- United States

- /

- Luxury

- /

- NasdaqGS:SHOO

Steven Madden, Ltd. (NASDAQ:SHOO) Stock's 25% Dive Might Signal An Opportunity But It Requires Some Scrutiny

To the annoyance of some shareholders, Steven Madden, Ltd. (NASDAQ:SHOO) shares are down a considerable 25% in the last month, which continues a horrid run for the company. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 49% in that time.

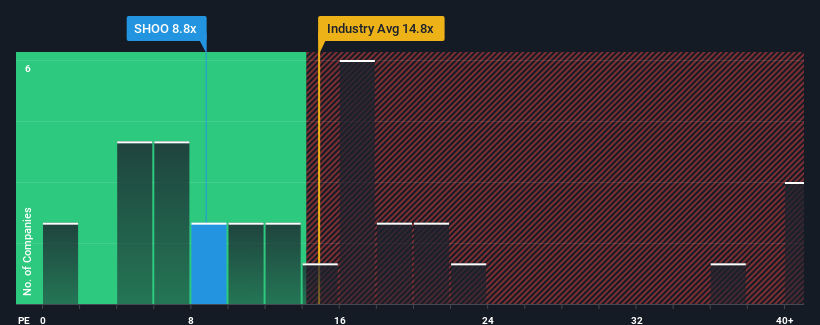

Even after such a large drop in price, Steven Madden may still be sending bullish signals at the moment with its price-to-earnings (or "P/E") ratio of 8.8x, since almost half of all companies in the United States have P/E ratios greater than 17x and even P/E's higher than 31x are not unusual. However, the P/E might be low for a reason and it requires further investigation to determine if it's justified.

Our free stock report includes 1 warning sign investors should be aware of before investing in Steven Madden. Read for free now.With earnings growth that's inferior to most other companies of late, Steven Madden has been relatively sluggish. The P/E is probably low because investors think this lacklustre earnings performance isn't going to get any better. If you still like the company, you'd be hoping earnings don't get any worse and that you could pick up some stock while it's out of favour.

View our latest analysis for Steven Madden

How Is Steven Madden's Growth Trending?

In order to justify its P/E ratio, Steven Madden would need to produce sluggish growth that's trailing the market.

If we review the last year of earnings, the company posted a result that saw barely any deviation from a year ago. Whilst it's an improvement, it wasn't enough to get the company out of the hole it was in, with earnings down 4.0% overall from three years ago. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

Looking ahead now, EPS is anticipated to climb by 8.4% each year during the coming three years according to the nine analysts following the company. With the market predicted to deliver 10% growth per annum, the company is positioned for a comparable earnings result.

With this information, we find it odd that Steven Madden is trading at a P/E lower than the market. Apparently some shareholders are doubtful of the forecasts and have been accepting lower selling prices.

The Key Takeaway

Steven Madden's P/E has taken a tumble along with its share price. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Steven Madden currently trades on a lower than expected P/E since its forecast growth is in line with the wider market. When we see an average earnings outlook with market-like growth, we assume potential risks are what might be placing pressure on the P/E ratio. At least the risk of a price drop looks to be subdued, but investors seem to think future earnings could see some volatility.

There are also other vital risk factors to consider before investing and we've discovered 1 warning sign for Steven Madden that you should be aware of.

If you're unsure about the strength of Steven Madden's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:SHOO

Steven Madden

Designs, sources, and markets fashion-forward branded and private label footwear, accessories, and apparel in the United States and internationally.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives