- United States

- /

- Luxury

- /

- NYSE:CPRI

Capri Holdings (CPRI): Revenue Forecast to Decline 4.3% Annually Challenges Turnaround Narrative

Reviewed by Simply Wall St

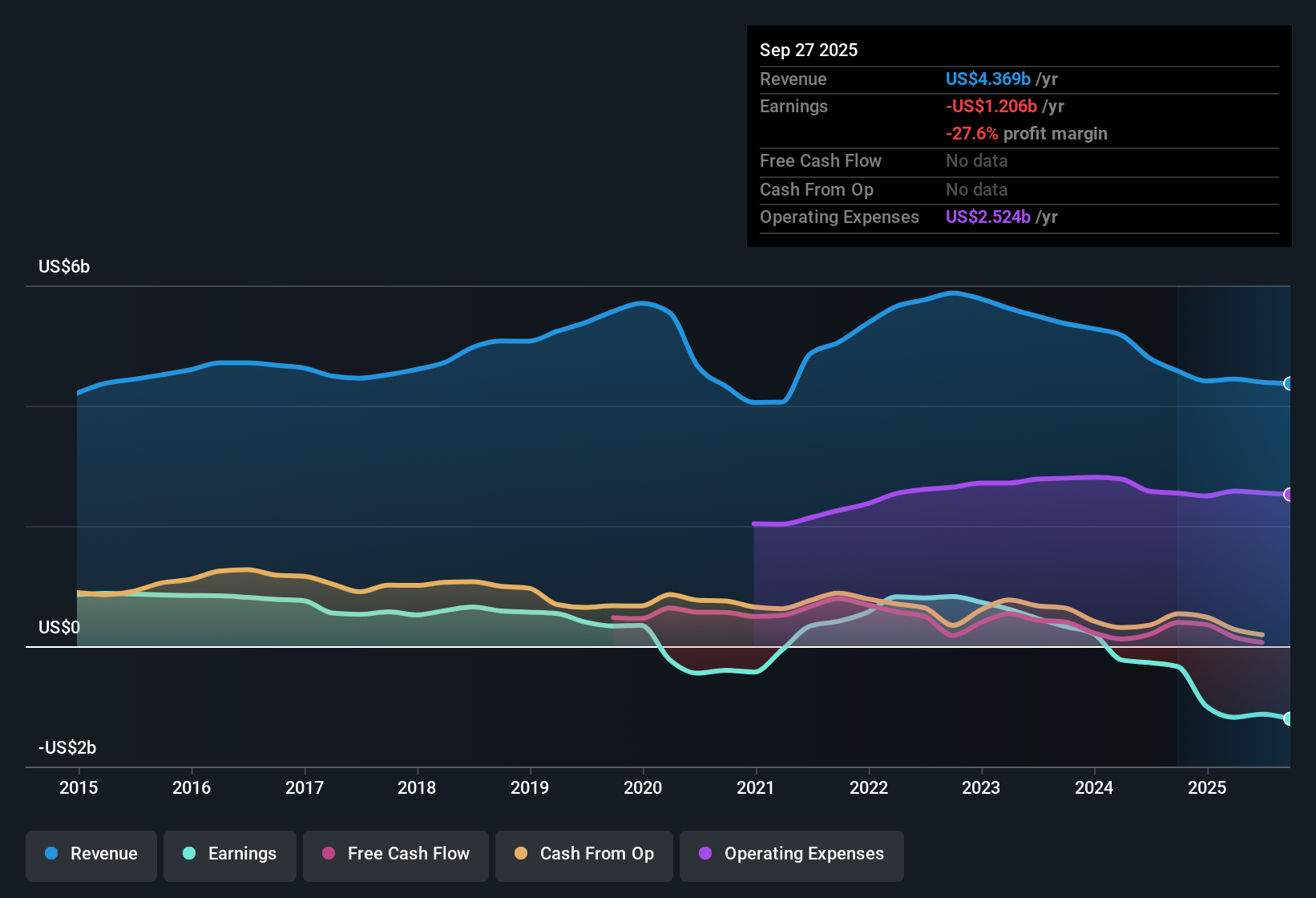

Capri Holdings (CPRI) reported another period of unprofitability, with revenue forecast to decline at a rate of 4.3% per year over the next three years. Despite recent losses and stagnant net profit margins, the company is projected to swing to profitability and grow earnings at a rapid 71.39% annually during that same period.

See our full analysis for Capri Holdings.Now, let’s see how these latest numbers measure up against the narratives investors are watching. This will help determine whether they confirm hopes of a turnaround or put new pressure on the story.

See what the community is saying about Capri Holdings

Margins Forecast to Swing From Negative 25.7% to 9.6%

- Analysts expect net profit margins to rise from negative 25.7% today to a positive 9.6% within three years, even as revenue is projected to decline at an annual rate of 4.3%.

- According to the analysts' consensus view, this sharp swing hinges on:

- Major investments in omnichannel capabilities and advanced analytics aimed at improving conversion and customer engagement may offset declining sales volumes.

- Supply chain and pricing initiatives are expected to drive margin recovery. However, continued retail and wholesale stagnation, especially in the core Michael Kors and Jimmy Choo brands, could undermine the transition to profitability.

- For more on how this margin turnaround ties into strategic shifts, check the full narrative breakdown in the Consensus Narrative. 📊 Read the full Capri Holdings Consensus Narrative.

Tariff Exposure and Cost Risks Intensify

- Capri is facing an $85 million unmitigated tariff impact in fiscal 2026, up from $60 million previously. This raises the cost of goods sold and puts additional pressure on gross margins.

- Critics highlight several key risks for the bearish case:

- Higher tariff costs could outpace gains from cost-cutting or pricing actions, especially if consumer response to brand revitalization remains weak.

- Persistent reliance on aggressive expense reductions and delayed investments in store renovations or product innovation may limit upside even if some cost savings materialize.

DCF Fair Value Signals Deep Discount

- Capri shares currently trade at $20.71, well below the DCF fair value of $31.65 and at a price-to-sales ratio of 0.6x versus an industry median of 0.7x. This suggests the market is heavily discounting execution and recovery risk.

- Analysts' consensus view notes:

- Despite weak growth forecasts, the discounted multiple and DCF gap could attract value-focused investors who believe in management’s ability to engineer a turnaround.

- However, consensus price targets remain below estimated fair value. This implies the Street is cautious about giving full credit to long-range recovery assumptions.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Capri Holdings on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Spot an angle others might miss? Craft your take on the data in just a few minutes and shape the next chapter: Do it your way

A great starting point for your Capri Holdings research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

Capri Holdings faces declining sales, ongoing unprofitability, and intense margin pressure from rising costs. This makes its recovery highly uncertain, despite optimistic forecasts.

If you want more consistent performers, try stable growth stocks screener (2077 results) to find companies delivering reliable revenue and earnings growth even when markets get tough.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CPRI

Capri Holdings

Engages in the design, marketing, distribution, and retail of branded women’s and men’s apparel, footwear, and accessories in the United States, Canada, Latin America, Europe, the Middle East, Africa, Asia, and the Oceania.

Undervalued with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives