- United States

- /

- Luxury

- /

- OTCPK:TBLT

Here's Why ToughBuilt Industries (NASDAQ:TBLT) Must Use Its Cash Wisely

We can readily understand why investors are attracted to unprofitable companies. For example, biotech and mining exploration companies often lose money for years before finding success with a new treatment or mineral discovery. Nonetheless, only a fool would ignore the risk that a loss making company burns through its cash too quickly.

So should ToughBuilt Industries (NASDAQ:TBLT) shareholders be worried about its cash burn? For the purpose of this article, we'll define cash burn as the amount of cash the company is spending each year to fund its growth (also called its negative free cash flow). The first step is to compare its cash burn with its cash reserves, to give us its 'cash runway'.

View our latest analysis for ToughBuilt Industries

Does ToughBuilt Industries Have A Long Cash Runway?

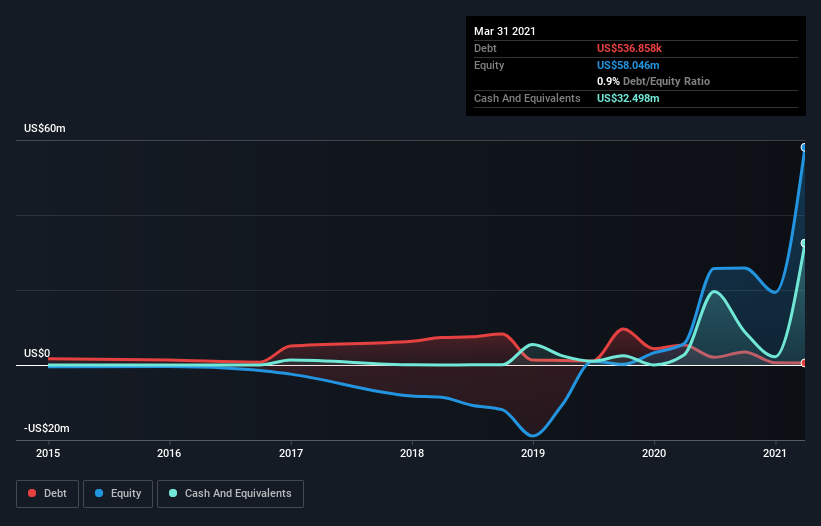

A cash runway is defined as the length of time it would take a company to run out of money if it kept spending at its current rate of cash burn. ToughBuilt Industries has such a small amount of debt that we'll set it aside, and focus on the US$32m in cash it held at March 2021. In the last year, its cash burn was US$38m. That means it had a cash runway of around 10 months as of March 2021. That's quite a short cash runway, indicating the company must either reduce its annual cash burn or replenish its cash. Importantly, if we extrapolate recent cash burn trends, the cash runway would be a lot longer. Depicted below, you can see how its cash holdings have changed over time.

How Well Is ToughBuilt Industries Growing?

It was quite stunning to see that ToughBuilt Industries increased its cash burn by 270% over the last year. It seems likely that the vociferous operating revenue growth of 166% during that time may well have given management confidence to ramp investment. In light of the data above, we're fairly sanguine about the business growth trajectory. Clearly, however, the crucial factor is whether the company will grow its business going forward. So you might want to take a peek at how much the company is expected to grow in the next few years.

How Easily Can ToughBuilt Industries Raise Cash?

Given the trajectory of ToughBuilt Industries' cash burn, many investors will already be thinking about how it might raise more cash in the future. Generally speaking, a listed business can raise new cash through issuing shares or taking on debt. Many companies end up issuing new shares to fund future growth. By comparing a company's annual cash burn to its total market capitalisation, we can estimate roughly how many shares it would have to issue in order to run the company for another year (at the same burn rate).

ToughBuilt Industries' cash burn of US$38m is about 64% of its US$60m market capitalisation. Given how large that cash burn is, relative to the market value of the entire company, we'd consider it to be a high risk stock, with the real possibility of extreme dilution.

Is ToughBuilt Industries' Cash Burn A Worry?

On this analysis of ToughBuilt Industries' cash burn, we think its revenue growth was reassuring, while its increasing cash burn has us a bit worried. After looking at that range of measures, we think shareholders should be extremely attentive to how the company is using its cash, as the cash burn makes us uncomfortable. On another note, ToughBuilt Industries has 5 warning signs (and 1 which is significant) we think you should know about.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of interesting companies, and this list of stocks growth stocks (according to analyst forecasts)

If you’re looking to trade ToughBuilt Industries, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if ToughBuilt Industries might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About OTCPK:TBLT

ToughBuilt Industries

Engages in design, manufacture, and distribution of home improvement and construction products for the building industry in the United States, the United Kingdom, Brazil, Canada, Europe, Mexico, and internationally.

Slight risk with weak fundamentals.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026