- United States

- /

- Luxury

- /

- NasdaqGS:LULU

Is Expansion into China and India Shifting lululemon's Competitive Edge and Brand Power (LULU)?

Reviewed by Sasha Jovanovic

- In recent news, lululemon athletica announced key international expansion initiatives, including aggressively growing its Mainland China presence and preparing to enter India via a franchise partner in fiscal 2026, while at the same time facing analyst concerns about heightened competition from Alo Yoga and shifting consumer sentiment in the premium activewear space.

- Analyst commentary suggests that lululemon’s recent product changes may have diluted its core brand appeal, making it more vulnerable to market share losses as newer entrants like Alo Yoga attract high-value customers with competitive promotions.

- With concerns over product direction and consumer engagement mounting, let's examine how these developments influence lululemon's long-term investment narrative.

Outshine the giants: these 27 early-stage AI stocks could fund your retirement.

lululemon athletica Investment Narrative Recap

To be a lululemon athletica shareholder today, you need to believe that its international growth story, especially in key emerging markets like China and India, can offset slower US performance and intensifying competition. The recent news highlights, however, that brand recalibration and a competitive push from Alo Yoga are weighing on the company’s most important catalyst, its ability to reignite US sales, while amplifying near-term risks of margin and market share pressure.

Among the latest announcements, lululemon’s accelerated international expansion, targeting 200 stores in China and a debut in India by fiscal 2026, stands out as particularly relevant. These moves directly support the multi-year revenue runway that the international strategy is expected to provide, but they now face greater scrutiny as investor focus sharpens on execution risks and the pace of penetration in new markets.

By contrast, the heightened competition in premium activewear may create longer-lasting margin pressures that investors should watch for, especially if...

Read the full narrative on lululemon athletica (it's free!)

lululemon athletica's outlook anticipates $12.8 billion in revenue and $1.9 billion in earnings by 2028. This implies a 5.4% annual revenue growth rate and a $0.1 billion earnings increase from the current $1.8 billion.

Uncover how lululemon athletica's forecasts yield a $194.36 fair value, a 15% upside to its current price.

Exploring Other Perspectives

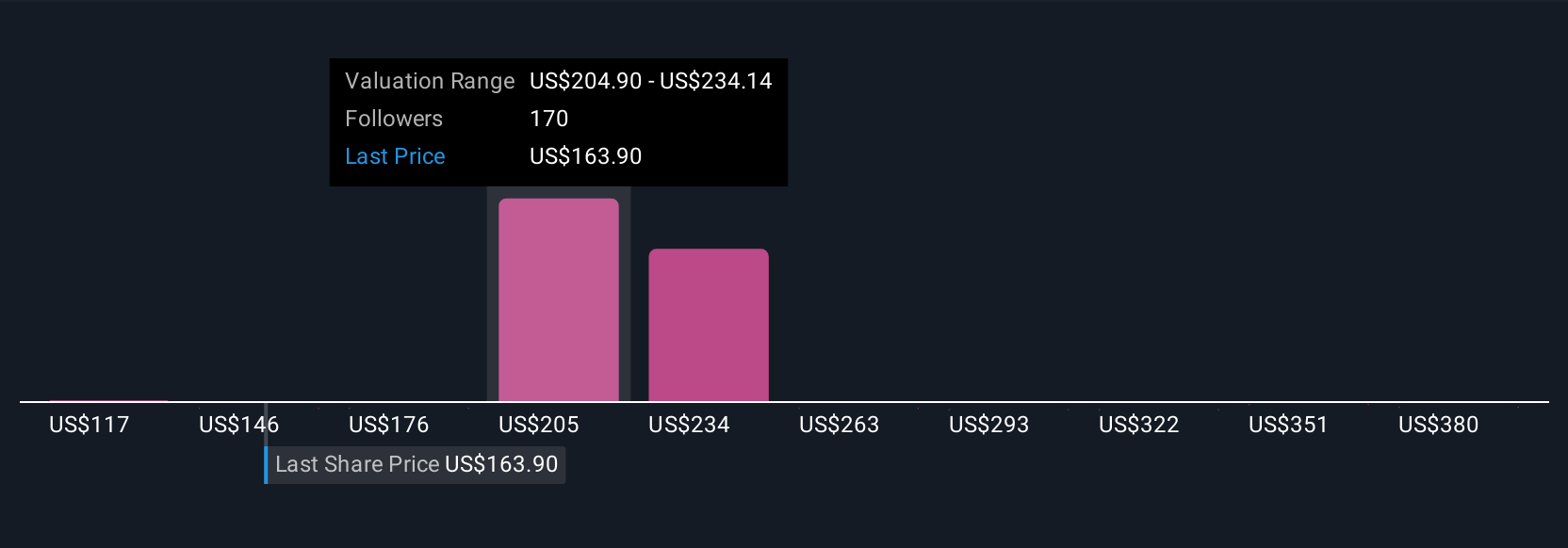

Private investors in the Simply Wall St Community assigned fair values for Lululemon ranging from US$117 to US$409 across 47 unique estimates. While many see meaningful upside, analysts cite rising industry rivalry and margin pressure as crucial factors shaping the company’s prospects, explore how your own outlook compares.

Explore 47 other fair value estimates on lululemon athletica - why the stock might be worth 31% less than the current price!

Build Your Own lululemon athletica Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your lululemon athletica research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free lululemon athletica research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate lululemon athletica's overall financial health at a glance.

Looking For Alternative Opportunities?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if lululemon athletica might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:LULU

lululemon athletica

Designs, distributes, and retails technical athletic apparel, footwear, and accessories for women and men under the lululemon brand in the United States, Canada, Mexico, China Mainland, Hong Kong, Taiwan, Macau, and internationally.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives