- United States

- /

- Leisure

- /

- NasdaqGS:PTON

Can Peloton’s (PTON) Formula 1 Tie-Up Reveal New Paths for User Engagement and Brand Differentiation?

Reviewed by Sasha Jovanovic

- The Formula 1 Las Vegas Grand Prix and Peloton Interactive jointly announced a series of exclusive fitness experiences and immersive onsite classes during the Las Vegas race weekend, including unique virtual content and live programming with Peloton instructors at the Wynn Las Vegas.

- This collaboration offers Peloton members access to virtual rides and runs along the actual Las Vegas Strip Circuit, highlighting how major event partnerships can broaden user engagement and showcase the brand’s connected fitness innovation.

- We'll explore how Peloton's event-driven partnership with Formula 1 could influence its audience reach and product engagement outlook.

These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Peloton Interactive Investment Narrative Recap

Investors in Peloton Interactive must believe the company can reinvigorate engagement and expand its user base, despite ongoing pressure on hardware sales and subscription growth. While Peloton’s new partnership during the Formula 1 Las Vegas Grand Prix bolsters its brand with exclusive content and experiential classes, this high-profile collaboration alone does not directly address the critical challenge of reversing subscriber and hardware unit declines in the near term, which remains the biggest risk to the business today.

Of the company's recent announcements, Peloton’s October launch of the Cross Training Series stands out alongside the F1 collaboration, as both highlight an effort to refresh and diversify its product lineup. The integration of AI-powered Peloton IQ and expanded workout modalities could help drive user engagement and retention, yet category saturation and slower subscriber acquisition continue to impact the most important catalysts for future revenue growth.

However, with the spotlight on big event partnerships, it is important for investors to recognize that persistent declines in connected fitness subscriptions could signal underlying demand issues and...

Read the full narrative on Peloton Interactive (it's free!)

Peloton Interactive's outlook anticipates $2.5 billion in revenue and $113.2 million in earnings by 2028. This scenario assumes a 0.4% annual revenue decline and an earnings increase of $232.1 million from the current -$118.9 million.

Uncover how Peloton Interactive's forecasts yield a $10.48 fair value, a 62% upside to its current price.

Exploring Other Perspectives

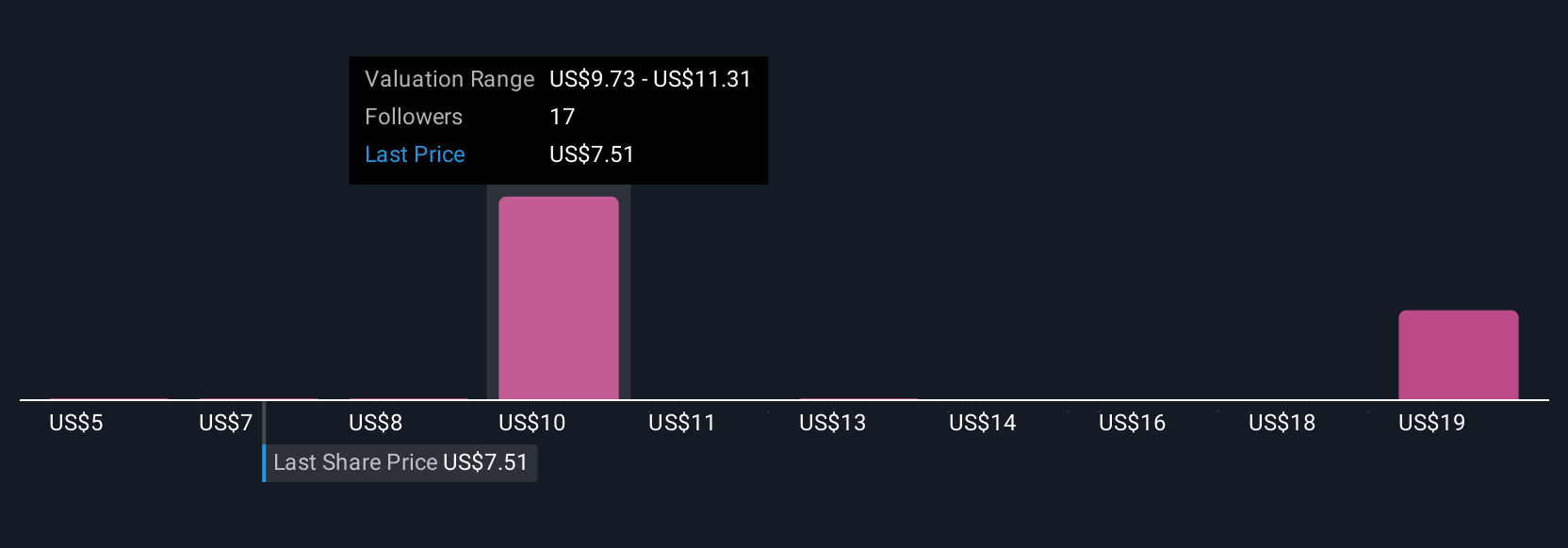

Eight fair value estimates from the Simply Wall St Community cluster between US$5 and US$20.30 per share, reflecting broad disagreement on Peloton’s growth outlook. Strong competition and shrinking subscriptions underscore why opinions can vary so widely, take a look at several perspectives to see where you align.

Explore 8 other fair value estimates on Peloton Interactive - why the stock might be worth over 3x more than the current price!

Build Your Own Peloton Interactive Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Peloton Interactive research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Peloton Interactive research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Peloton Interactive's overall financial health at a glance.

No Opportunity In Peloton Interactive?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PTON

Peloton Interactive

Provides fitness and wellness products and services in North America and internationally.

Reasonable growth potential and slightly overvalued.

Similar Companies

Market Insights

Community Narratives