- United States

- /

- Consumer Durables

- /

- NasdaqCM:RIME

Market Might Still Lack Some Conviction On The Singing Machine Company, Inc. (NASDAQ:MICS) Even After 46% Share Price Boost

Those holding The Singing Machine Company, Inc. (NASDAQ:MICS) shares would be relieved that the share price has rebounded 46% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. Still, the 30-day jump doesn't change the fact that longer term shareholders have seen their stock decimated by the 63% share price drop in the last twelve months.

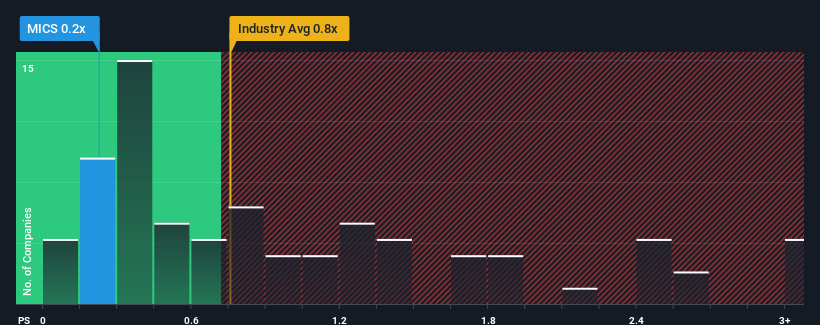

Although its price has surged higher, when close to half the companies operating in the United States' Consumer Durables industry have price-to-sales ratios (or "P/S") above 0.8x, you may still consider Singing Machine Company as an enticing stock to check out with its 0.2x P/S ratio. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Singing Machine Company

How Singing Machine Company Has Been Performing

With revenue that's retreating more than the industry's average of late, Singing Machine Company has been very sluggish. It seems that many are expecting the dismal revenue performance to persist, which has repressed the P/S. If you still like the company, you'd want its revenue trajectory to turn around before making any decisions. If not, then existing shareholders will probably struggle to get excited about the future direction of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Singing Machine Company.Is There Any Revenue Growth Forecasted For Singing Machine Company?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Singing Machine Company's to be considered reasonable.

Retrospectively, the last year delivered a frustrating 45% decrease to the company's top line. As a result, revenue from three years ago have also fallen 28% overall. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Turning to the outlook, the next year should generate growth of 26% as estimated by the only analyst watching the company. With the industry only predicted to deliver 3.7%, the company is positioned for a stronger revenue result.

With this in consideration, we find it intriguing that Singing Machine Company's P/S sits behind most of its industry peers. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

The Bottom Line On Singing Machine Company's P/S

Despite Singing Machine Company's share price climbing recently, its P/S still lags most other companies. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

To us, it seems Singing Machine Company currently trades on a significantly depressed P/S given its forecasted revenue growth is higher than the rest of its industry. The reason for this depressed P/S could potentially be found in the risks the market is pricing in. While the possibility of the share price plunging seems unlikely due to the high growth forecasted for the company, the market does appear to have some hesitation.

Plus, you should also learn about these 3 warning signs we've spotted with Singing Machine Company (including 2 which shouldn't be ignored).

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:RIME

Algorhythm Holdings

Engages in the development, marketing, and sale of consumer karaoke audio equipment, accessories, and musical recordings in North America, Australia, the United Kingdom, Europe, and internationally.

Slight risk with mediocre balance sheet.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026