- United States

- /

- Consumer Durables

- /

- NYSE:DFH

Has the Recent 24% Drop Created an Opportunity in Dream Finders Homes for 2025?

Reviewed by Bailey Pemberton

- Wondering whether Dream Finders Homes is a hidden bargain, an overpriced risk, or something in between? You are not alone. Today's market moves have many investors asking the same question.

- The stock has taken a wild ride recently, dropping 10.6% in the last week and down 24.6% over the past month, with year-to-date returns at -15.7%. Looking further back, shares are still up an impressive 92.9% over the last three years, even after a tough 12 months marked by a -38.9% decline.

- Much of this volatility has been fueled by sector-wide concerns about new home sales and mortgage rates. News reports have also highlighted Dream Finders Homes' continued expansion into key growth markets. Headlines suggest management is actively pursuing land acquisition despite short-term uncertainty, positioning the business for potential future rebounds.

- According to our analysis, the company scores a 3 out of 6 on our valuation checks, indicating it's undervalued in half of our preferred measures. We'll break down the strengths and limitations of the main valuation methods next, and provide a look at what might be an even smarter way to judge value at the end of this article.

Find out why Dream Finders Homes's -38.9% return over the last year is lagging behind its peers.

Approach 1: Dream Finders Homes Discounted Cash Flow (DCF) Analysis

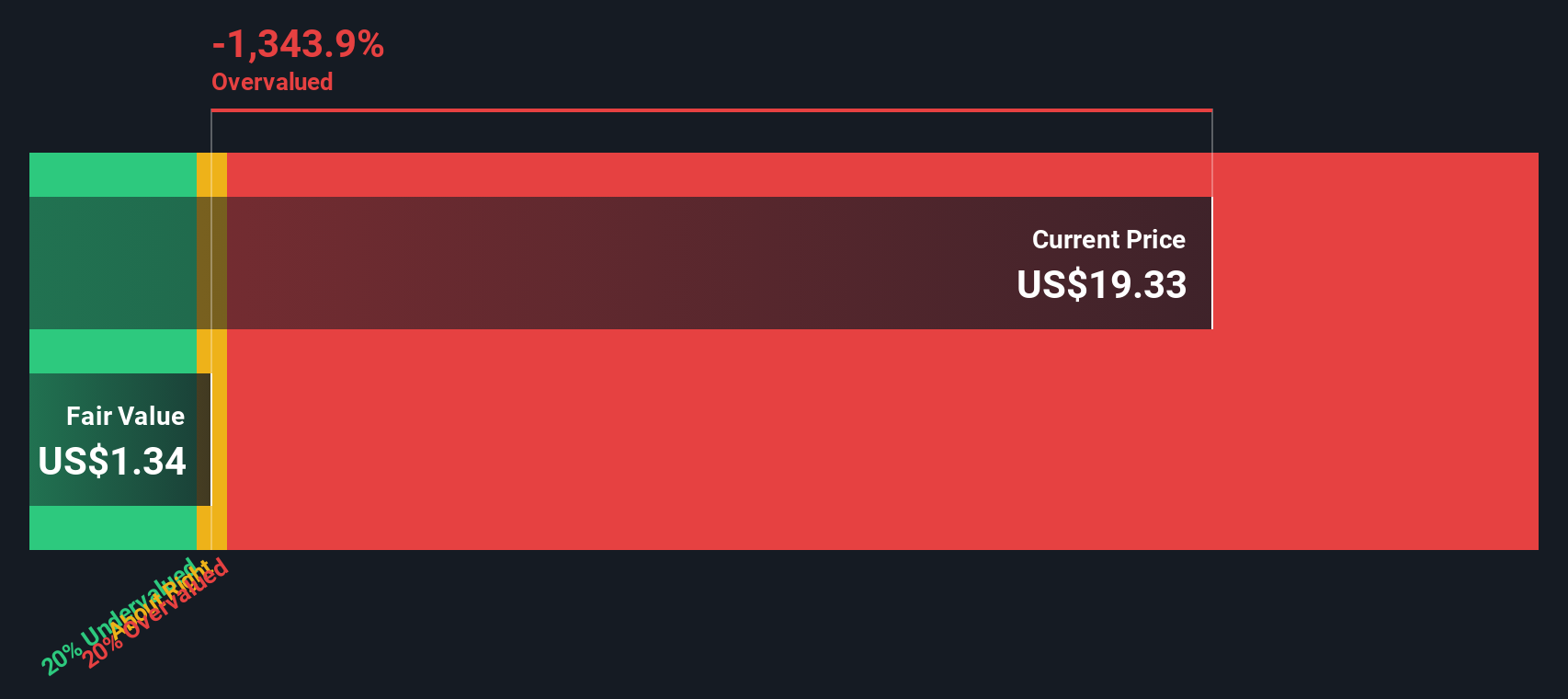

The Discounted Cash Flow (DCF) method estimates a company's value by projecting its future cash flows and discounting them back to today's dollars. For Dream Finders Homes, this model uses the 2 Stage Free Cash Flow to Equity approach, which relies on a series of detailed cash flow projections and market estimates.

