- United States

- /

- Consumer Durables

- /

- NasdaqGS:SONO

Does Sonos Stock Reflect Its True Value After Expansion Into Smart Speakers?

Reviewed by Bailey Pemberton

- If you have ever wondered whether Sonos might actually be a value pick hiding in plain sight, you are not alone. Let's get right to the heart of what the numbers and recent headlines reveal.

- After a 24.7% gain over the last year and a 14.0% lift year-to-date, Sonos stock has certainly caught some fresh attention. However, short-term dips of -4.6% this week and -1.2% over the past month signal there is still some volatility to watch.

- Recent news has included Sonos’ ongoing efforts to expand its smart speaker ecosystem and fresh product launches aimed at broadening appeal beyond its core audiophile customer base. Industry analysts speculate this could explain some of the renewed market interest, as investors assess whether these moves will help Sonos sustain its growth trajectory.

- On a traditional valuation framework, Sonos scores just 1 out of 6 on our undervaluation checks. A deeper dive into multiple methods, and perhaps an even better way to assess value, awaits further in the article.

Sonos scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Sonos Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates a company's value today by projecting its future cash flows and then discounting them back to the present. This approach helps investors gauge whether a stock’s current price reflects its underlying business potential.

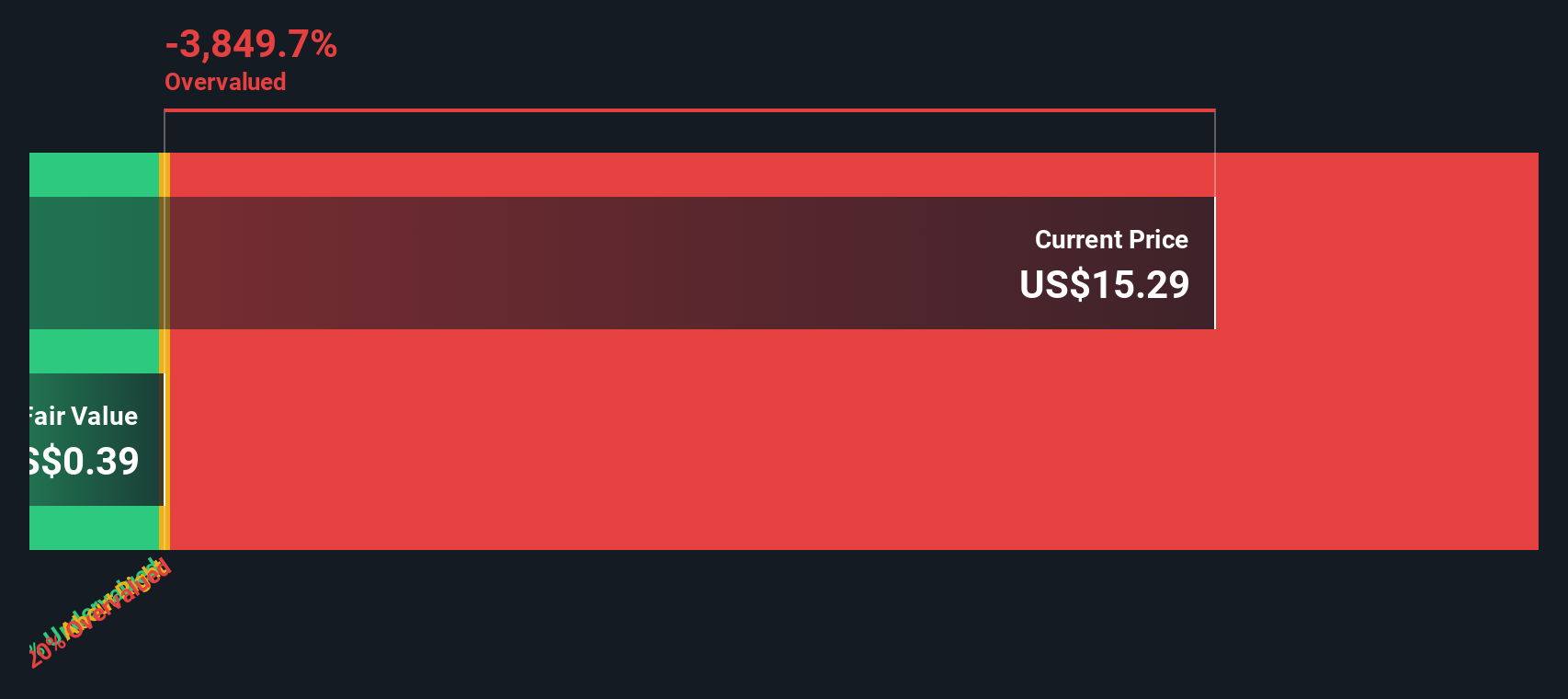

For Sonos, the latest reported Free Cash Flow stands at $50.7 million. Looking ahead, projections for 2025 suggest Free Cash Flow could rise to $117.4 million. However, in the longer term, forecasts show a significant decline over the subsequent decade, with cash flow estimates dropping sharply after 2025 and leveling off just below $2 million by 2035. It is important to note that forecasts beyond five years rely on extrapolation rather than concrete analyst estimates.

