- United States

- /

- Consumer Durables

- /

- NasdaqCM:KOSS

Is Now The Time To Put Koss (NASDAQ:KOSS) On Your Watchlist?

Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

Despite being in the age of tech-stock blue-sky investing, many investors still adopt a more traditional strategy; buying shares in profitable companies like Koss (NASDAQ:KOSS). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Koss with the means to add long-term value to shareholders.

Check out our latest analysis for Koss

How Fast Is Koss Growing Its Earnings Per Share?

In business, profits are a key measure of success; and share prices tend to reflect earnings per share (EPS) performance. So for many budding investors, improving EPS is considered a good sign. It's an outstanding feat for Koss to have grown EPS from US$0.033 to US$1.23 in just one year. Even though that growth rate may not be repeated, that looks like a breakout improvement.

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. To cut to the chase Koss' EBIT margins dropped last year, and so did its revenue. Shareholders will be hoping for a change in fortunes if they're looking for profit growth.

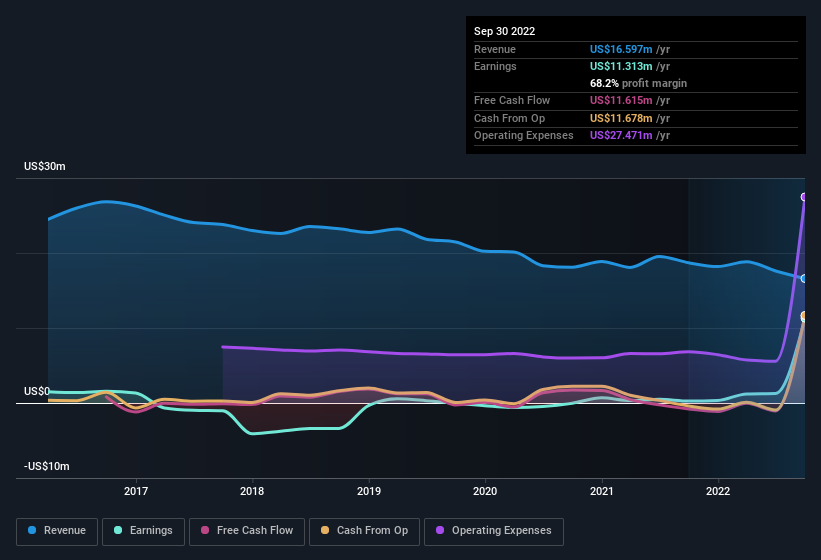

The chart below shows how the company's bottom and top lines have progressed over time. Click on the chart to see the exact numbers.

Koss isn't a huge company, given its market capitalisation of US$55m. That makes it extra important to check on its balance sheet strength.

Are Koss Insiders Aligned With All Shareholders?

Insider interest in a company always sparks a bit of intrigue and many investors are on the lookout for companies where insiders are putting their money where their mouth is. Because often, the purchase of stock is a sign that the buyer views it as undervalued. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

With strong conviction, Koss insiders have stood united by refusing to sell shares over the last year. But more importantly, Independent Director William Sweasy spent US$140k acquiring shares, doing so at an average price of US$7.01. Purchases like this clue us in to the to the faith management has in the business' future.

Recent insider purchases of Koss stock is not the only way management has kept the interests of the general public shareholders in mind. Namely, Koss has a very reasonable level of CEO pay. Our analysis has discovered that the median total compensation for the CEOs of companies like Koss with market caps under US$200m is about US$731k.

Koss offered total compensation worth US$417k to its CEO in the year to June 2022. That comes in below the average for similar sized companies and seems pretty reasonable. CEO remuneration levels are not the most important metric for investors, but when the pay is modest, that does support enhanced alignment between the CEO and the ordinary shareholders. It can also be a sign of good governance, more generally.

Should You Add Koss To Your Watchlist?

Koss' earnings per share have been soaring, with growth rates sky high. Not to mention the company's insiders have been adding to their portfolios and the CEO's remuneration policy looks to have had shareholders in mind seeing as it's quite modest for the company size. The strong EPS growth suggests Koss may be at an inflection point. If so, then its potential for further gains probably merit a spot on your watchlist. We don't want to rain on the parade too much, but we did also find 1 warning sign for Koss that you need to be mindful of.

The good news is that Koss is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Koss might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:KOSS

Koss

Engages in the design, manufacture, and sale of stereo headphones and related accessories in the United States, Sweden, the Czech Republic, Japan, Malaysia, Korea, Canada, and internationally.

Flawless balance sheet with very low risk.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success