- United States

- /

- Consumer Durables

- /

- NasdaqGS:HOFT

Hooker Furnishings Corporation's (NASDAQ:HOFT) P/S Is Still On The Mark Following 25% Share Price Bounce

Hooker Furnishings Corporation (NASDAQ:HOFT) shares have had a really impressive month, gaining 25% after a shaky period beforehand. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 19% in the last twelve months.

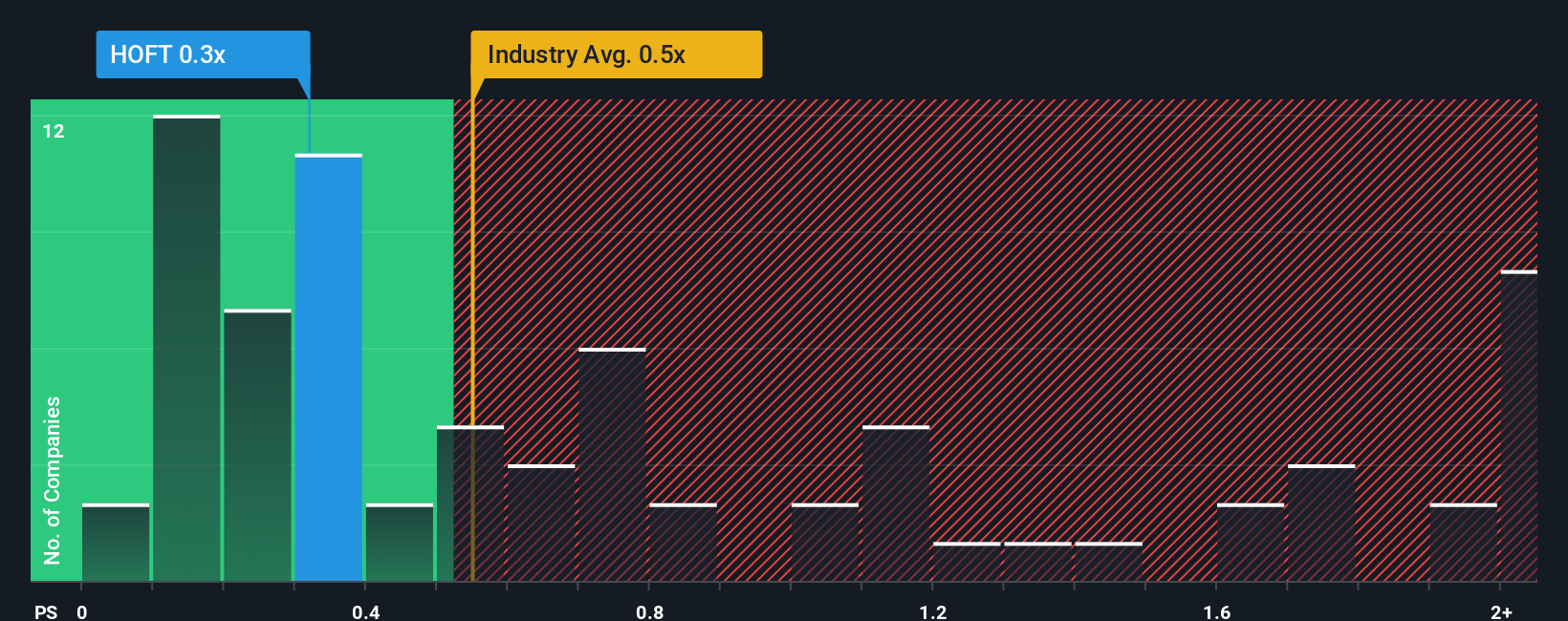

In spite of the firm bounce in price, there still wouldn't be many who think Hooker Furnishings' price-to-sales (or "P/S") ratio of 0.3x is worth a mention when the median P/S in the United States' Consumer Durables industry is similar at about 0.5x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

View our latest analysis for Hooker Furnishings

How Hooker Furnishings Has Been Performing

Hooker Furnishings could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. One possibility is that the P/S ratio is moderate because investors think this poor revenue performance will turn around. If not, then existing shareholders may be a little nervous about the viability of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Hooker Furnishings.How Is Hooker Furnishings' Revenue Growth Trending?

The only time you'd be comfortable seeing a P/S like Hooker Furnishings' is when the company's growth is tracking the industry closely.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 3.9%. As a result, revenue from three years ago have also fallen 33% overall. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Shifting to the future, estimates from the dual analysts covering the company suggest revenue should grow by 7.1% per year over the next three years. Meanwhile, the rest of the industry is forecast to expand by 7.0% per year, which is not materially different.

In light of this, it's understandable that Hooker Furnishings' P/S sits in line with the majority of other companies. It seems most investors are expecting to see average future growth and are only willing to pay a moderate amount for the stock.

What Does Hooker Furnishings' P/S Mean For Investors?

Hooker Furnishings' stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

A Hooker Furnishings' P/S seems about right to us given the knowledge that analysts are forecasting a revenue outlook that is similar to the Consumer Durables industry. At this stage investors feel the potential for an improvement or deterioration in revenue isn't great enough to push P/S in a higher or lower direction. All things considered, if the P/S and revenue estimates contain no major shocks, then it's hard to see the share price moving strongly in either direction in the near future.

It is also worth noting that we have found 1 warning sign for Hooker Furnishings that you need to take into consideration.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Hooker Furnishings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:HOFT

Hooker Furnishings

Designs, manufactures, imports, and markets residential household, hospitality, and contract furniture products.

Good value with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

No miracle in sight

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success