- United States

- /

- Leisure

- /

- NasdaqGS:SWIM

Latham Group (SWIM): Strong Profit Growth Forecasted Despite Modest Revenue and Premium Valuation

Reviewed by Simply Wall St

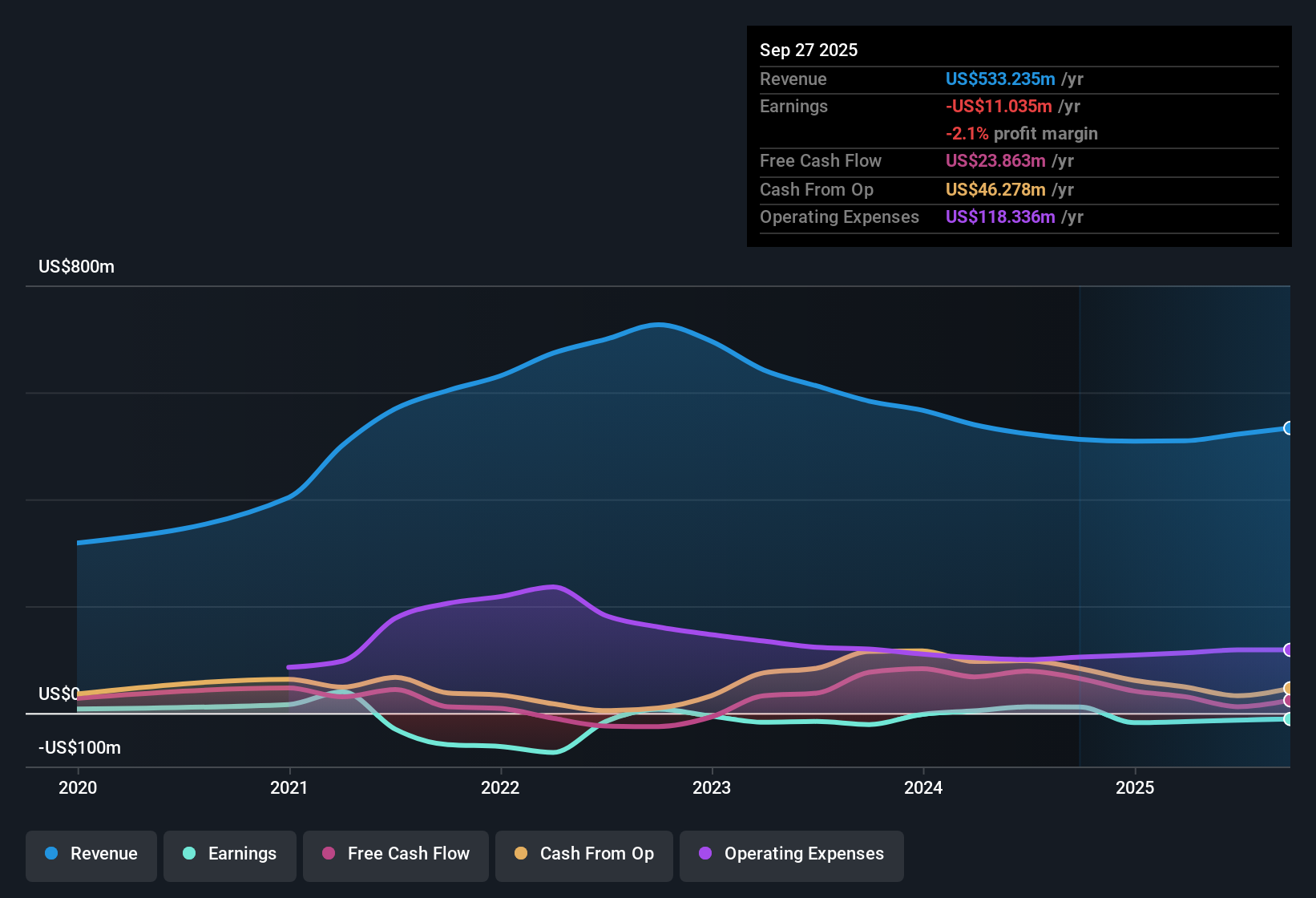

Latham Group (SWIM) is currently unprofitable, with expectations to turn profitable within the next three years. Earnings are forecast to grow quickly at 46.36% per year, significantly outpacing the broader market. Revenue is projected to rise by 4.8% per year, which is a much slower pace than the US market's 10.5%. The company has steadily reduced its losses by an annual rate of 13.7% over the past five years. While the Price-to-Sales Ratio sits well above industry peers at 1.6x, shares are trading below their estimated fair value at $6.95 per share versus $10.06. This sets up a constructive thesis for investors focused on profit turnaround and undervaluation, even as topline growth remains modest.

See our full analysis for Latham Group.The next section will stack up these figures against the most widely followed market narratives, highlighting where the story behind the numbers gets confirmed or challenged.

See what the community is saying about Latham Group

Margins Move from -2.5% to 5.1% in Forecasts

- Analysts project Latham Group’s profit margin will swing from -2.5% today to 5.1% within three years, a striking reversal not yet matched by revenue growth rates in the US market.

- Analysts' consensus view emphasizes that the company’s efficiency improvements in manufacturing and strategic mix shift toward higher-margin fiberglass pools are expected to deliver this margin expansion.

- Consensus narrative notes recent 400 basis point improvement in gross margins, citing automation and value engineering as fundamental drivers that reinforce the turnaround story.

- However, the outlook hinges on execution in "Sand State" markets and continuing post-pandemic demand for at-home outdoor amenities, which could be sensitive to ongoing housing market weakness or higher interest rates.

- There is upside potential in margin expansion as analysts believe cost discipline and market share gains could accelerate profit recovery. 📊 Read the full Latham Group Consensus Narrative.

SG&A Expenses Rise to $31.9 Million

- SG&A expenses climbed to $31.9 million, up by $5.3 million year over year. This is a notable outlay as management ramps up marketing and product expansion even while sales growth lags the broader US market pace.

- Analysts' consensus view points out that while lead growth is strong and investments target future sales, there is risk these cost increases may not immediately convert to pool orders.

- This puts pressure on net margins if consumer conversion remains subdued, especially in an environment where industry demand is only gradually recovering from a trough.

- Consensus narrative warns that further increases in spending without corresponding topline acceleration could constrain near-term profitability, despite long-term earnings optimism.

High Debt Load: Net Leverage at 3.0x

- Latham’s net debt leverage ratio stands at 3.0x, with $281 million in total debt. This scale of borrowing may limit future investment flexibility even as EBITDA leverage improves.

- Analysts' consensus view explains that high leverage could pose a material constraint on funding innovation or further acquisitions if operating cash flow falters.

- With interest rates elevated and US housing construction still below long-term averages, analysts flag debt servicing and refinancing risk as a top concern for future earnings growth.

- Still, successful cash generation and margin improvement could offset some debt risks, but the balance remains delicate as market conditions evolve.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Latham Group on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a unique take on the numbers? Share your perspective and build your own story in just a few minutes. Do it your way

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Latham Group.

See What Else Is Out There

Despite strong profit margin forecasts, Latham Group’s high debt load and rising expenses may limit flexibility if market or demand conditions weaken further.

Prefer sturdier finances? Try solid balance sheet and fundamentals stocks screener (1979 results) to discover companies with lower leverage and reliable liquidity, which are designed to handle tough market conditions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SWIM

Latham Group

Designs, manufactures, and markets in-ground residential swimming pools in North America, Australia, and New Zealand.

Adequate balance sheet with moderate growth potential.

Market Insights

Community Narratives