- United States

- /

- Consumer Durables

- /

- NasdaqGS:SONO

Will New CEO Tom Conrad Mark a Turning Point in Sonos (SONO) Innovation Strategy?

Reviewed by Simply Wall St

- Sonos, Inc. has appointed Tom Conrad as its permanent Chief Executive Officer, effective July 23, 2025, following his interim leadership since January and years of board service.

- Conrad’s extensive background in developing and scaling consumer technology brands, including leadership roles at Pandora and Snap Inc., may influence the company’s direction in smart home audio innovation.

- We'll explore how Tom Conrad’s appointment as CEO could help reinforce Sonos’s focus on product innovation and global expansion.

These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Sonos Investment Narrative Recap

To be a Sonos shareholder today, you need to believe the company can reignite organic growth and expand its position in premium home audio even as competitive pressures and a slower revenue trajectory persist. The appointment of Tom Conrad as permanent CEO does not immediately alter the most pressing short-term catalyst, success in expanding into new categories and geographies, but it could offer added stability to the leadership team in a period of operational change. Yet, key risks around margin pressure from tariffs and trade volatility remain and are not directly resolved by this leadership news.

Among recent developments, the board’s approval of a new US$150 million share repurchase program is particularly relevant given the company’s shift toward cost efficiency and renewed focus on maximizing shareholder value. This move, set against a backdrop of restructuring efforts and margin improvement initiatives, aligns with the need to counterbalance sluggish topline trends and demonstrate capital discipline while repositioning the business for future growth. But for investors, the contrast between such shareholder returns and the underlying challenge of declining core revenue is hard to ignore.

On the other hand, investors should be aware that persistent global tariff volatility could...

Read the full narrative on Sonos (it's free!)

Sonos' narrative projects $1.5 billion revenue and $113.8 million earnings by 2028. This requires 1.2% yearly revenue growth and a $183.1 million earnings increase from current earnings of -$69.3 million.

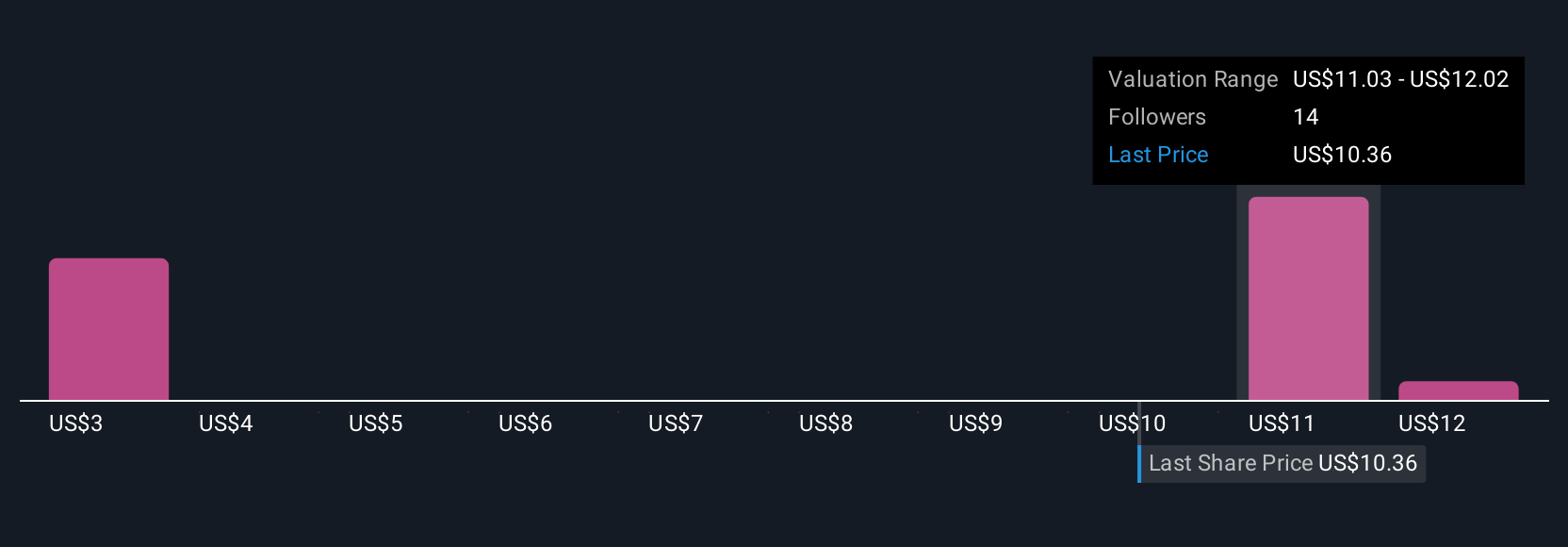

Uncover how Sonos' forecasts yield a $11.62 fair value, in line with its current price.

Exploring Other Perspectives

Retail fair value estimates from the Simply Wall St Community span from US$11.63 to US$40.09 across four views. While opinions are split on valuation, many continue to focus on the importance of innovation and leadership consistency in Sonos’s future.

Explore 4 other fair value estimates on Sonos - why the stock might be worth over 3x more than the current price!

Build Your Own Sonos Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Sonos research is our analysis highlighting 1 key reward that could impact your investment decision.

- Our free Sonos research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Sonos' overall financial health at a glance.

Seeking Other Investments?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 19 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- The end of cancer? These 25 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SONO

Sonos

Designs, develops, manufactures, and sells audio products and services in the Americas, Europe, the Middle East, Africa, and the Asia Pacific.

Flawless balance sheet and overvalued.

Similar Companies

Market Insights

Community Narratives