- United States

- /

- Leisure

- /

- NasdaqGS:HAS

Hasbro’s Valuation After New Partnership and 36% Share Price Run in 2025

Reviewed by Bailey Pemberton

- Are you wondering whether Hasbro’s recent run-up means the stock is a hidden gem, or if there’s more to the story beneath the surface?

- After climbing 36.2% year-to-date, Hasbro’s share price has outpaced many of its peers, with a notable 26.2% gain over the past 12 months, even while seeing a modest dip of 1.4% this week.

- These price moves have coincided with the company making headlines for a new partnership deal that could broaden its entertainment reach, along with a sale of non-core assets. Both of these developments have caught investors’ attention and contributed to renewed optimism and volatility.

- But if you look at Hasbro’s current valuation score of 0 out of 6, it suggests that by most traditional methods, the stock isn’t undervalued at all. Next, we’ll break down what that means across different valuation approaches. Stick around, as there is a smarter way to think about value that we’ll get to by the end of this article.

Hasbro scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Hasbro Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company’s value by projecting its future free cash flows and discounting them back to today’s value. It is a widely used method for investors to determine whether a stock’s price reflects its true worth, based on how much cash the business will generate over time.

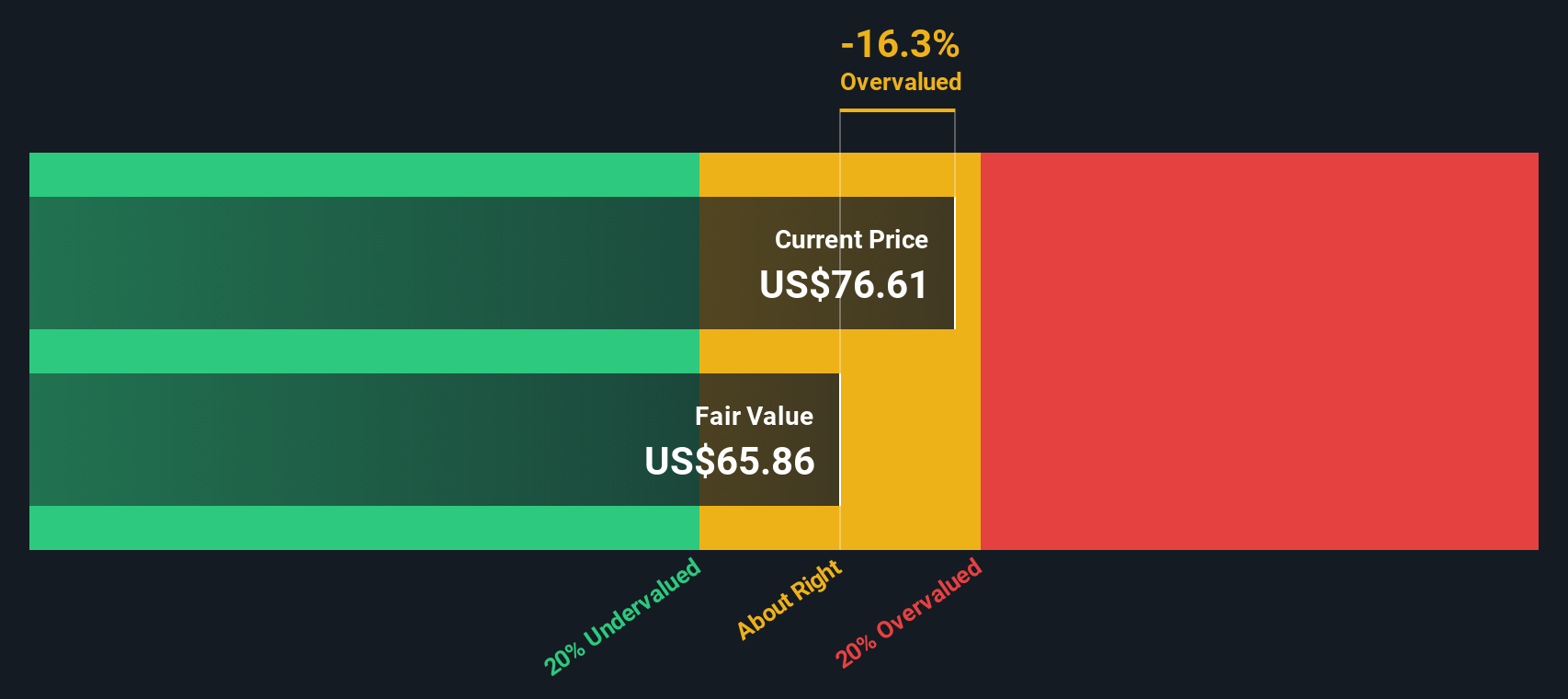

For Hasbro, current Free Cash Flow is $543.9 million. Analyst projections estimate this figure will increase to $859 million in 2026, before moderating to $668 million in 2027. Beyond 2027, future cash flows are extrapolated and show a gradual decline. Simply Wall St forecasts around $472 million by 2035. All cash flows are reported in US dollars.

Using these projections, the DCF model estimates Hasbro’s fair value at $66.16 per share. This reflects a 16.2% premium to the current share price, meaning the stock is considered overvalued based on these cash flow expectations.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Hasbro may be overvalued by 16.2%. Discover 838 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Hasbro Price vs Sales

The Price-to-Sales (P/S) ratio is often the preferred valuation metric for companies like Hasbro whose profitability may fluctuate, but whose revenue base offers a consistent benchmark for comparison. This multiple is especially meaningful for businesses in transitional phases or facing variable margins, as it focuses on top-line performance rather than bottom-line earnings.

A "normal" or "fair" P/S ratio can depend heavily on a company’s growth expectations and risk profile. Rapidly growing or highly innovative companies typically command higher P/S multiples as investors anticipate future sales expansion. Companies in more mature or risky sectors generally trade at lower multiples.

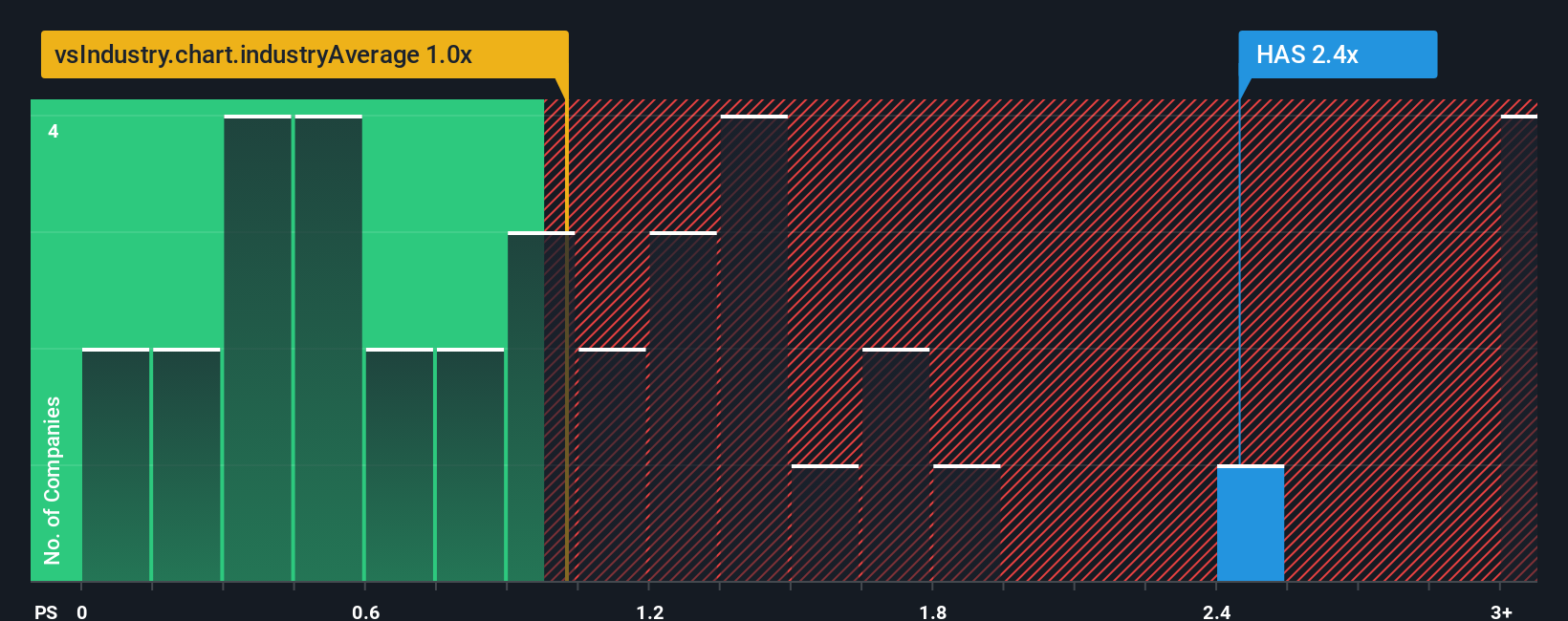

Currently, Hasbro trades at a Price-to-Sales ratio of 2.47x. This is significantly higher than the Leisure industry average of 0.98x and above its peer group average of 1.08x. On the surface, this might suggest that Hasbro is valued at a premium compared to many of its competitors.

However, Simply Wall St’s "Fair Ratio" metric provides deeper insight by factoring in growth prospects, profit margins, market capitalization, and risk, all specific to Hasbro’s unique situation. This proprietary approach aims to reflect what the appropriate multiple should be given all relevant fundamentals, rather than simply comparing to broad industry peers.

For Hasbro, the Fair Ratio is calculated at 1.99x. With the actual P/S multiple at 2.47x, this indicates that the stock is trading above what would be considered fair value on this metric, suggesting it is currently overvalued based on sales fundamentals.

Result: OVERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1403 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Hasbro Narrative

Earlier we mentioned there is a smarter way to look at valuation, so let's introduce you to Narratives. A Narrative is your unique investment story: it brings together your view on a company’s products, strategy, industry shifts, and management with your own numbers, such as future revenue, profit margins, and fair value estimates, connecting what you believe will happen to what a stock is worth.

Unlike a static spreadsheet or a single analyst forecast, Narratives link Hasbro’s story to a financial forecast and turn that into a real, actionable fair value estimate. Narratives are easy to use and available to everyone on Simply Wall St’s Community page, where millions of investors share their perspectives and assumptions, so you can see the full range of possible outcomes in one place.

With Narratives, you can quickly compare your fair value estimate to Hasbro’s current price to decide if you want to buy, sell, or simply watch for more updates. Even better, Narratives update dynamically as new information comes out, reflecting earnings results or headline news. This makes it a living view of the opportunity or risk.

For example, some investors see Hasbro’s value as very low due to shrinking revenues and brand missteps, while others believe digital growth and stronger margins mean the shares are worth much more than today’s price. Your Narrative lets you decide which view makes the most sense to you.

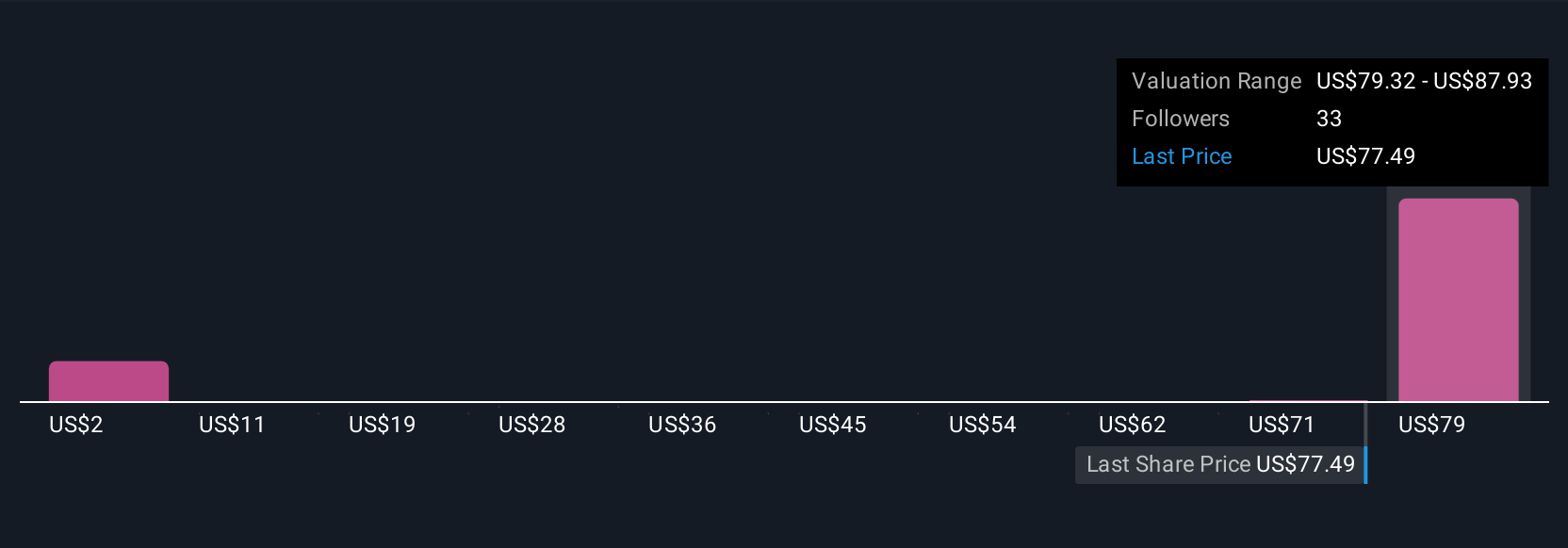

For Hasbro, we will make it easy for you with previews of two leading Hasbro Narratives:

- 🐂 Hasbro Bull Case

Fair Value: $90.67

Undervalued by 15.2%

Revenue Growth Rate: 4.77%

- Growth driven by successful digital gaming, international expansion, and strong franchise brands, producing high-margin recurring income streams.

- Operational efficiency improvements, broader licensing, and cost rationalization are expected to lift profit margins and stabilize long-term earnings.

- Analysts predict 10.5% upside from the current price. Continued success relies on maintaining franchise strength and managing transformation risks.

- 🐻 Hasbro Bear Case

Fair Value: $1.90

Overvalued by 3946.8%

Revenue Growth Rate: -93.0%

- Deep challenges in retail and brand performance, with many flagship properties losing relevance or facing ongoing mismanagement.

- Operational and strategy missteps, including failed video game initiatives and persistent leadership issues, are leading to mounting losses and layoffs.

- Extremely negative outlook. This narrative sees Hasbro’s structure and debt load as unsustainable and warns of severe risk of insolvency.

Do you think there's more to the story for Hasbro? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hasbro might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:HAS

Hasbro

Operates as a toy and game company in the United States, Europe, Canada, Mexico, Latin America, Australia, China, and Hong Kong.

Reasonable growth potential average dividend payer.

Similar Companies

Market Insights

Community Narratives