- United States

- /

- Consumer Durables

- /

- NasdaqGS:SONO

Sonos (SONO): Losses Widen 60% Annually, Extended Unprofitability Challenges Optimistic Narratives

Reviewed by Simply Wall St

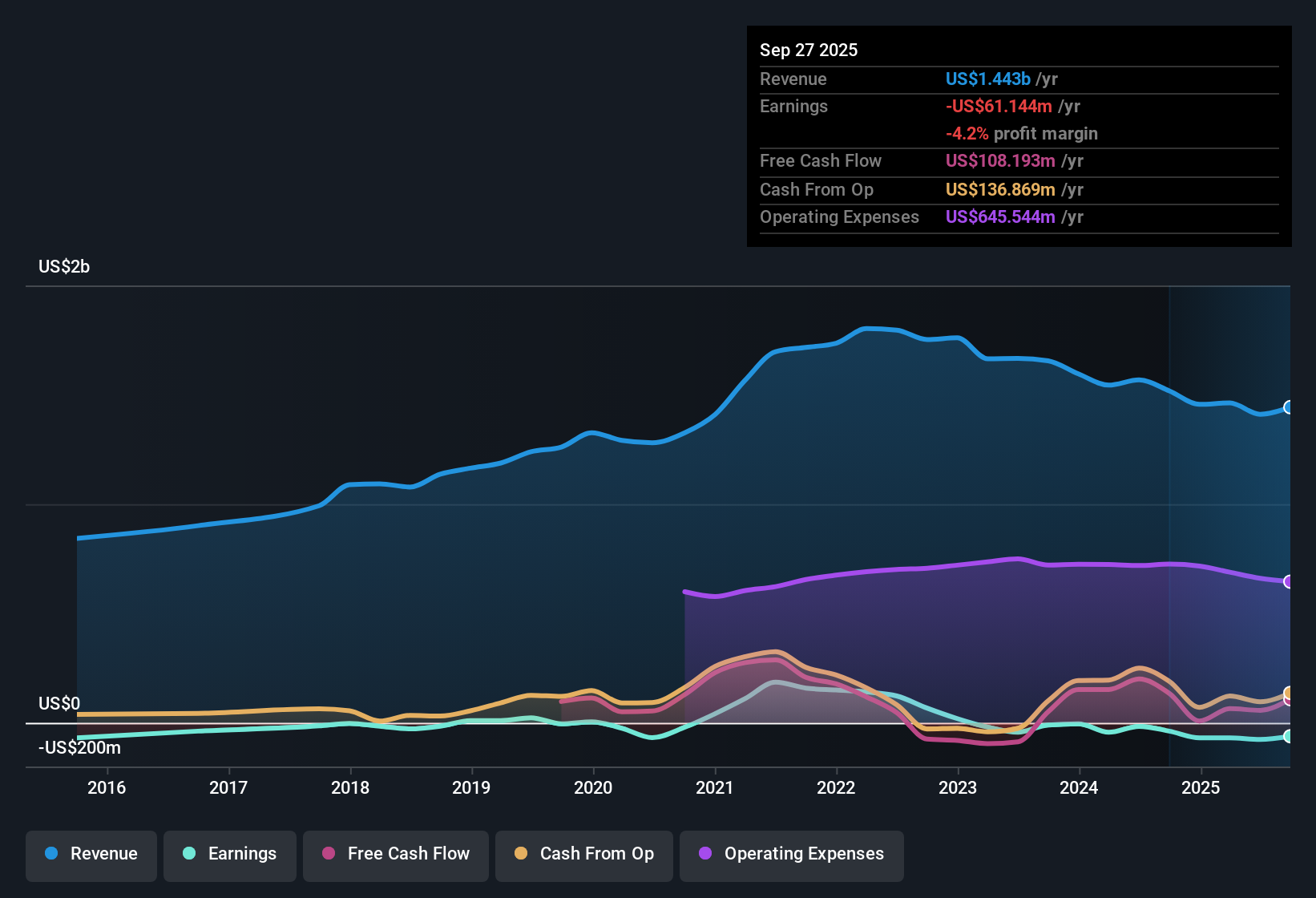

Sonos (SONO) continues to struggle with profitability, posting losses that have increased at an average rate of 60% annually over the past five years. Despite trading at $16.29 per share, the company's revenue is projected to grow at just 5.5% per year, lagging behind the broader US market's 10.4% pace. Current forecasts point to ongoing unprofitability through at least the next three years. With shares trading above the discounted cash flow-derived fair value and margins showing no sign of improvement, investors are left weighing the relative value on a sales basis against persistent losses and muted top-line growth.

See our full analysis for Sonos.Next, we'll see how Sonos's latest earnings match up with the key narratives investors and the market have been following, highlighting what the numbers confirm and where they might raise new questions.

See what the community is saying about Sonos

Profit Margin Still -5.4%

- Sonos continues to post a negative profit margin, remaining at -5.4% with no clear sign of moving toward breakeven. Forecasts do not expect profitability within the next three years.

- According to the analysts' consensus view, the company’s drive to bolster margins through cost restructuring and targeted international expansion is expected to improve profitability over time.

- Persistent losses and muted top-line growth pose a direct challenge to optimistic projections of stronger earnings.

- Consensus narrative highlights that enhanced software and AI integration could drive long-term margin expansion. However, so far, the unchanging net margin invites healthy skepticism.

See if analysts believe Sonos is finally on the path to stronger earnings in the full consensus narrative. 📊 Read the full Sonos Consensus Narrative.

Peer Sales Valuation Discount, Yet Over Industry Average

- Sonos trades at a Price-To-Sales (P/S) ratio of 1.4x, significantly below its peer group at 2.3x, but still above the broader US Consumer Durables industry average of 0.6x.

- Consensus narrative maintains that this relative peer discount could help offset concerns about weak profits.

- A premium to the sector average leaves little margin for error, particularly as revenue projections trail the overall market.

- This tension is at the heart of the consensus. Can Sonos’s brand loyalty and platform strategy justify its higher P/S, or will lagging growth make that premium hard to defend?

DCF Fair Value Well Below Market Price

- With Sonos stock at $16.29 and discounted cash flow (DCF) fair value estimated at just $6.21, shares are trading at more than double their intrinsic value by this method.

- As the consensus narrative sees it, confidence in Sonos’s strategic evolution, including diversification and software-driven recurring revenue, must be weighed against a valuation that prices in best-case scenarios.

- The current price also slightly exceeds the official analyst price target of 16.85, indicating limited near-term upside as projected by Wall Street.

- This gap between calculated fair value and the market price keeps the investment case dependent on multi-year margin improvements that have yet to materialize.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Sonos on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a different take on the figures? Put your viewpoint into action and craft your own narrative in just a few minutes. Do it your way.

See What Else Is Out There

Sonos faces persistent losses, sluggish revenue growth, and a market price well above intrinsic value. This makes its investment case hinge on uncertain long-term improvements.

If an overstretched valuation and weak profitability concern you, use these 853 undervalued stocks based on cash flows to shift your search toward companies trading below their fair value with real upside potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SONO

Sonos

Designs, develops, manufactures, and sells audio products and services in the Americas, Europe, the Middle East, Africa, and the Asia Pacific.

Flawless balance sheet and overvalued.

Similar Companies

Market Insights

Community Narratives