- United States

- /

- Consumer Durables

- /

- NYSE:BLD

TopBuild (BLD): Assessing Valuation After a Strong Year-to-Date Share Price Rally

Reviewed by Simply Wall St

TopBuild (BLD) has quietly outperformed many construction peers this year, and with the stock up roughly 38% year to date, investors are asking whether the recent momentum still offers reasonable upside.

See our latest analysis for TopBuild.

Recent trading has cooled a little, with a modest pullback in the 7 day share price return after a strong year to date share price return and robust multi year total shareholder returns. Taken together, these still point to underlying momentum rather than exhaustion.

If TopBuild has you rethinking where growth could come from next, it might be worth scanning fast growing stocks with high insider ownership for other intriguing opportunities on your radar.

With earnings still growing and the share price already near record highs, the key question now is whether TopBuild is quietly trading below its true value or if the market has fully priced in its next leg of growth.

Most Popular Narrative: 11.3% Undervalued

With TopBuild last closing at 426.78 dollars against a narrative fair value near 481 dollars, the current price sits noticeably below that estimate.

The company's disciplined M and A strategy in a highly fragmented industry, along with investments in operational efficiencies and supply chain optimization, is expected to unlock synergies, expand scale, and drive incremental EBITDA margin improvements, contributing to stronger future earnings growth.

Want to see how steady but unspectacular growth, slimmer margins, and a still rich earnings multiple can all add up to an upside story? The full narrative unpacks the math behind that gap between price and fair value, and the capital allocation moves that hold it together.

Result: Fair Value of $480.93 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent housing market softness and potential missteps integrating new acquisitions could challenge TopBuild's growth assumptions and narrow that perceived valuation gap.

Find out about the key risks to this TopBuild narrative.

Another Lens on Valuation

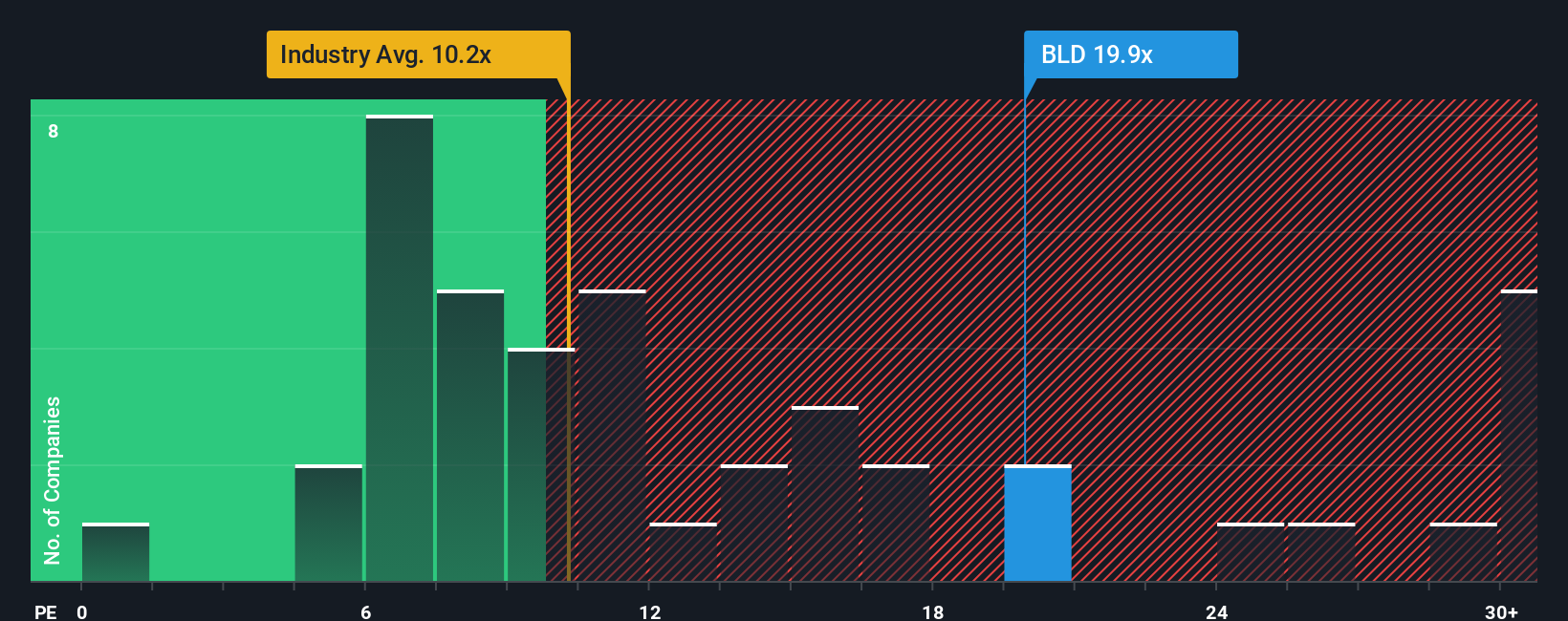

While the narrative and DCF style fair value suggest TopBuild is undervalued, its 21 times earnings multiple tells a different story. That is well above the 14.9 times peer average and the 11.1 times Consumer Durables benchmark, and even above a 17.6 times fair ratio our models point to.

This richer multiple means less margin for error, because any disappointment in growth or margins could see the valuation drift back toward that lower fair ratio. Is the quality of the business and its execution strong enough to keep the premium intact?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own TopBuild Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a personalized view in just minutes: Do it your way.

A great starting point for your TopBuild research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Ready for your next move?

Before you move on, lock in your advantage by using the Simply Wall Street Screener to pinpoint fresh opportunities that match your strategy and risk appetite.

- Capture potential bargains early by scanning these 914 undervalued stocks based on cash flows that the market may be overlooking despite strong underlying cash flows.

- Capitalize on the AI wave by targeting these 25 AI penny stocks positioned to benefit from accelerating adoption across industries.

- Strengthen your income stream by reviewing these 13 dividend stocks with yields > 3% that combine attractive yields with solid fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if TopBuild might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BLD

TopBuild

Engages in the installation and distribution of insulation and other building material products to the construction industry.

Mediocre balance sheet with limited growth.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Q3 Outlook modestly optimistic

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion