- United States

- /

- Luxury

- /

- NasdaqGS:LULU

Will Lululemon's (LULU) Leadership Shuffle Reveal a New Direction for Global Growth?

Reviewed by Sasha Jovanovic

- Lululemon athletica announced significant executive changes, including the departure of President of the Americas Celeste Burgoyne at the end of December 2025 and the consolidation of regional leadership under André Maestrini, who is now overseeing all global stores and digital channels.

- These leadership appointments come as the company executes a turnaround strategy to address slowing U.S. sales and intensifying competition in the activewear sector.

- We'll explore how the recent leadership consolidation may influence Lululemon's efforts to reinvigorate its U.S. performance and support global expansion.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

lululemon athletica Investment Narrative Recap

To be a lululemon shareholder today, you need to believe the brand can successfully reignite growth in its US core while continuing to build on its expanding international presence and performance-driven innovation. The consolidation of global leadership under André Maestrini is designed to streamline execution, but its true impact on the immediate US sales turnaround, the most important short-term catalyst, remains to be seen; for now, the changes themselves do not materially alter the main risk: weak US demand and tariff-driven margin pressure.

Among the latest announcements, lululemon’s new Team Canada Olympic kit exemplifies both product innovation and brand exposure, aligning with the company’s core catalyst of revitalizing interest and driving engagement in North America through fresh design and technical advances. As the company prepares to increase the share of new styles and innovate across core categories, these types of partnerships may help address concerns around brand fatigue and lagging sales in key markets.

But be aware: in contrast, investors should not overlook the ongoing risk from additional US tariffs and the removal of the de minimis exemption, which could…

Read the full narrative on lululemon athletica (it's free!)

lululemon athletica's outlook anticipates $12.8 billion in revenue and $1.9 billion in earnings by 2028. This assumes annual revenue growth of 5.4% and a $0.1 billion increase in earnings from the current $1.8 billion.

Uncover how lululemon athletica's forecasts yield a $193.54 fair value, a 5% upside to its current price.

Exploring Other Perspectives

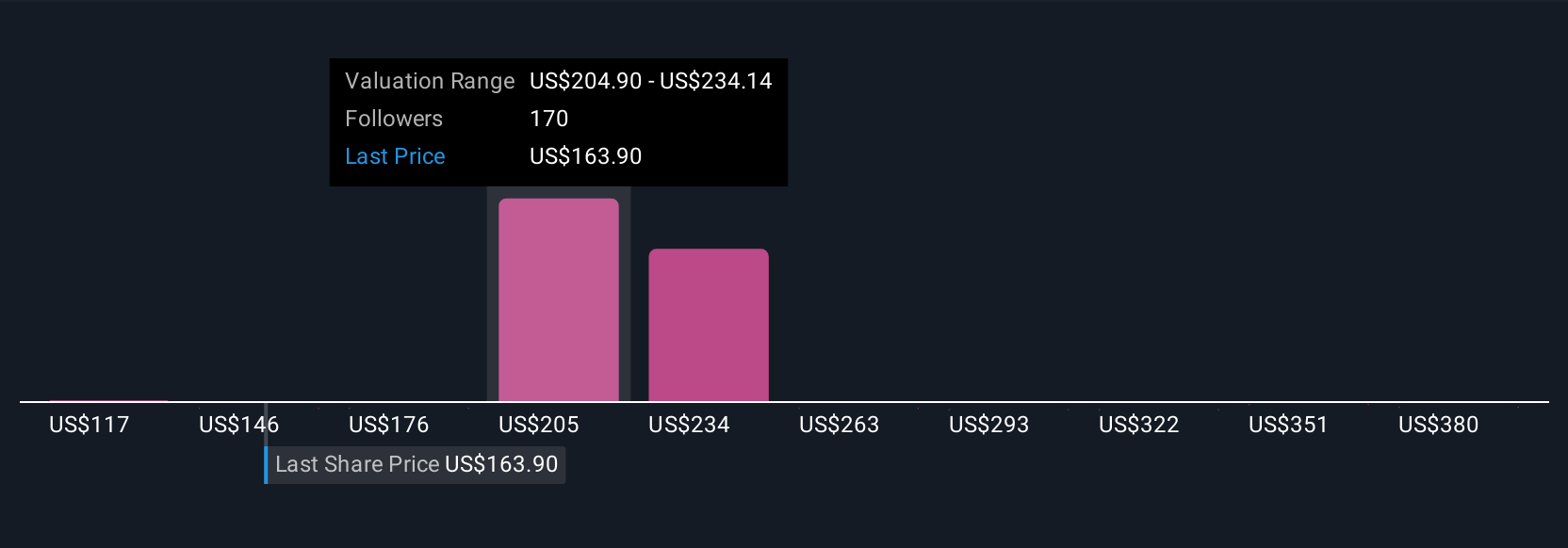

Simply Wall St Community members submitted 46 fair value estimates ranging widely from US$117 to US$410 per share. With so many perspectives, the spotlight lands on weak US demand and how it could limit any expected turnaround and future returns.

Explore 46 other fair value estimates on lululemon athletica - why the stock might be worth over 2x more than the current price!

Build Your Own lululemon athletica Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your lululemon athletica research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free lululemon athletica research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate lululemon athletica's overall financial health at a glance.

Seeking Other Investments?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if lululemon athletica might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:LULU

lululemon athletica

Designs, distributes, and retails technical athletic apparel, footwear, and accessories for women and men under the lululemon brand in the United States, Canada, Mexico, China Mainland, Hong Kong, Taiwan, Macau, and internationally.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026