- United States

- /

- Leisure

- /

- NasdaqGS:PTON

Peloton Interactive, Inc.'s (NASDAQ:PTON) Popularity With Investors Under Threat As Stock Sinks 26%

To the annoyance of some shareholders, Peloton Interactive, Inc. (NASDAQ:PTON) shares are down a considerable 26% in the last month, which continues a horrid run for the company. Still, a bad month hasn't completely ruined the past year with the stock gaining 33%, which is great even in a bull market.

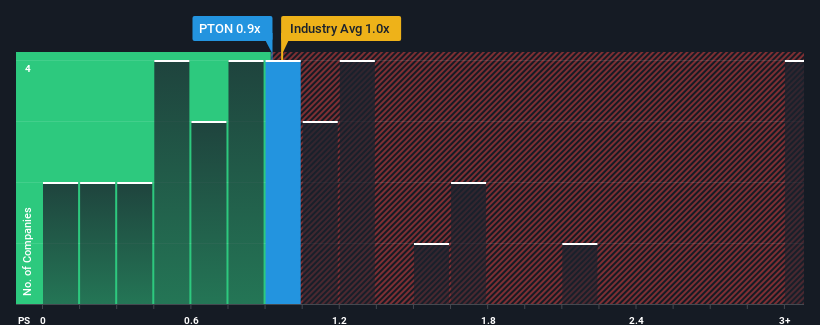

Even after such a large drop in price, it's still not a stretch to say that Peloton Interactive's price-to-sales (or "P/S") ratio of 0.9x right now seems quite "middle-of-the-road" compared to the Leisure industry in the United States, seeing as it matches the P/S ratio of the wider industry. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Check out our latest analysis for Peloton Interactive

How Has Peloton Interactive Performed Recently?

Recent times have been more advantageous for Peloton Interactive as its revenue hasn't fallen as much as the rest of the industry. Perhaps the market is expecting future revenue performance fall back in line with the poorer industry performance, which has kept the P/S contained. If you still like the company, you'd want its revenue trajectory to turn around before making any decisions. But at the very least, you'd be hoping the company doesn't fall back into the pack if your plan is to pick up some stock while it's not in favour.

Keen to find out how analysts think Peloton Interactive's future stacks up against the industry? In that case, our free report is a great place to start.Do Revenue Forecasts Match The P/S Ratio?

In order to justify its P/S ratio, Peloton Interactive would need to produce growth that's similar to the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 4.0%. The last three years don't look nice either as the company has shrunk revenue by 37% in aggregate. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to slump, contracting by 0.9% each year during the coming three years according to the analysts following the company. With the industry predicted to deliver 3.5% growth each year, that's a disappointing outcome.

With this in consideration, we think it doesn't make sense that Peloton Interactive's P/S is closely matching its industry peers. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. There's a good chance these shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the negative growth outlook.

What Does Peloton Interactive's P/S Mean For Investors?

With its share price dropping off a cliff, the P/S for Peloton Interactive looks to be in line with the rest of the Leisure industry. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Our check of Peloton Interactive's analyst forecasts revealed that its outlook for shrinking revenue isn't bringing down its P/S as much as we would have predicted. When we see a gloomy outlook like this, our immediate thoughts are that the share price is at risk of declining, negatively impacting P/S. If the poor revenue outlook tells us one thing, it's that these current price levels could be unsustainable.

There are also other vital risk factors to consider and we've discovered 2 warning signs for Peloton Interactive (1 is significant!) that you should be aware of before investing here.

If these risks are making you reconsider your opinion on Peloton Interactive, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:PTON

Peloton Interactive

Provides fitness and wellness products and services in North America and internationally.

Reasonable growth potential and slightly overvalued.

Similar Companies

Market Insights

Community Narratives