- United States

- /

- Consumer Durables

- /

- NYSE:CCS

Century Communities (CCS): Assessing Valuation Following New Cottonwood Place Launch in North Carolina

Reviewed by Simply Wall St

Century Communities (CCS) just revealed plans for Cottonwood Place, a new Century Complete community scheduled to open in Tabor City, North Carolina. The launch highlights affordable homes along with convenient access to Myrtle Beach.

See our latest analysis for Century Communities.

Century Communities’ Cottonwood Place announcement comes shortly after several other new developments and a recently declared quarterly dividend. Despite the steady stream of launches, the company’s share price is down nearly 18% year-to-date and total shareholder return over the past year sits at -29%, though longer-term shareholders have still seen a 44% gain over five years. Momentum right now is muted, as investors watch for signals of a turnaround.

If this mix of new projects and long-term gains has you wondering what else is out there, it might be the perfect moment to broaden your search and discover fast growing stocks with high insider ownership

With all eyes on Century Communities’ recent launches and steady, if muted, long-term growth, the real question is whether investors are overlooking hidden value in the stock or if current prices already reflect future prospects.

Most Popular Narrative: 9.4% Undervalued

According to the most popular narrative, the fair value for Century Communities is set at $66.00, which is notably higher than its recent closing price of $59.78. This difference is drawing attention as the company navigates a shifting housing market.

Ongoing elevated mortgage rates and affordability constraints are dampening homebuyer demand. As a result, Century Communities is increasing sales incentives and accepting lower average selling prices. This is already putting downward pressure on gross margins and is expected to weigh further on both revenues and earnings in the coming quarters.

Ever wondered what’s fueling this optimistic valuation? The core of the narrative rests on bold earnings and margin targets, plus a multiple that stands out compared to industry norms. Curious which future financial shifts are central to this price? The complete narrative untangles it all.

Result: Fair Value of $66.00 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent U.S. housing undersupply and Century Communities’ expanding community footprint could challenge these cautious projections if demand outpaces current expectations.

Find out about the key risks to this Century Communities narrative.

Another View: What Does Our DCF Model Say?

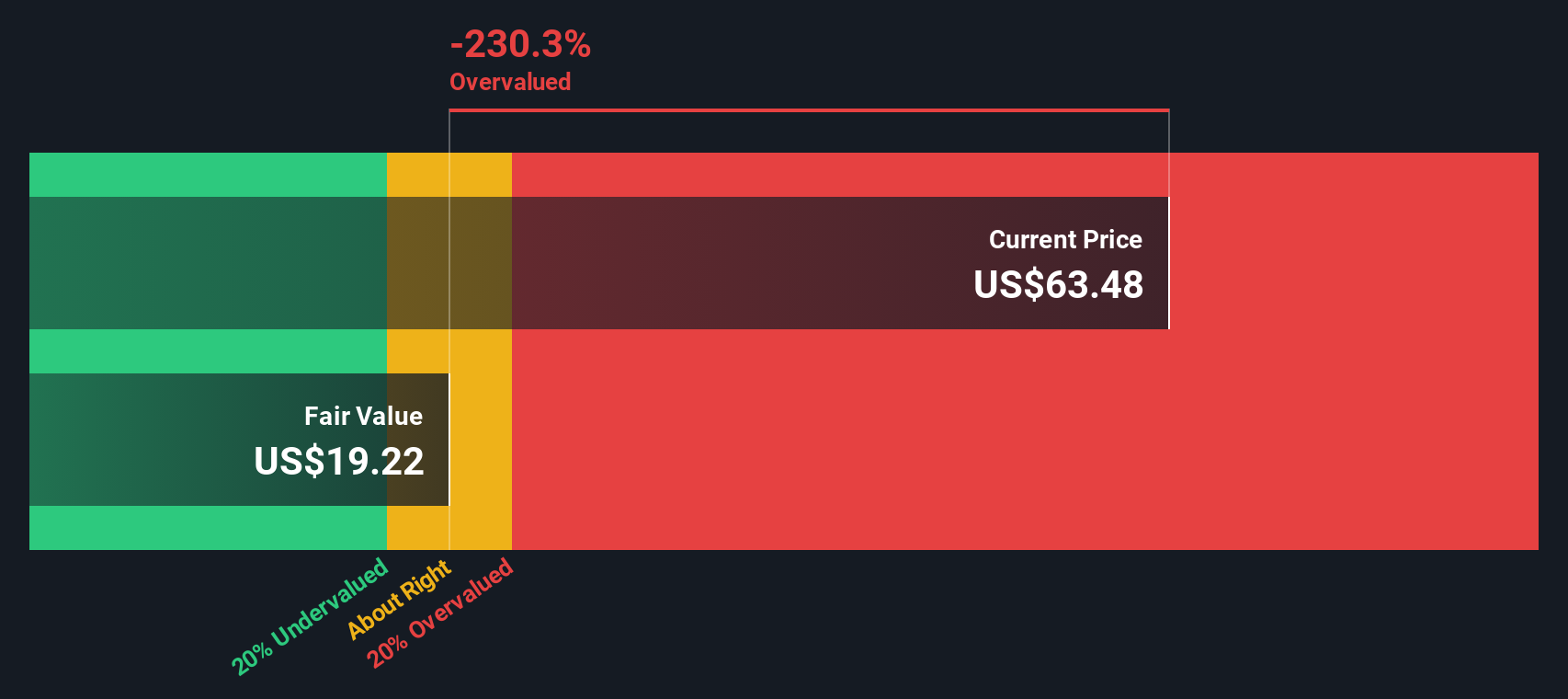

While the current fair value estimate relies on analyst price targets, the SWS DCF model takes a different approach by projecting future cash flows to arrive at an intrinsic value. Interestingly, this model suggests that Century Communities is overvalued at recent prices. This raises fresh questions about market optimism or overlooked risks. Is the DCF model capturing something analysts might miss, or is it too cautious in today’s shifting housing landscape?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Century Communities for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 855 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Century Communities Narrative

If you want a fresh perspective or want to dig deeper yourself, you can build your own take on Century Communities in just a few minutes with Do it your way

A great starting point for your Century Communities research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t let great opportunities pass you by when the next standout stock could be just a click away. Use the tools seasoned investors trust to stay ahead.

- Target steady passive income from companies offering impressive yields as you check out these 15 dividend stocks with yields > 3%.

- Fuel your portfolio’s potential by tapping into the latest breakthroughs with these 25 AI penny stocks.

- Boost your returns by pinpointing hidden bargain stocks through these 855 undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CCS

Century Communities

Engages in the design, development, construction, marketing, and sale of single-family attached and detached homes.

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives