- United States

- /

- Leisure

- /

- NasdaqGS:PTON

Peloton (PTON): Valuation Perspective Following New Healthcare Partnerships and Expansion Into Wellness

Reviewed by Simply Wall St

Peloton Interactive (PTON) just announced two major healthcare collaborations, connecting its fitness platform with leading medical expertise and digital health care plans. This strategic move focuses on merging exercise, science-backed recovery, and broader wellness access for members.

See our latest analysis for Peloton Interactive.

Peloton’s recent healthcare-focused alliances have caught investors’ attention, with last week’s swift 5.2% share price gain highlighting renewed momentum. While the share price has slipped nearly 11% year-to-date, the past quarter’s 16% return stands out. A striking 39% total return over the last year signals that sentiment may be improving after years of volatility.

If Peloton’s push into health and recovery has you rethinking your watchlist, it could be the perfect time to check out other healthcare innovators. See the full list for free with See the full list for free..

After a turbulent few years and a noteworthy rally, is Peloton stock still trading at a discount with upside ahead, or is the market already factoring in the company’s healthcare-driven growth story?

Most Popular Narrative: 22.8% Undervalued

The prevailing market narrative values Peloton at $10.18 per share, nearly 23% above the recent close of $7.86. This gives Peloton a valuation edge in the eyes of most analysts and suggests that the company's transformation is not yet fully reflected in the share price. As a result, there is potential for a bold, growth-oriented outlook.

Peloton is leveraging advanced technologies, including AI-powered personalized coaching and human-driven community features, to broaden its offerings from cardio into holistic wellness (strength, sleep, stress, nutrition). This approach aligns with growing global health consciousness and may support future subscription revenue growth along with higher engagement and reduced churn.

Curious about how ambitious operational goals and a future turnaround drive this price target? The narrative focuses on margin recovery and profit growth, trends typically associated with industry leaders. Want to know the most surprising quantitative assumption supporting this fair value? Discover what key financial change the narrative anticipates next.

Result: Fair Value of $10.18 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, challenges remain, including slowing hardware sales and the risk that higher prices could deter new subscribers. These factors could potentially curb Peloton's growth story.

Find out about the key risks to this Peloton Interactive narrative.

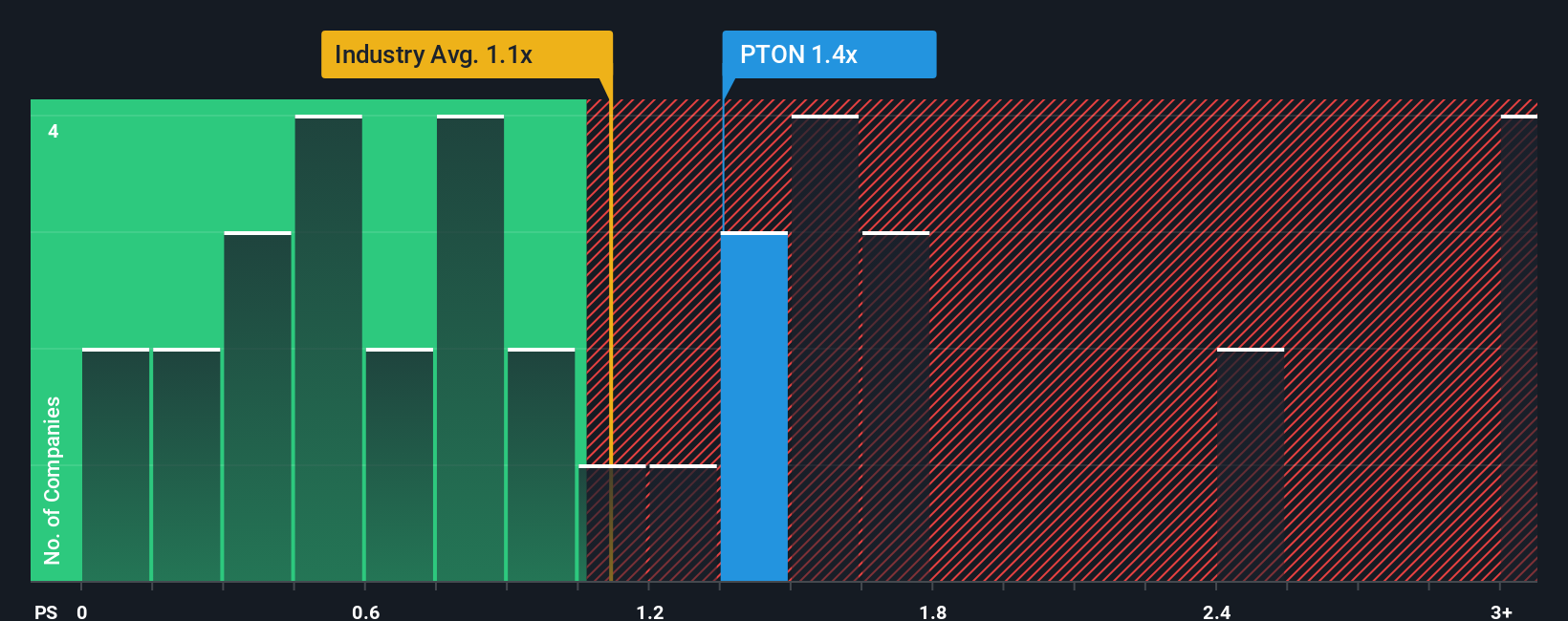

Another View: Price-to-Sales Tells a Different Story

Looking at Peloton through its price-to-sales ratio, the stock appears expensive. At 1.3x, it is above both the US Leisure industry average of 0.9x and the peer average of 1.2x. The market is also pricing it higher than its estimated fair ratio of 1.1x. Does this mean expectations are running ahead of reality?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Peloton Interactive Narrative

If you want to dig deeper or form your own perspective, try building your own view on Peloton’s journey in under three minutes, and Do it your way.

A great starting point for your Peloton Interactive research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Opportunities?

Don't settle for the usual picks and open the door to new opportunities that could drive your portfolio forward when others are missing out.

- Jump on fresh momentum by scanning for value with these 877 undervalued stocks based on cash flows, uncovering stocks priced below their true worth.

- Tap into powerful income streams and steady returns by reviewing these 17 dividend stocks with yields > 3% offering reliable yields above 3%.

- Accelerate your edge in emerging tech by checking out these 24 AI penny stocks that are making headlines in the world of artificial intelligence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PTON

Peloton Interactive

Provides fitness and wellness products and services in North America and internationally.

Reasonable growth potential and fair value.

Similar Companies

Market Insights

Community Narratives