- United States

- /

- Consumer Durables

- /

- NasdaqCM:KOSS

Koss (NASDAQ:KOSS) pulls back 13% this week, but still delivers shareholders impressive 32% CAGR over 5 years

Koss Corporation (NASDAQ:KOSS) shareholders might be concerned after seeing the share price drop 23% in the last quarter. But in stark contrast, the returns over the last half decade have impressed. It's fair to say most would be happy with 300% the gain in that time. Generally speaking the long term returns will give you a better idea of business quality than short periods can. Only time will tell if there is still too much optimism currently reflected in the share price. Unfortunately not all shareholders will have held it for five years, so spare a thought for those caught in the 56% decline over the last three years: that's a long time to wait for profits.

Although Koss has shed US$9.9m from its market cap this week, let's take a look at its longer term fundamental trends and see if they've driven returns.

View our latest analysis for Koss

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

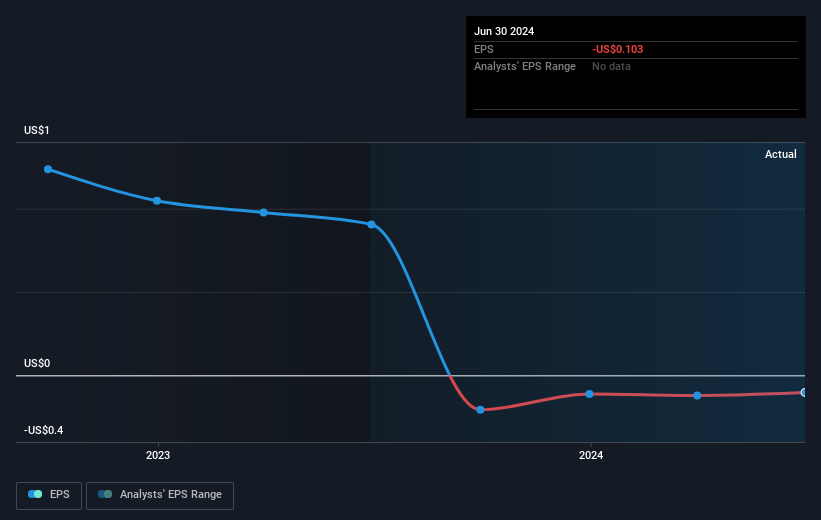

Over half a decade, Koss managed to grow its earnings per share at 29% a year. So the EPS growth rate is rather close to the annualized share price gain of 32% per year. Therefore one could conclude that sentiment towards the shares hasn't morphed very much. Indeed, it would appear the share price is reacting to the EPS.

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

It's probably worth noting that the CEO is paid less than the median at similar sized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. It might be well worthwhile taking a look at our free report on Koss' earnings, revenue and cash flow.

A Different Perspective

We're pleased to report that Koss shareholders have received a total shareholder return of 173% over one year. That's better than the annualised return of 32% over half a decade, implying that the company is doing better recently. In the best case scenario, this may hint at some real business momentum, implying that now could be a great time to delve deeper. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Consider risks, for instance. Every company has them, and we've spotted 2 warning signs for Koss you should know about.

If you are like me, then you will not want to miss this free list of undervalued small caps that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Koss might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:KOSS

Koss

Engages in the design, manufacture, and sale of stereo headphones and related accessories in the United States, Sweden, the Czech Republic, Ukraine, Korea, Georgia, Canada, and internationally.

Flawless balance sheet minimal.