- United States

- /

- Consumer Durables

- /

- NYSE:COOK

Traeger (COOK): Discounted Valuation Draws Focus as Losses Narrow, Revenue Trails Market Expectations

Reviewed by Simply Wall St

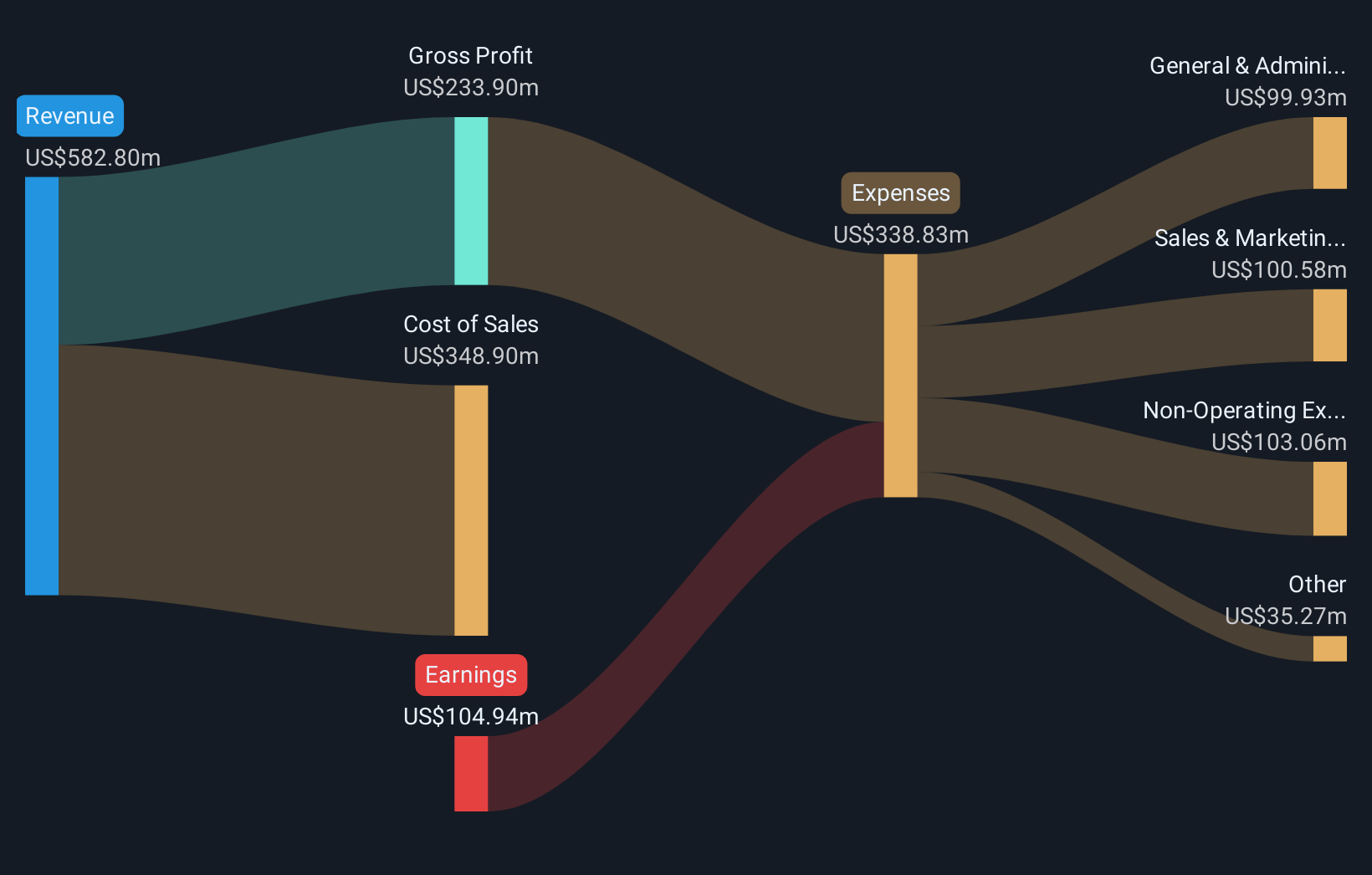

Traeger (COOK) remains unprofitable but has narrowed its losses at a modest annualized rate of 0.3% over the past five years. Looking ahead, revenue is forecast to grow at 1.7% per year, which trails the broader US market’s projected pace of 10.4%. With no flagged risks and trading below estimated fair value, attention is turning to COOK's discounted price-to-sales ratio of 0.2x compared to its peers and industry averages.

See our full analysis for Traeger.Next, we will compare these numbers against the major narratives to see where the latest results reinforce or challenge market expectations.

Curious how numbers become stories that shape markets? Explore Community Narratives

Losses Narrow at a Steady Pace

- Traeger is still unprofitable, but over the past five years, it has narrowed its annualized losses by 0.3%, signaling cost discipline while growth remains modest.

- Recent market commentary points to brand loyalty and stable demand as reasons losses have not worsened, with observers noting:

- Customer loyalty is highlighted in social and product reviews, pointing to a base of repeat buyers despite slow profit progress.

- Analysts suggest the lack of dramatic loss reduction keeps the stock in a “wait and see” position, especially as macro trends weigh on discretionary spending.

Forecast Growth Lags Sector Leaders

- While Traeger’s revenue is forecast to rise at 1.7% per year, this trails the broader US market’s projected 10.4% annual pace, signaling investors should temper expectations for rapid turnaround.

- Prevailing market analysis emphasizes the importance of consumer confidence and recovery for future growth:

- Periods of economic strength could lift home cooking demand and drive sales beyond these currently muted forecasts.

- However, ongoing pressure from macroeconomic headwinds may continue to limit upside until a clear catalyst emerges, such as a successful product launch or rebound in discretionary spending.

Deep Discount Relative to Industry Peers

- With a price-to-sales ratio of 0.2x, Traeger trades below direct peers (average of 0.4x) and the US Consumer Durables industry (0.6x), while its share price is just $0.86 versus a DCF fair value of $8.53.

- This steep discount has caught investor attention, especially given the absence of flagged risks:

- Market sentiment suggests that unless a major earnings or operational catalyst materializes, shares may stay range-bound despite cheap valuation multiples.

- Contrasts between the deep discount and ongoing unprofitability create a classic “value trap” versus “potential turnaround” debate for new buyers.

For an unbiased look at how market narratives could shift, check out the full Consensus Narrative for COOK and see what both sides are watching for next. 📊 Read the full Traeger Consensus Narrative.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Traeger's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Traeger’s sluggish revenue growth and ongoing unprofitability highlight that it lags behind sector leaders who consistently deliver steady and predictable results.

If you want more consistency and fewer surprises, focus on companies showing reliable expansion and proven resilience by checking out stable growth stocks screener (2078 results).

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Traeger might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:COOK

Traeger

Designs, sources, sells, and supports wood pellet fueled barbecue grills and pellet fueled barbecue grills for retailers, distributors, and direct to consumers in the United States and internationally.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives