- United States

- /

- Luxury

- /

- NasdaqGM:PLBY

It's Down 33% But PLBY Group, Inc. (NASDAQ:PLBY) Could Be Riskier Than It Looks

PLBY Group, Inc. (NASDAQ:PLBY) shareholders that were waiting for something to happen have been dealt a blow with a 33% share price drop in the last month. For any long-term shareholders, the last month ends a year to forget by locking in a 57% share price decline.

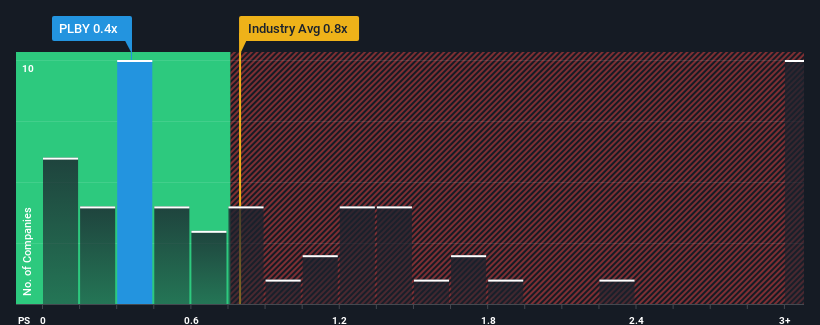

Even after such a large drop in price, it's still not a stretch to say that PLBY Group's price-to-sales (or "P/S") ratio of 0.4x right now seems quite "middle-of-the-road" compared to the Luxury industry in the United States, where the median P/S ratio is around 0.8x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Check out our latest analysis for PLBY Group

What Does PLBY Group's Recent Performance Look Like?

PLBY Group hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. One possibility is that the P/S ratio is moderate because investors think this poor revenue performance will turn around. If not, then existing shareholders may be a little nervous about the viability of the share price.

Want the full picture on analyst estimates for the company? Then our free report on PLBY Group will help you uncover what's on the horizon.Is There Some Revenue Growth Forecasted For PLBY Group?

The only time you'd be comfortable seeing a P/S like PLBY Group's is when the company's growth is tracking the industry closely.

Retrospectively, the last year delivered a frustrating 22% decrease to the company's top line. This means it has also seen a slide in revenue over the longer-term as revenue is down 28% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Shifting to the future, estimates from the three analysts covering the company suggest revenue should grow by 12% per year over the next three years. With the industry only predicted to deliver 6.2% each year, the company is positioned for a stronger revenue result.

With this in consideration, we find it intriguing that PLBY Group's P/S is closely matching its industry peers. It may be that most investors aren't convinced the company can achieve future growth expectations.

The Final Word

Following PLBY Group's share price tumble, its P/S is just clinging on to the industry median P/S. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Looking at PLBY Group's analyst forecasts revealed that its superior revenue outlook isn't giving the boost to its P/S that we would've expected. There could be some risks that the market is pricing in, which is preventing the P/S ratio from matching the positive outlook. It appears some are indeed anticipating revenue instability, because these conditions should normally provide a boost to the share price.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 4 warning signs with PLBY Group, and understanding them should be part of your investment process.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:PLBY

Playboy

PLBY Group, Inc. operates as a pleasure and leisure company in the United States, Australia, China, the United Kingdom, and internationally.

Slight and overvalued.

Similar Companies

Market Insights

Community Narratives