According to this DCF analysis, the fair value per Sonos share is $0.39. Compared to the current market price, this implies Sonos stock is trading at a 4,259.9% premium to its estimated intrinsic value. In other words, the market price is dramatically higher than what the company's cash flow outlook supports.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Sonos may be overvalued by 4259.9%. Discover 843 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Sonos Price vs Sales

For companies like Sonos, which are not currently profitable but generate meaningful revenue, the Price-to-Sales (P/S) ratio is often the most informative valuation tool. Unlike earnings-based multiples, P/S focuses purely on top-line sales. This makes it particularly useful when profits are unstable or negative but growth prospects remain in focus.

What counts as a “fair” P/S ratio can depend on factors like a company’s future growth outlook and overall business risk. Generally, higher growth expectations or lower risk warrant a higher P/S multiple. Slower growth or higher risk translate to lower multiples.

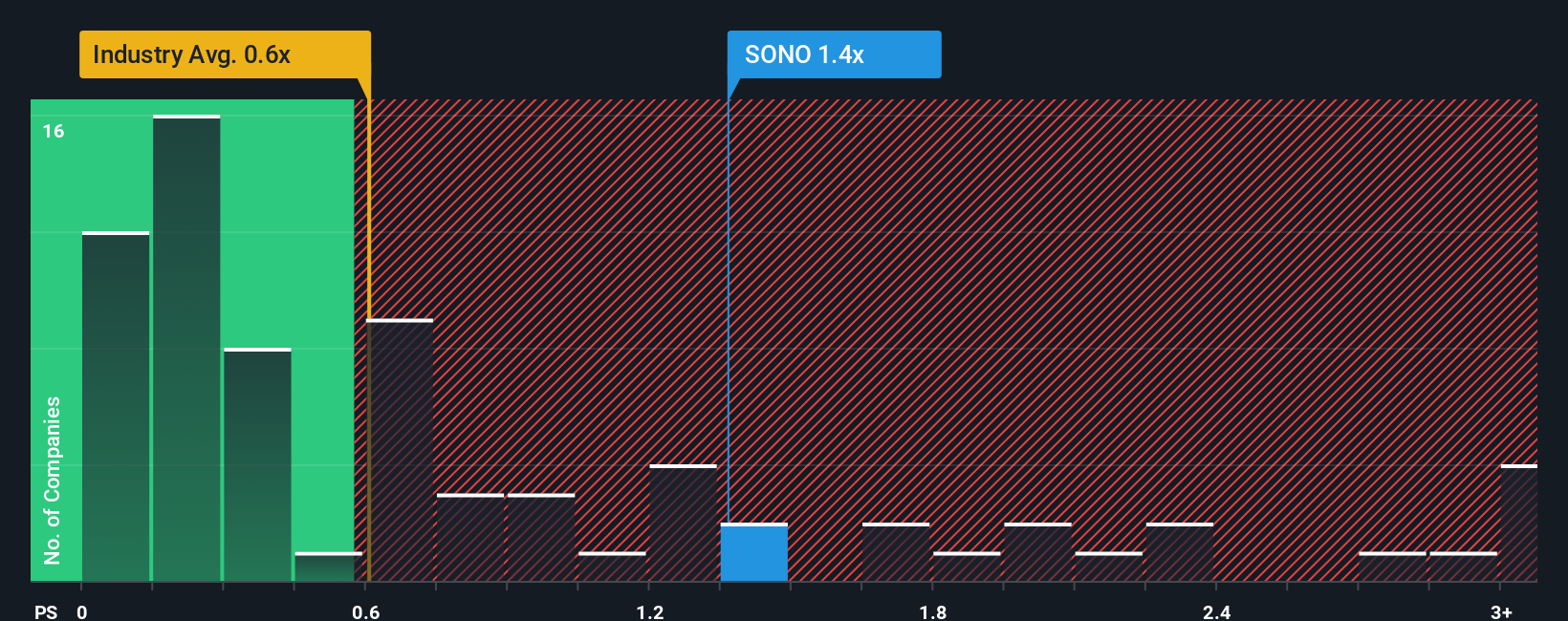

Currently, Sonos trades at a P/S ratio of 1.44x. For comparison, the average among its peers is 2.42x, while the broader Consumer Durables industry has a lower average at just 0.60x. At first glance, Sonos appears less expensive than its closest peers but above the industry average.

