- United States

- /

- Luxury

- /

- NYSE:CRI

Carter’s (CRI) Valuation: Is the Recent Rally Justified or Already Priced In?

Reviewed by Simply Wall St

See our latest analysis for Carter's.

Even with this recent rally, Carter's share price remains well below its highs, reflecting a tough year for investors. Despite a 21.9% gain over the past 90 days, the one-year total shareholder return is down 40%. The stock’s short-term momentum looks positive; however, the longer-term picture still signals caution.

If you're looking for other discovery opportunities beyond the apparel sector, now could be a smart time to explore fast growing stocks with high insider ownership.

But with share prices still lagging far behind previous highs and fundamentals under pressure, is Carter’s trading at a bargain, or is the market already pricing in any recovery ahead?

Most Popular Narrative: 31.5% Overvalued

With Carter's last close at $32.35 and the most-followed narrative fair value set at $24.60, the stock currently sits well above what is considered justified by consensus expectations. The narrative builds its case on structural and industry-specific headwinds, providing a distinct perspective on where shares might be headed next.

Carter's brand maturity and limited international penetration constrain organic top-line growth. International expansion remains modest despite stronger growth in markets like Brazil, suggesting forward earnings growth will remain capped. Heavy reliance on baby and young children's apparel leaves the company exposed to demographic volatility and concentrated demand risk, potentially increasing earnings volatility, especially as fast-fashion competitors expand in this segment.

Curious why the narrative suggests such a steep discount to today’s price? The key drivers are bold projections for shrinking margins and weak revenue growth, all summarized in an earnings forecast that breaks from industry trends. Want to discover exactly how these make-or-break factors shape Carter’s fair value? The numbers behind this story may surprise you.

Result: Fair Value of $24.60 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing international expansion and the company’s success in attracting new customers with innovative and premium products could help offset some of these headwinds.

Find out about the key risks to this Carter's narrative.

Another View: Are Multiples Sending A Different Signal?

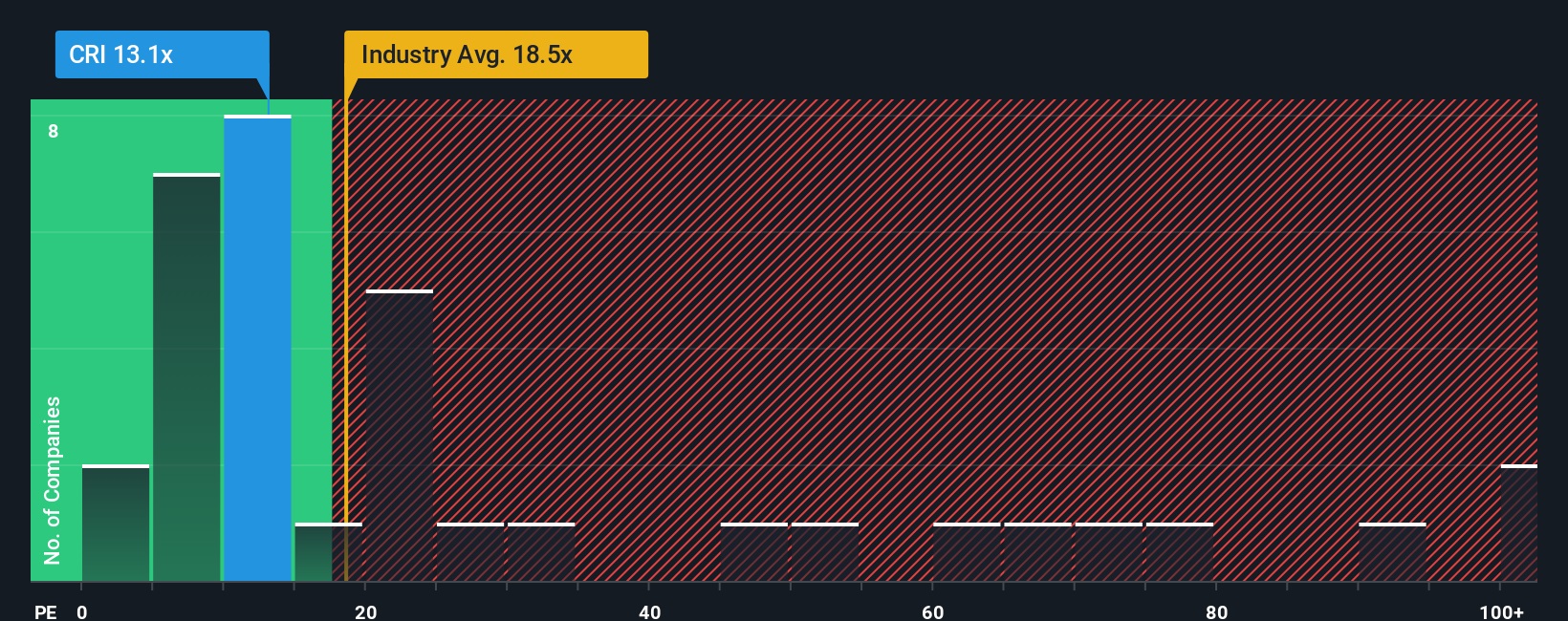

While the consensus analyst valuation spotlights downside risk, Carter’s is trading at a price-to-earnings ratio of 8.9x. This is not only well below both its US Luxury industry peers (19.7x) and the peer group average (56.1x), but also above the “fair ratio” of 5.2x. Such a gap could signal an opportunity or a value trap. If the market’s expectations shift, this ratio could move closer to that fair benchmark. Could this discounted multiple reflect the risks already, or is deeper downside still in play?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Carter's Narrative

If you want to challenge the consensus or dig into Carter's numbers yourself, it's fast and easy to build your own perspective. You can do it all in under three minutes: Do it your way.

A great starting point for your Carter's research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don’t settle for just one stock when you can quickly spot compelling opportunities with the right tools. Stay ahead of the market and strengthen your portfolio today.

- Catch emerging trends in artificial intelligence by reviewing these 27 AI penny stocks to discover rapid innovation and fresh profit potential.

- Secure dependable yields for your financial future by examining these 17 dividend stocks with yields > 3% with consistent and attractive returns above 3%.

- Ride the momentum of undervalued picks with strong cash flow by checking out these 877 undervalued stocks based on cash flows before other investors catch on.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CRI

Carter's

Designs, sources, and markets branded childrenswear and related products under the Carter's, OshKosh, Skip Hop, Child of Mine, Just One You, Simple Joys, Little Planet, and other brands in the United States and internationally.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives