- United States

- /

- Luxury

- /

- NYSE:CPRI

Capri Holdings (CPRI): Evaluating Valuation After Recent Share Price Gains and Analyst Insights

Reviewed by Simply Wall St

Capri Holdings (CPRI) shares have edged higher over the past week, building on steady momentum seen during the month. Investors seem to be weighing recent company developments, with returns in the past month and quarter both looking positive.

See our latest analysis for Capri Holdings.

Capri Holdings has enjoyed a clear upswing lately, with the share price notching an 11.8% gain over the past month and nearly 21% year-to-date. This momentum stands out, especially as the company’s one-year total shareholder return of 9% has helped to offset deeper losses from prior years and could hint at renewed investor optimism.

If recent gains have you looking for what else is trending, consider expanding your search and discover fast growing stocks with high insider ownership

With solid recent gains and the share price still trading at a modest discount to analysts’ expectations, investors might wonder if Capri Holdings is now undervalued or if the market has already factored in the company’s next stage of growth.

Most Popular Narrative: 4.9% Undervalued

The most closely followed narrative benchmarks Capri Holdings’ fair value at $26.17, slightly above its latest close of $24.89. This sets up a tight margin between current market sentiment and what analysts believe the company is really worth.

Planned investment in major store renovations and selective new store openings in high-potential urban centers is expected to elevate customer experience and brand perception, resulting in higher store-level productivity and stronger revenue growth.

Wondering what convinces analysts to back this fair value? The full narrative leans heavily on Capri Holdings’ push for margin growth and a revised trajectory in profit margins. Uncover which financial milestones are supposed to propel future valuations higher. Take a look at the behind-the-scenes numbers and strategic pivots that could be game-changers for the business.

Result: Fair Value of $26.17 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, continued revenue declines and potential setbacks in revitalizing core brands remain key risks. These factors could challenge Capri Holdings’ recovery narrative.

Find out about the key risks to this Capri Holdings narrative.

Another View: Multiples Tell a Different Story

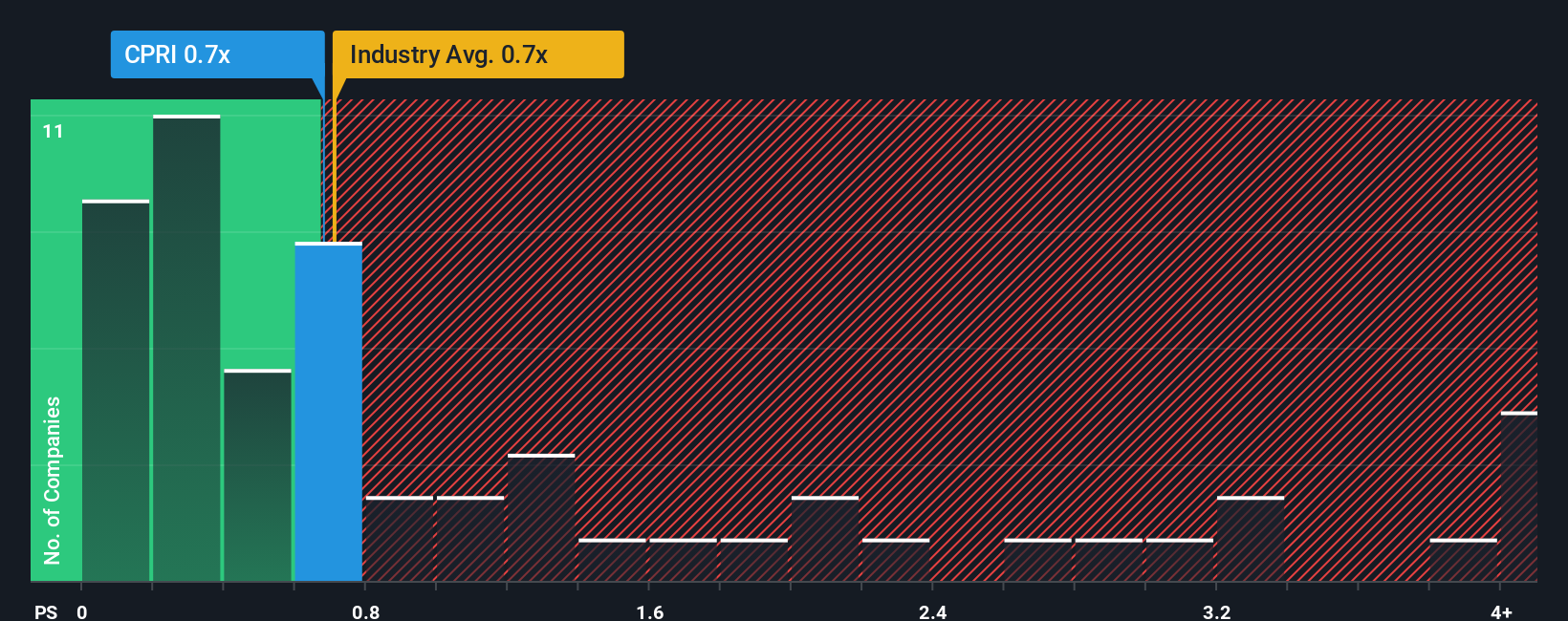

Looking at Capri Holdings through the lens of its price-to-sales ratio paints a more cautious picture. Currently, the stock trades at 0.7x sales, which is higher than its peer average of 0.6x but aligns with the broader US Luxury industry at 0.7x. While this suggests limited downside risk, it also hints that investors are already pricing in much of the near-term recovery potential. Could the market be underestimating or overestimating what is next for Capri?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Capri Holdings Narrative

If you see things differently or want to dig into your own numbers, you can build your own Capri Holdings view in just a few minutes. Do it your way

A great starting point for your Capri Holdings research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Don't miss a chance to expand your horizons and give your portfolio an edge with tailored opportunities you may not have considered yet.

- Capitalize on stable income streams by checking out these 14 dividend stocks with yields > 3%, offering attractive yields and consistent performance above 3%.

- Take the lead in tomorrow’s medical breakthroughs by seeking out these 30 healthcare AI stocks, transforming diagnostics, drug discovery, and patient care.

- Catch undervalued gems early by reviewing these 933 undervalued stocks based on cash flows, powered by cash flow fundamentals and strong upside potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CPRI

Capri Holdings

Engages in the design, marketing, distribution, and retail of branded women’s and men’s apparel, footwear, and accessories in the United States, Canada, Latin America, Europe, the Middle East, Africa, Asia, and the Oceania.

Good value with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success