However, Simply Wall St’s proprietary Fair Ratio adjusts for more than just industry and peer averages. It incorporates Sonos’ unique blend of sales growth, margin profile, business risks, and market capitalization to create an individualized benchmark. This approach is regarded as more reliable than relying solely on general averages, as it ensures the fair value assessment is tailored to the company’s specific context.

The Fair Ratio for Sonos stands at 0.87x, noticeably below the company’s current P/S of 1.44x. Given this gap is greater than 0.10, this suggests Sonos is trading at a premium relative to what the company’s fundamentals would warrant.

Result: OVERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1410 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Sonos Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is your personal investment story for a company. It connects your expectations for Sonos’s business (like growth drivers and risks) to a structured financial forecast, which is then translated into a fair value.

Narratives make valuation feel accessible: you describe what you believe will shape Sonos’s future, estimate key numbers such as revenue and margins, and see the fair value that results from your view. This tool is available within the Community section of Simply Wall St, where millions of investors share and compare their different perspectives and evolving forecasts.

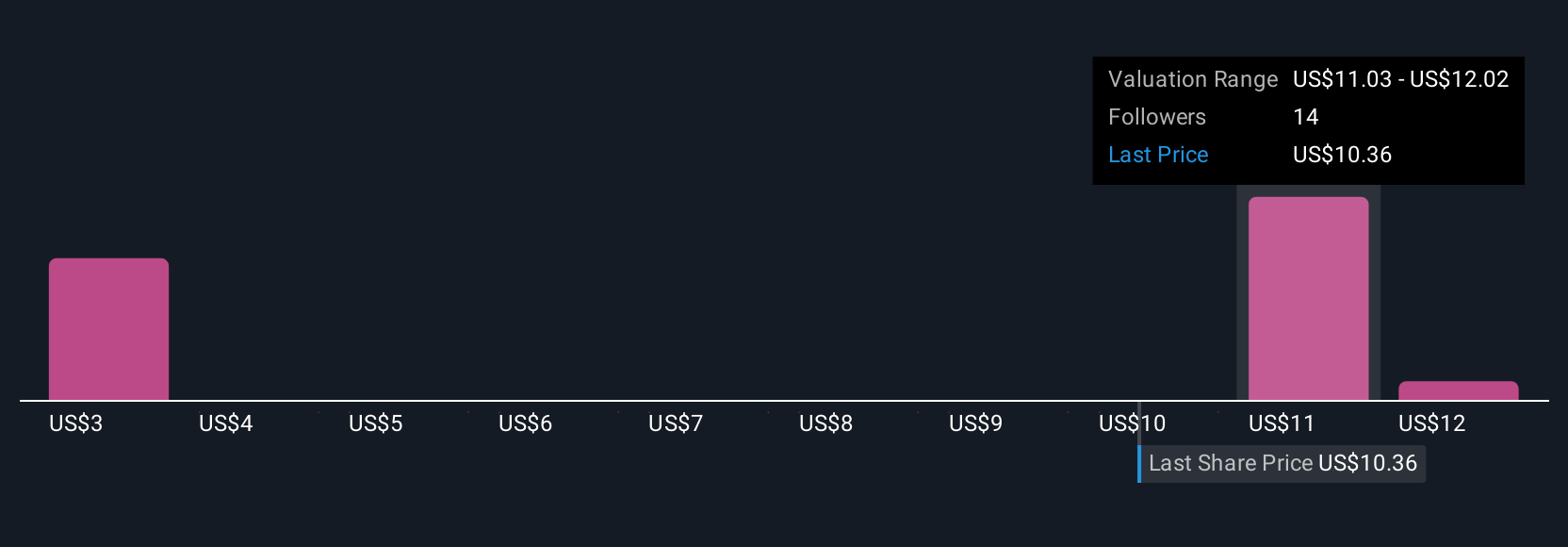

Narratives help you quickly see whether your fair value points to a buying or selling opportunity relative to the current share price, while continuously updating to reflect new news or company results. For example, one investor might see Sonos’s software-led expansion and international growth as supporting a fair value of $17 per share, while another might focus on cost pressures and sluggish volumes, landing closer to $11. Both are valid, evidence-backed viewpoints that you can test, discuss, and refine in real time with the Community.

Do you think there's more to the story for Sonos? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SONO

Sonos

Designs, develops, manufactures, and sells audio products and services in the Americas, Europe, the Middle East, Africa, and the Asia Pacific.

Flawless balance sheet and overvalued.

Similar Companies

Market Insights

Community Narratives