The current Free Cash Flow for Dream Finders Homes stands at $43.6 million. Looking ahead, annual cash flows are forecast to decline over the next decade, with analysts anticipating $23.9 million in 2026 and projections declining further to roughly $9.7 million in 2035. It is important to note that estimates beyond five years are extrapolated rather than directly forecast by analysts. This adds a layer of uncertainty beyond 2028.

Based on these cash flow projections, the DCF model calculates an intrinsic value of $1.34 per share. This result implies that the current market price is a significant 1343.9% above the DCF-implied fair value, indicating the stock trades substantially above what the cash flow model suggests it is worth.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Dream Finders Homes may be overvalued by 1343.9%. Discover 836 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Dream Finders Homes Price vs Earnings

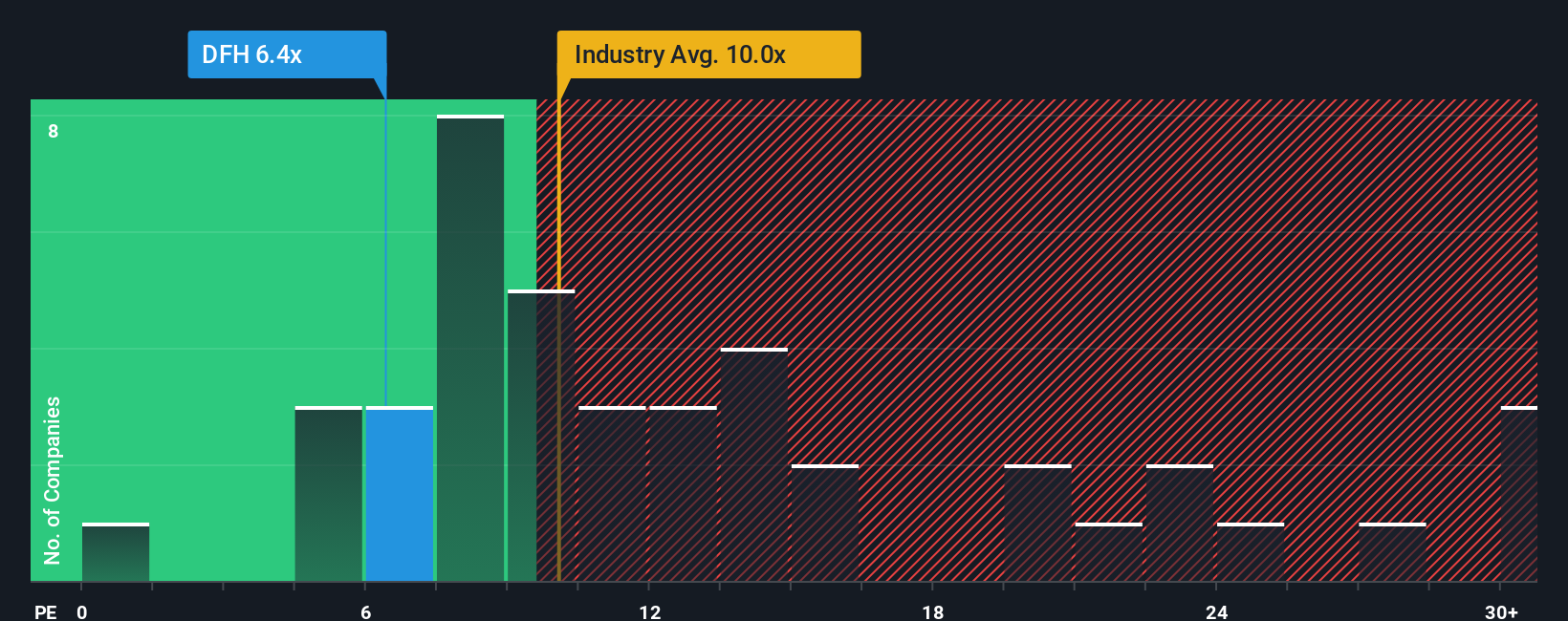

The Price-to-Earnings (PE) ratio is a widely used metric for valuing profitable companies like Dream Finders Homes because it shows how much investors are willing to pay for every dollar of earnings. It works best for established firms generating steady profits, making it a relevant measure in this case.

Growth expectations and risk play a big role in what counts as a "normal" or "fair" PE ratio. High-growth companies or those in less risky industries can justify higher PE ratios. Businesses facing more uncertainty or slower expansion typically trade at lower multiples.

Dream Finders Homes currently trades at a PE ratio of 6.54x. This is lower than both the Consumer Durables industry average of 10.86x and the peer average of 8.08x. On first glance, this suggests the stock might be undervalued versus its competitors.

However, Simply Wall St provides a Fair Ratio of 10.71x for Dream Finders Homes. This proprietary calculation goes beyond peer or industry benchmarks by factoring in specific characteristics such as the company’s earnings growth outlook, margins, size, and unique risk profile. As a result, it delivers a more nuanced view of what the company "should" trade at and helps investors avoid comparisons that overlook key differences between companies.

Comparing the actual PE ratio of 6.54x with the Fair Ratio of 10.71x indicates that Dream Finders Homes is trading at a significant discount to fair value on this measure, pointing to a potentially undervalued stock.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1406 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Dream Finders Homes Narrative

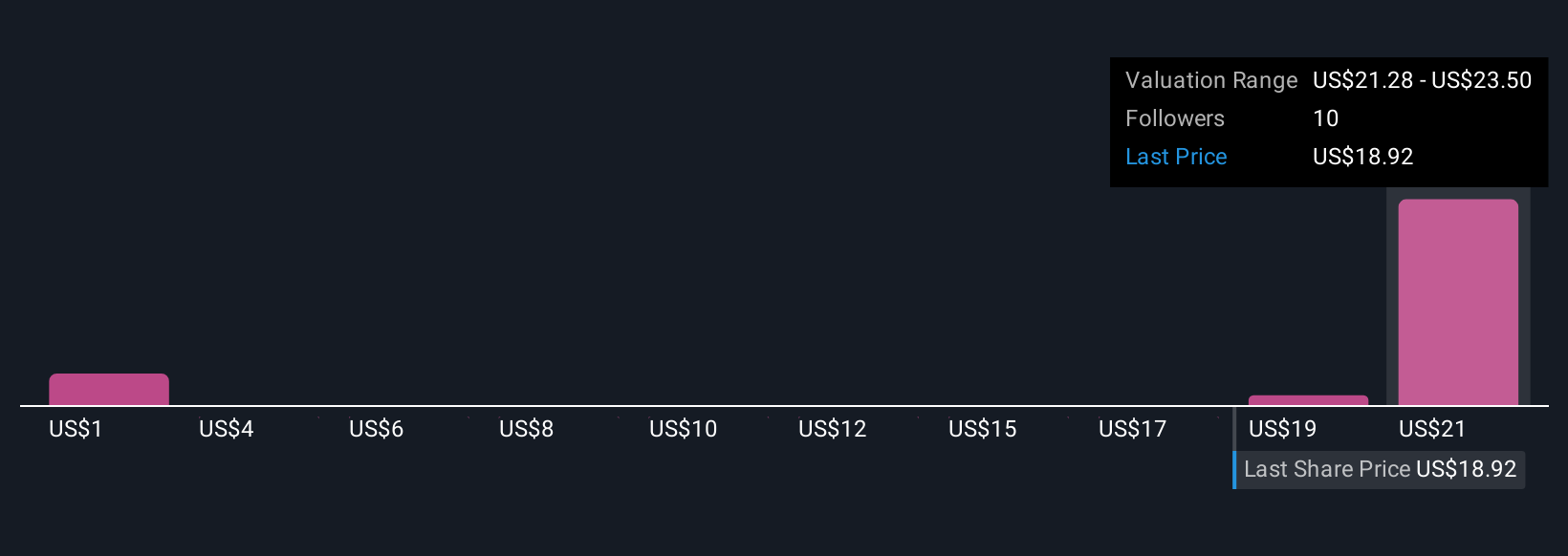

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is a powerful tool that allows investors to craft their own story behind the numbers by setting what they believe the fair value should be, and laying out their views on Dream Finders Homes’ future revenue, profits, and margins.

Narratives connect a company’s story directly to a financial forecast and fair value, making it easier to see how personal perspectives influence investment decisions. On Simply Wall St’s Community page, millions of investors use Narratives to track their perspectives, compare them to the crowd, and spot buy or sell opportunities by weighing Fair Value against the current Price.

The best part is that Narratives update automatically every time new information emerges, such as earnings releases or market news, keeping your viewpoint relevant and actionable. For example, one investor might believe Dream Finders Homes should be valued at its highest recent estimate, thanks to aggressive expansion plans, while another sets their Narrative at the lowest value due to concerns about declining cash flows.

With Narratives, you gain a flexible, dynamic, and intuitive way to decide what Dream Finders Homes is really worth and whether now is the right moment to act.

Do you think there's more to the story for Dream Finders Homes? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DFH

Dream Finders Homes

Through its subsidiary, Dream Finders Homes LLC, engages in the homebuilding business in the United States.

Fair value with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives