- United States

- /

- Luxury

- /

- NasdaqGM:PLBY

With A 37% Price Drop For PLBY Group, Inc. (NASDAQ:PLBY) You'll Still Get What You Pay For

PLBY Group, Inc. (NASDAQ:PLBY) shareholders that were waiting for something to happen have been dealt a blow with a 37% share price drop in the last month. Still, a bad month hasn't completely ruined the past year with the stock gaining 51%, which is great even in a bull market.

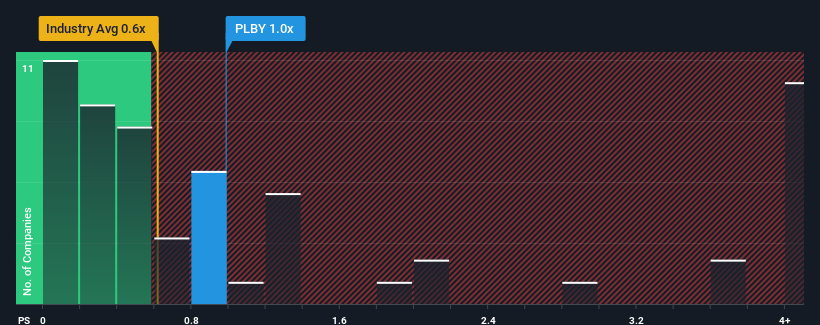

Even after such a large drop in price, it's still not a stretch to say that PLBY Group's price-to-sales (or "P/S") ratio of 1x right now seems quite "middle-of-the-road" compared to the Luxury industry in the United States, where the median P/S ratio is around 0.6x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

View our latest analysis for PLBY Group

How PLBY Group Has Been Performing

PLBY Group could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. Perhaps the market is expecting its poor revenue performance to improve, keeping the P/S from dropping. However, if this isn't the case, investors might get caught out paying too much for the stock.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on PLBY Group.Is There Some Revenue Growth Forecasted For PLBY Group?

The only time you'd be comfortable seeing a P/S like PLBY Group's is when the company's growth is tracking the industry closely.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 19%. The last three years don't look nice either as the company has shrunk revenue by 53% in aggregate. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Shifting to the future, estimates from the two analysts covering the company suggest revenue should grow by 3.8% over the next year. That's shaping up to be similar to the 3.3% growth forecast for the broader industry.

With this in mind, it makes sense that PLBY Group's P/S is closely matching its industry peers. Apparently shareholders are comfortable to simply hold on while the company is keeping a low profile.

The Bottom Line On PLBY Group's P/S

Following PLBY Group's share price tumble, its P/S is just clinging on to the industry median P/S. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

A PLBY Group's P/S seems about right to us given the knowledge that analysts are forecasting a revenue outlook that is similar to the Luxury industry. At this stage investors feel the potential for an improvement or deterioration in revenue isn't great enough to push P/S in a higher or lower direction. Unless these conditions change, they will continue to support the share price at these levels.

Before you settle on your opinion, we've discovered 2 warning signs for PLBY Group that you should be aware of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:PLBY

Playboy

PLBY Group, Inc. operates as a pleasure and leisure company in the United States, Australia, China, the United Kingdom, and internationally.

Slight and overvalued.

Similar Companies

Market Insights

Community Narratives