- United States

- /

- Luxury

- /

- NYSE:AS

Amer Sports (NYSE:AS): Examining Valuation Trends After Recent Share Price Volatility

Reviewed by Simply Wall St

Amer Sports (NYSE:AS) shares have caught some attention after a recent swing in trading volume. Investors appear to be weighing the company's recent growth numbers and considering how they might impact future returns.

See our latest analysis for Amer Sports.

Amer Sports’ share price has shown some volatility lately, but stepping back reveals a bigger trend. The company’s short-term momentum has been modest, yet its total shareholder return over the past year stands at an impressive 59.3%. Investors seem to be taking notice, weighing new growth signals against risks as the longer-term trajectory continues to build.

If you’re keeping an eye out for other standout names making waves in consumer brands, this could be the perfect time to discover fast growing stocks with high insider ownership

With Amer Sports trading about 23% below its intrinsic value and showing strong earnings growth, the key question remains: is this a golden entry point for investors, or has the market already accounted for future gains?

Most Popular Narrative: 32% Undervalued

The current Amer Sports share price of $31.38 is well below the most popular narrative’s fair value estimate, creating a significant valuation gap and presenting a compelling forward-looking story.

Ongoing investment in direct-to-consumer channels (both physical stores and e-commerce) is fueling higher full-price sales, reduced markdowns, and enhanced customer engagement. This supports scalable top-line growth and drives adjusted operating margin expansion.

Want a peek into why this valuation stands out from its rivals? Below the surface are bold assumptions about margin improvements and growth drivers that many investors may overlook. Interested in the unique metrics shaping this high-conviction price target? Click through to see how analysts compiled this narrative.

Result: Fair Value of $46.14 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, a heavy reliance on Asia-Pacific growth and the potential for rising competition could present real headwinds if these trends shift unexpectedly.

Find out about the key risks to this Amer Sports narrative.

Another View: What Do Market Multiples Say?

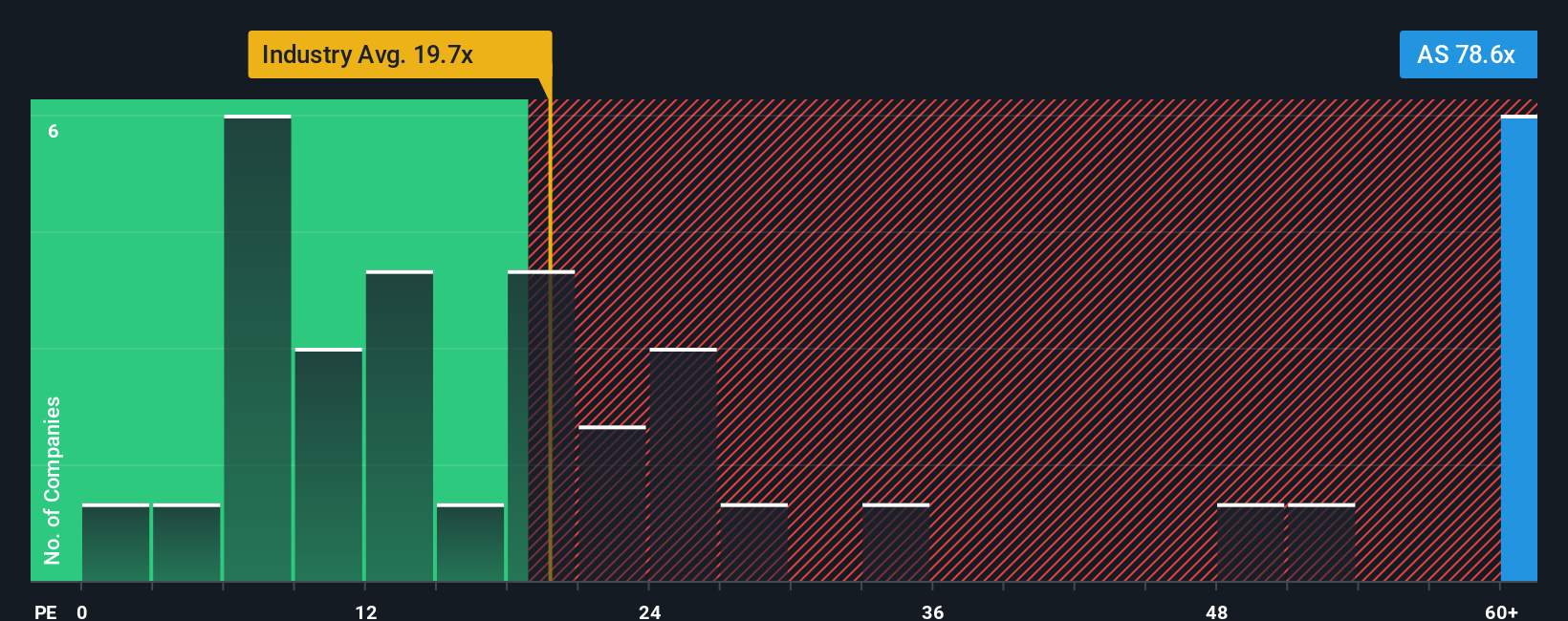

Looking at Amer Sports through the lens of its price-to-earnings ratio tells a different story. The current multiple is 77.7x, which is more than double both the peer average (32.5x) and the US Luxury industry average (18.2x). Even compared to a fair ratio of 26.8x, the stock looks expensive on this metric. This kind of premium suggests investors expect outsized growth, but it also introduces greater risk if those expectations are not delivered. Could the market be too optimistic, or is there real upside still to be unlocked?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Amer Sports Narrative

If you have a different take or enjoy digging into the numbers firsthand, you can easily craft your own view in just a few minutes: Do it your way

A great starting point for your Amer Sports research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Ideas?

You could be just one smart move away from your next standout investment. Don’t settle for the obvious. This is your chance to spot tomorrow’s winners ahead of the crowd.

- Uncover unique gems by checking out these 862 undervalued stocks based on cash flows showing potential where the market doesn’t yet see it.

- Tap into powerful trends and get in early with these 26 AI penny stocks shaping industries with artificial intelligence innovation.

- Collect steady returns by scanning these 14 dividend stocks with yields > 3% delivering reliable income through generous yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AS

Amer Sports

Designs, manufactures, markets, distributes, and sells sports equipment, apparel, footwear, and accessories in Europe, the Middle East, Africa, the Americas, Mainland China, Hong Kong, Macau, Taiwan, and the Asia Pacific.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives