vertical integration, efficient operations, industry consolidation, and disciplined financial management enable cost control, margin protection, and consistent market share gains.

Which bold financial moves are really fueling that upside? The narrative's estimated fair value comes from surprisingly optimistic assumptions about profit trajectory, operational discipline, and market share growth that most investors may have missed. Curious what the biggest swing factor is? The answer might show just how much growth and risk is packed into these projections.

Result: Fair Value of $164.80 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent affordability challenges and rising land costs could weigh on margins, which challenges the view that D.R. Horton remains undervalued in this market.

Find out about the key risks to this D.R. Horton narrative.

Another View: Value Through the Market Lens

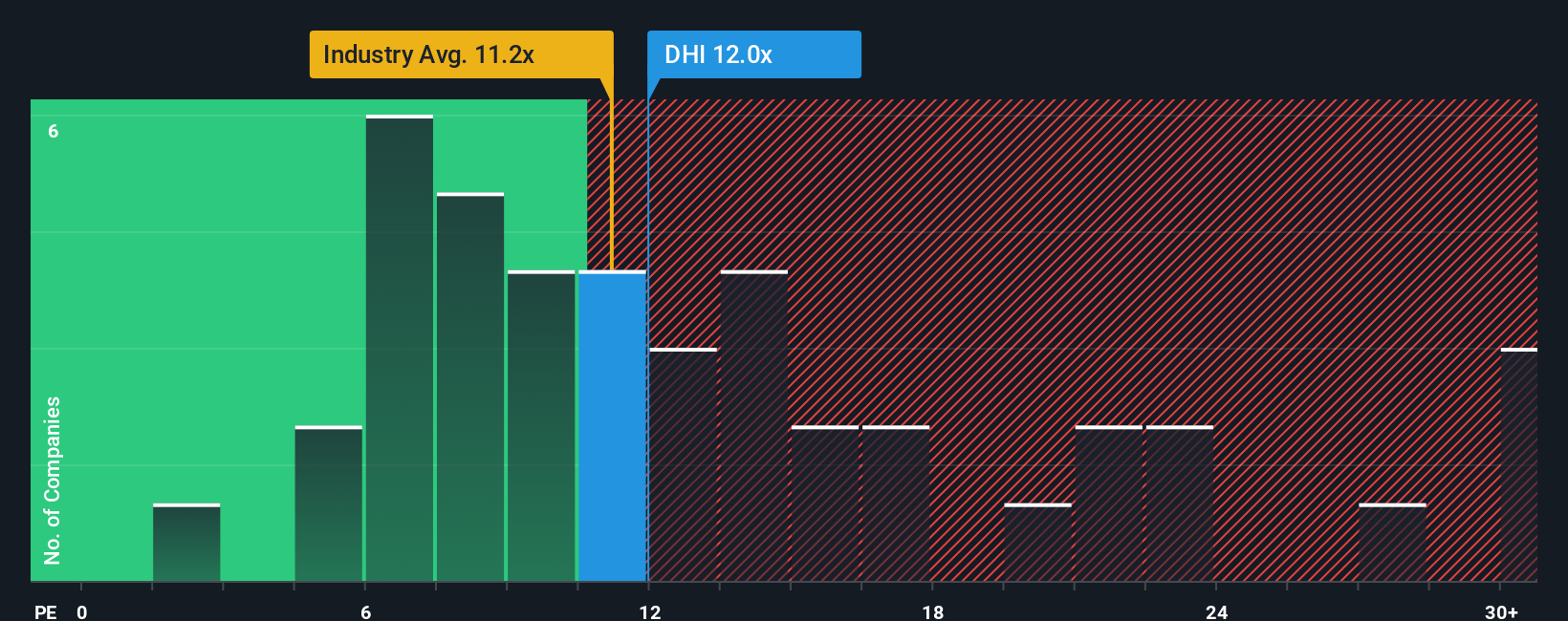

While some see D.R. Horton as undervalued based on fair value estimates, a look at its price-to-earnings ratio raises questions. The current ratio stands at 11.4x, slightly above peers at 10.6x and the industry average of 11x. However, it remains well below the fair ratio of 19.1x. This gap could signal untapped opportunity or simply highlight valuation risk, depending on whether the market reprices or holds steady. Could upside or downside be closer than investors think?

See what the numbers say about this price — find out in our valuation breakdown.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out D.R. Horton for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 906 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own D.R. Horton Narrative

If you're not convinced by these perspectives, or want to dig deeper into the numbers yourself, it's easy to build your own narrative in just a few minutes. Do it your way

A great starting point for your D.R. Horton research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Opportunities?

Don’t just watch from the sidelines while others spot tomorrow’s winners first. Unlock powerful investment themes with proven track records by taking your research to the next level.

- Capture potential upside from emerging trends by checking out these 27 AI penny stocks which are poised for growth in artificial intelligence advancements.

- Maximize your income stream by browsing these 18 dividend stocks with yields > 3% that offer attractive yields above 3% and reliable payout histories.

- Get ahead of market underestimations and invest with confidence using these 906 undervalued stocks based on cash flows filtered by strong cash flow fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DHI

D.R. Horton

Operates as a homebuilding company in East, North, Southeast, South Central, Southwest, and Northwest regions in the United States.

Excellent balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives