- United States

- /

- Luxury

- /

- NYSE:CRI

Will Carter’s (CRI) Governance Tweaks and Steady Dividend Shape a Stronger Capital Strategy?

Reviewed by Sasha Jovanovic

- On November 13, 2025, Carter’s, Inc. approved several amendments to its corporate bylaws, clarifying procedures for shareholder meetings and director nominations, while also reaffirming its quarterly dividend at US$0.25 per share payable in December 2025.

- The governance changes introduce tighter controls around who can call and lead shareholder meetings, while the continuing dividend signals management’s commitment to capital returns amid operational adjustments.

- We'll review how Carter’s refreshed shareholder procedures and dividend declaration may influence its outlook in a challenging marketplace.

We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Carter's Investment Narrative Recap

To believe in Carter's as a shareholder, you need to trust in its ability to defend and grow its position in children's apparel despite demographic headwinds and intensifying competition. The recent bylaw amendments and dividend reaffirmation show a focus on governance and capital returns, but they are unlikely to materially change the near-term catalyst, which remains centered on Carter’s international growth and product innovation. The main risk, persistent US birth rate declines, remains unchanged by these updates.

The most relevant announcement here is Carter’s Q3 earnings release, which revealed net income and margins significantly below last year. In this context, the continued dividend signals stability, but also sharpens questions about future cash flows and profit sustainability as revenue growth is expected to stay flat and competition pressures mount. In contrast to dividend continuity, investors should be aware of how sustained demographic decline may...

Read the full narrative on Carter's (it's free!)

Carter's is projected to reach $2.8 billion in revenue and $39.2 million in earnings by 2028. This outlook is based on a 0.4% annual revenue decline and a decrease in earnings of $93.3 million from the current $132.5 million.

Uncover how Carter's forecasts yield a $29.50 fair value, in line with its current price.

Exploring Other Perspectives

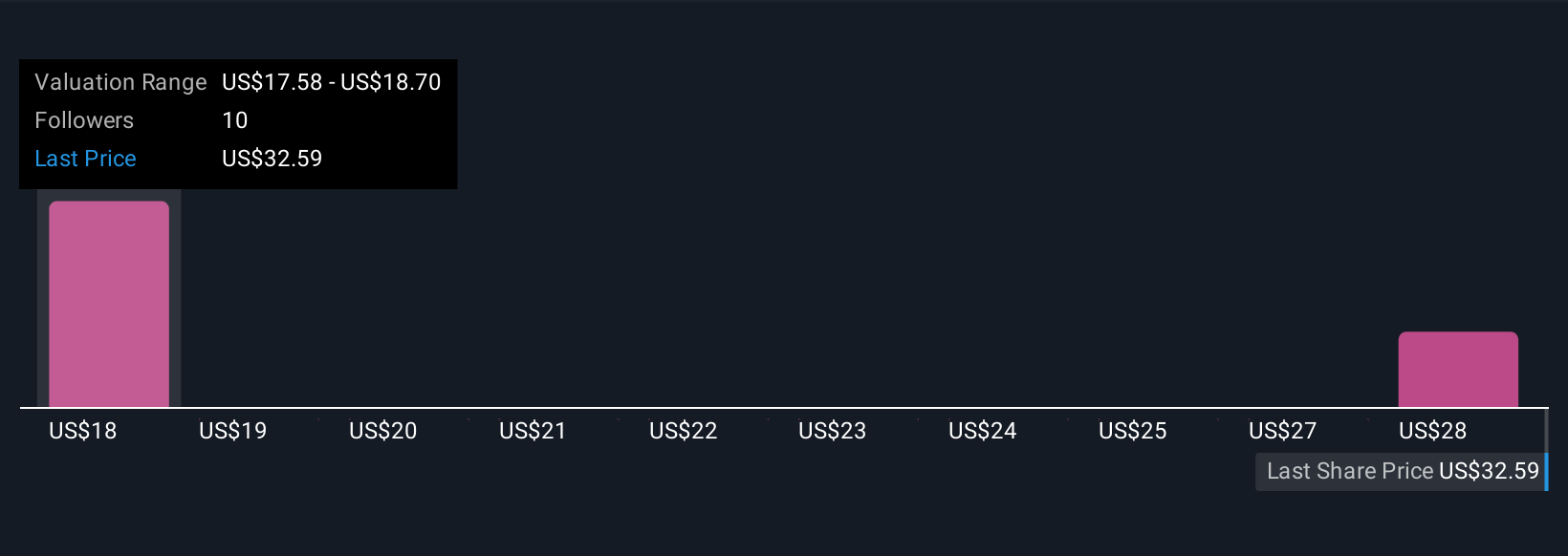

Simply Wall St Community members shared three fair value estimates for Carter's, ranging from US$17.22 to US$29.50 per share. With risk around a shrinking US customer base looming, exploring multiple viewpoints may help you understand how expectations for market demand and earnings recovery can differ.

Explore 3 other fair value estimates on Carter's - why the stock might be worth as much as $29.50!

Build Your Own Carter's Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Carter's research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Carter's research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Carter's overall financial health at a glance.

Contemplating Other Strategies?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CRI

Carter's

Designs, sources, and markets branded childrenswear and related products under the Carter's, OshKosh, Skip Hop, Child of Mine, Just One You, Simple Joys, Little Planet, and other brands in the United States and internationally.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives