- United States

- /

- Leisure

- /

- NasdaqGS:PTON

Evaluating Peloton (PTON): What Recent Stock Swings Reveal About Its Current Valuation

Reviewed by Simply Wall St

See our latest analysis for Peloton Interactive.

Peloton’s share price has swung notably in recent weeks, with a 1-day share price return of 0.85% offsetting part of its 7-day and 30-day declines. Despite these short-term fluctuations, the longer-term momentum remains weak as reflected in a -19.25% share price return year-to-date and a -10.09% total shareholder return over the past twelve months.

If Peloton’s recent price swings have you thinking about fresh opportunities, now’s the perfect time to discover fast growing stocks with high insider ownership

With Peloton now trading at a significant discount to analyst price targets and reporting improving net income, the question is whether the market is overlooking a bargain or if future growth is already reflected in the price.

Most Popular Narrative: 30% Undervalued

Peloton's current share price sits well below the narrative's estimated fair value, sparking debate about whether recent innovations are fully reflected by the market or if there's hidden upside yet to be priced in.

Peloton is leveraging advanced technologies, including AI-powered personalized coaching and human-driven community features, to broaden its offerings from cardio into holistic wellness (strength, sleep, stress, nutrition). This approach aligns with growing global health consciousness and may support future subscription revenue growth as well as higher engagement and reduced churn.

Want the real story behind this valuation? The narrative hinges on bold expectations for a turnaround in profitability and surprising projections for future growth. Curious how ambitious margin improvements and a rising earnings multiple could play out? There is a lot more to uncover. See how these quantitative assumptions stack up against what the market currently believes.

Result: Fair Value of $10.18 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent subscriber declines and growing competition from low-cost fitness providers could quickly reverse Peloton's recovery narrative if these headwinds become more severe.

Find out about the key risks to this Peloton Interactive narrative.

Another View: Looking Through the Multiples Lens

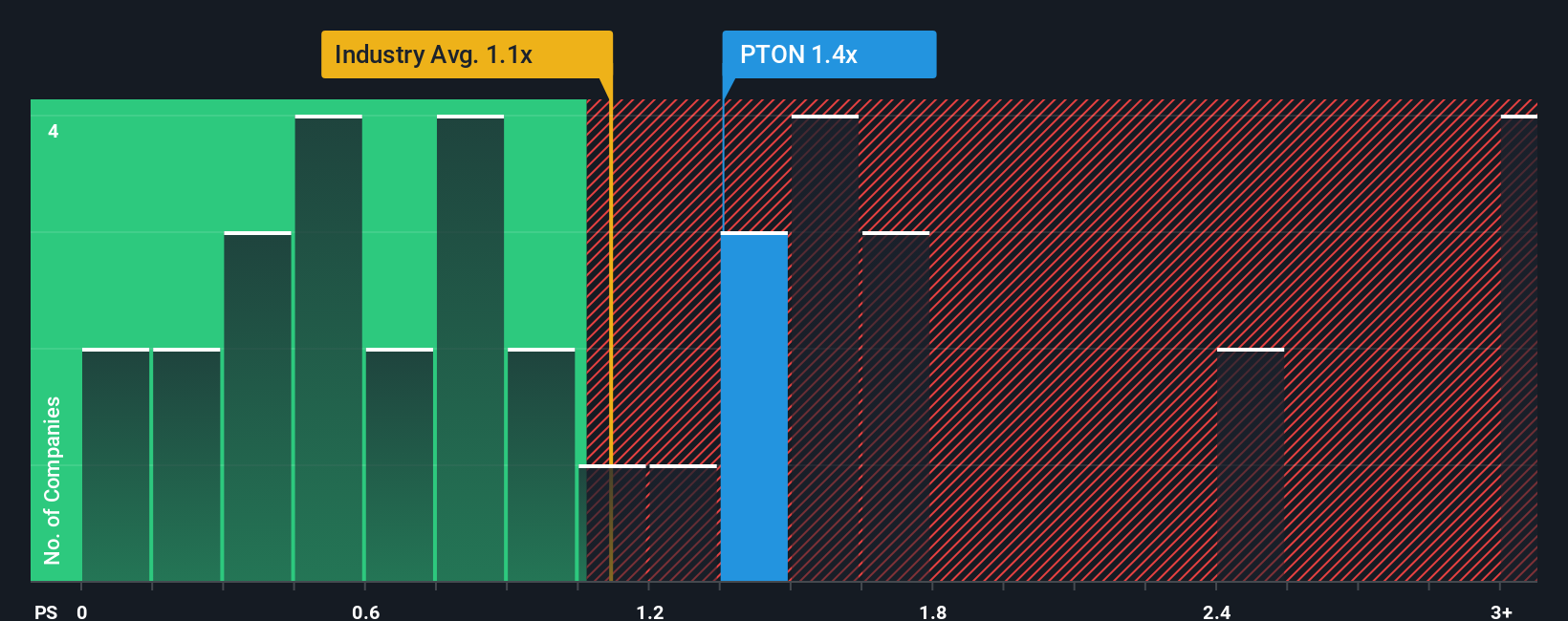

Switching to the price-to-sales ratio, Peloton trades at 1.2x, which is higher than the US Leisure industry average of 0.9x, but matches its peer average. This suggests Peloton may be priced at a premium compared to the broader industry, even as the fair ratio sits at 1x. Does this premium signal investor confidence or introduce more valuation risk?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Peloton Interactive Narrative

If you see things differently or want to dive deeper into the data on your own terms, you can shape your perspective in just a few minutes. Do it your way

A great starting point for your Peloton Interactive research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don’t let opportunity pass you by. Ignite your portfolio by taking action with unique stock ideas specially selected for growth-focused investors like you.

- Tap into rapid digital health advancements and spot emerging players by checking out these 33 healthcare AI stocks to uncover breakthroughs in AI-powered medicine.

- Boost your search for market value by scanning these 844 undervalued stocks based on cash flows, where stocks with strong cash flows might be priced below their true worth right now.

- Capture the power of consistent returns and find companies rewarding shareholders by reviewing these 20 dividend stocks with yields > 3% with above-average yields.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PTON

Peloton Interactive

Provides fitness and wellness products and services in North America and internationally.

Reasonable growth potential and fair value.

Similar Companies

Market Insights

Community Narratives