- United States

- /

- Luxury

- /

- NasdaqGS:SHOO

Not Many Are Piling Into Steven Madden, Ltd. (NASDAQ:SHOO) Just Yet

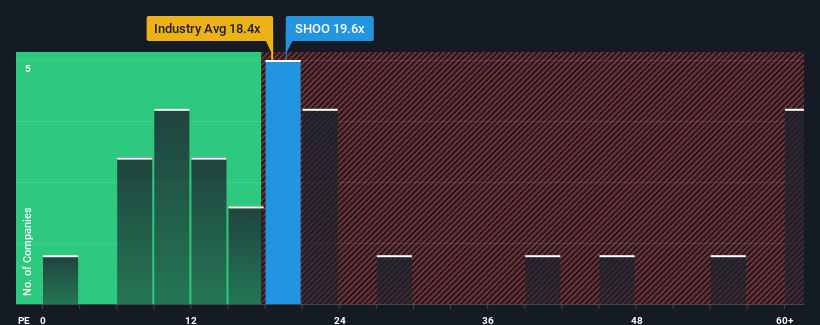

It's not a stretch to say that Steven Madden, Ltd.'s (NASDAQ:SHOO) price-to-earnings (or "P/E") ratio of 18.3x right now seems quite "middle-of-the-road" compared to the market in the United States, where the median P/E ratio is around 18x. Although, it's not wise to simply ignore the P/E without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

With its earnings growth in positive territory compared to the declining earnings of most other companies, Steven Madden has been doing quite well of late. It might be that many expect the strong earnings performance to deteriorate like the rest, which has kept the P/E from rising. If not, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

View our latest analysis for Steven Madden

Does Growth Match The P/E?

The only time you'd be comfortable seeing a P/E like Steven Madden's is when the company's growth is tracking the market closely.

Taking a look back first, we see that the company managed to grow earnings per share by a handy 13% last year. This was backed up an excellent period prior to see EPS up by 164% in total over the last three years. So we can start by confirming that the company has done a great job of growing earnings over that time.

Shifting to the future, estimates from the seven analysts covering the company suggest earnings should grow by 16% per year over the next three years. That's shaping up to be materially higher than the 10% each year growth forecast for the broader market.

With this information, we find it interesting that Steven Madden is trading at a fairly similar P/E to the market. It may be that most investors aren't convinced the company can achieve future growth expectations.

The Final Word

We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Steven Madden currently trades on a lower than expected P/E since its forecast growth is higher than the wider market. There could be some unobserved threats to earnings preventing the P/E ratio from matching the positive outlook. It appears some are indeed anticipating earnings instability, because these conditions should normally provide a boost to the share price.

You always need to take note of risks, for example - Steven Madden has 2 warning signs we think you should be aware of.

Of course, you might also be able to find a better stock than Steven Madden. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:SHOO

Steven Madden

Designs, sources, and markets fashion-forward branded and private label footwear, accessories, and apparel in the United States and internationally.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives