- United States

- /

- Consumer Durables

- /

- NasdaqGS:UEIC

Why Investors Shouldn't Be Surprised By Universal Electronics Inc.'s (NASDAQ:UEIC) 31% Share Price Plunge

Universal Electronics Inc. (NASDAQ:UEIC) shareholders that were waiting for something to happen have been dealt a blow with a 31% share price drop in the last month. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 49% in that time.

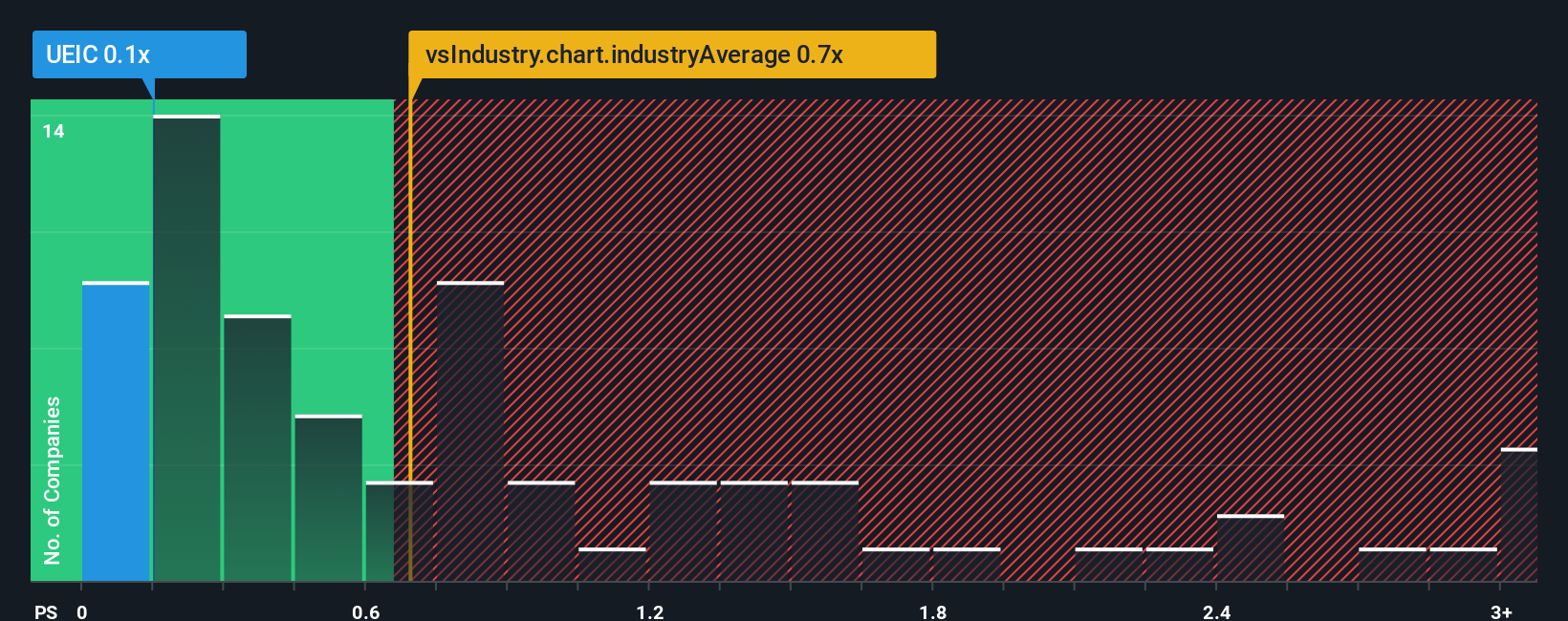

Since its price has dipped substantially, it would be understandable if you think Universal Electronics is a stock with good investment prospects with a price-to-sales ratios (or "P/S") of 0.1x, considering almost half the companies in the United States' Consumer Durables industry have P/S ratios above 0.7x. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

Check out our latest analysis for Universal Electronics

How Universal Electronics Has Been Performing

Universal Electronics' revenue growth of late has been pretty similar to most other companies. One possibility is that the P/S ratio is low because investors think this modest revenue performance may begin to slide. If not, then existing shareholders have reason to be optimistic about the future direction of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Universal Electronics.Is There Any Revenue Growth Forecasted For Universal Electronics?

The only time you'd be truly comfortable seeing a P/S as low as Universal Electronics' is when the company's growth is on track to lag the industry.

Taking a look back first, we see that the company managed to grow revenues by a handy 4.0% last year. Still, lamentably revenue has fallen 30% in aggregate from three years ago, which is disappointing. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Shifting to the future, estimates from the three analysts covering the company suggest revenue growth is heading into negative territory, declining 4.5% over the next year. Meanwhile, the broader industry is forecast to expand by 2.4%, which paints a poor picture.

In light of this, it's understandable that Universal Electronics' P/S would sit below the majority of other companies. Nonetheless, there's no guarantee the P/S has reached a floor yet with revenue going in reverse. There's potential for the P/S to fall to even lower levels if the company doesn't improve its top-line growth.

What Does Universal Electronics' P/S Mean For Investors?

Universal Electronics' recently weak share price has pulled its P/S back below other Consumer Durables companies. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

With revenue forecasts that are inferior to the rest of the industry, it's no surprise that Universal Electronics' P/S is on the lower end of the spectrum. As other companies in the industry are forecasting revenue growth, Universal Electronics' poor outlook justifies its low P/S ratio. It's hard to see the share price rising strongly in the near future under these circumstances.

We don't want to rain on the parade too much, but we did also find 1 warning sign for Universal Electronics that you need to be mindful of.

If you're unsure about the strength of Universal Electronics' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:UEIC

Universal Electronics

Designs, develops, manufactures, ships, and supports home entertainment control products, technology and software solutions, climate control solutions, wireless sensors and smart home control products, and audio-video accessories.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success