- United States

- /

- Consumer Durables

- /

- NasdaqGS:SONO

Sonos (SONO) Valuation: Assessing the Impact of Strong Q4 Earnings on Investor Optimism

Reviewed by Simply Wall St

Sonos (SONO) just reported its fourth quarter earnings, highlighting both year-over-year sales growth and a narrowing net loss. These results are front and center for investors watching the stock's next move.

See our latest analysis for Sonos.

Sonos’s upbeat earnings seem to have reignited investor optimism, reflected in a 51.7% share price gain over the last 90 days and a 1-year total shareholder return of 22.1%. Momentum is clearly building as the company delivers improving financial results.

If you’re searching for your next idea, now is an ideal moment to broaden your investing universe and discover fast growing stocks with high insider ownership

This rapid surge raises a crucial question for investors: is Sonos still trading below its true value, or has the rally already factored in all of the company’s anticipated future growth, creating little room for upside?

Most Popular Narrative: 16% Overvalued

According to the most widely followed narrative, Sonos’s fair value is pegged at $14.35 per share, which is noticeably lower than the recent closing price of $16.64. This suggests the market is anticipating more growth or profitability than the current analyst consensus, but the expectations gap is growing.

Ongoing diversification into new product categories (such as headphones and enhanced home theater), coupled with growing focus on software-enabled functionality and future recurring services, is expected to reduce revenue volatility and cyclicality. This is seen as supporting both topline growth and higher net margins over the medium to long term.

What is really fueling this premium? Behind the scenes are bold assumptions about growth and profit margins that only a handful of industry leaders have matched. Ever wondered what surprising financial forecasts justify this lofty pricing? Don’t miss the full narrative revealing each lever behind the market’s elevated expectations.

Result: Fair Value of $14.35 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing tariff pressures and a lull in new hardware releases could hamper Sonos's near-term growth and challenge the current bullish outlook.

Find out about the key risks to this Sonos narrative.

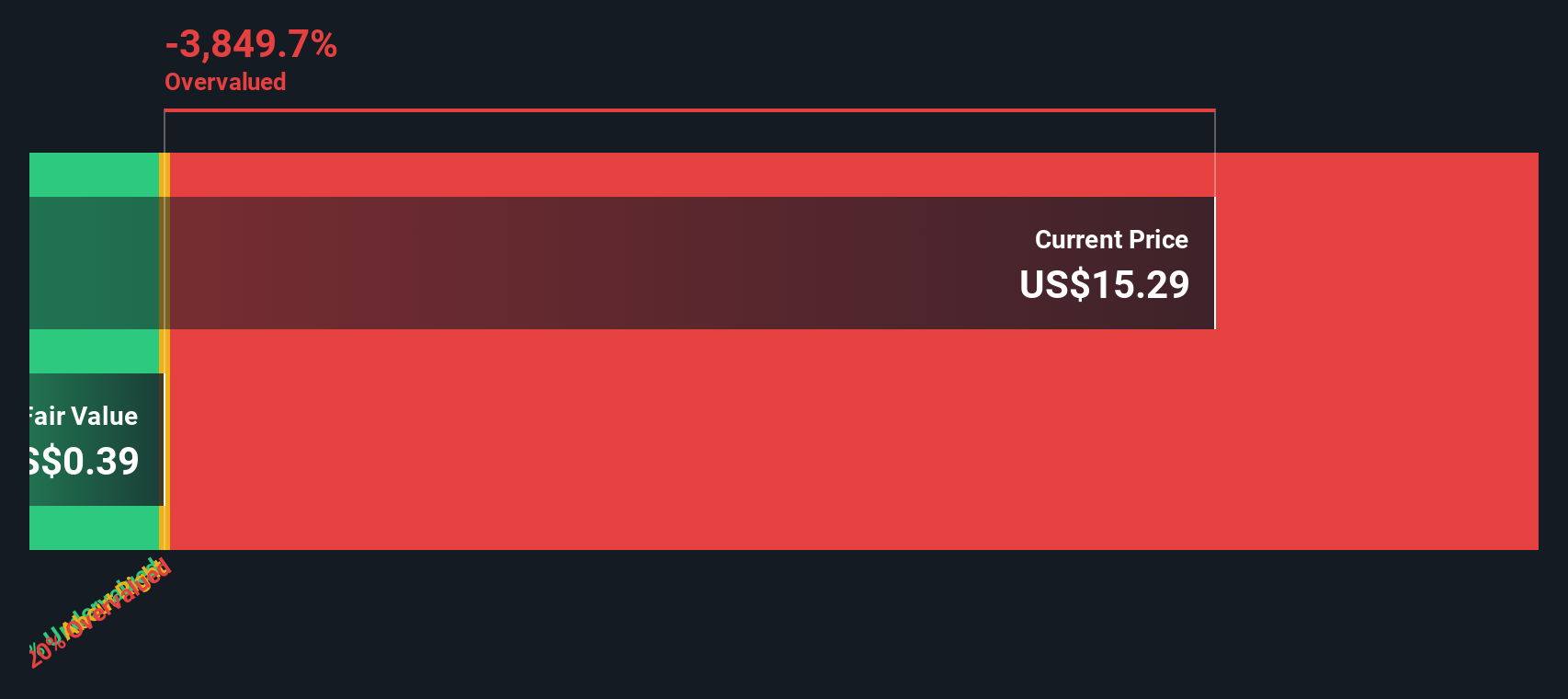

Another View: The SWS DCF Model Says Overvalued, Too

Looking at Sonos through our DCF model, the estimate of fair value stands at just $0.38. This figure is far below both the recent share price and analyst targets. This sharp contrast implies that the current price could be factoring in aggressive long-term growth assumptions. Which viewpoint is right? Can Sonos justify its lofty multiples, or is the market pricing in too much hope?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Sonos Narrative

If you have a different perspective or want to investigate the numbers for yourself, you can craft your own narrative in just a few minutes. Do it your way

Prefer to form your own view? Our platform makes it easy to explore a stock's fundamentals and create your own narrative in minutes.

Looking for more investment ideas?

Take control of your investing journey by tapping into fresh opportunities you might miss if you stick to the usual names. Check out ideas shaping the next wave of growth:

- Capture the potential of breakthrough biotech by checking out these 33 healthcare AI stocks, which are transforming medicine with artificial intelligence and predictive analytics.

- Unlock value and consistent income by reviewing these 20 dividend stocks with yields > 3%, offering attractive yields over 3 percent and proven financial strength.

- Get ahead of the curve and ride the surging momentum in digital assets with these 81 cryptocurrency and blockchain stocks, which are leading innovation in blockchain and cryptocurrency markets.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SONO

Sonos

Designs, develops, manufactures, and sells audio products and services in the Americas, Europe, the Middle East, Africa, and the Asia Pacific.

Flawless balance sheet and overvalued.

Similar Companies

Market Insights

Community Narratives