- United States

- /

- Leisure

- /

- NasdaqGM:ESCA

Escalade (ESCA): One-Off Gain Drives Earnings Growth, Challenging Views on Core Profitability

Reviewed by Simply Wall St

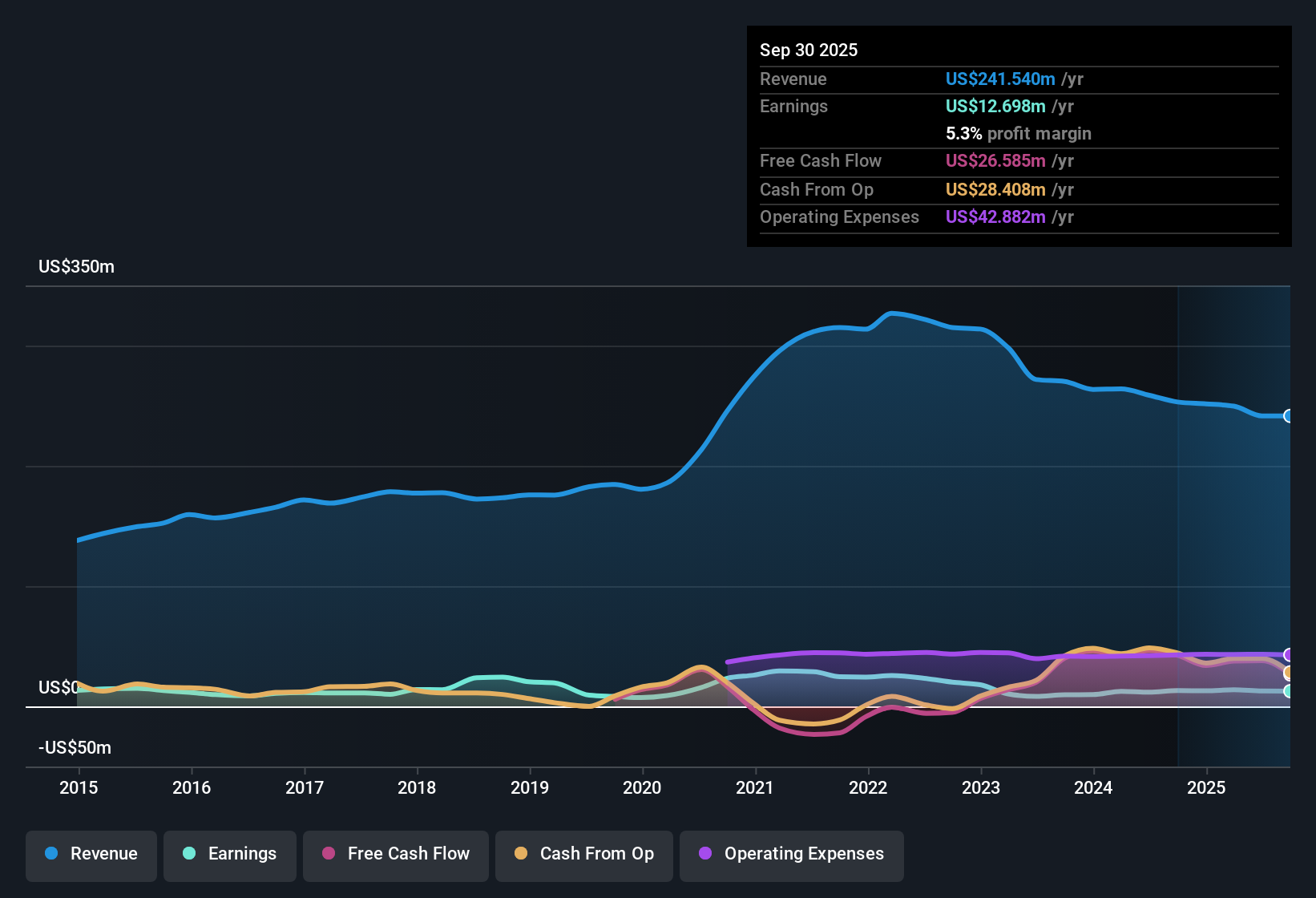

Escalade (ESCA) posted earnings growth of 9% over the past year, reversing a five-year trend of average annual declines of 22.2%. The company reported a net profit margin of 5.3%, up from last year's 4.5%, with results boosted by a significant one-off gain of $3.9 million that impacts reported profitability. While valuation metrics put Escalade well below both peer and industry price-to-earnings ratios, the results highlight both an improved margin picture and the caution flags investors will want to weigh given the non-recurring nature of recent earnings support.

See our full analysis for Escalade.The next section will put Escalade's latest numbers head to head with the prevailing narrative, highlighting whether consensus views are holding up or due for a rethink.

See what the community is saying about Escalade

Tariff Exposure Adds Cost Volatility

- Net sales dropped 13% year-over-year, as delayed customer orders and reduced discretionary spending weighed on demand for Escalade’s products.

- Analysts' consensus view highlights that exposure to tariffs and reliance on globally sourced goods could continue to create cost swings that squeeze gross margins, especially if Escalade cannot fully pass higher costs to customers.

- The consensus narrative also cites the risk that operational improvements might not offset supply chain complexity, risking long-term net earnings power if tariff issues persist.

Repeated One-Off Gains Mask True Profitability

- This year’s reported earnings include a $3.9 million one-time gain, which the EDGAR summary notes materially boosts net profit margin but is not likely to repeat or reflect core performance moving forward.

- According to analysts' consensus, while Escalade’s operational efficiencies are driving cost improvements and fueling margin expansion in theory, these reported results are less convincing given the ongoing use of non-recurring items.

- The consensus narrative flags that profit quality is challenged by items like one-time gains, making it harder to judge sustainable earnings versus short-term boosts.

Shares Priced Below Peer and Analyst Benchmarks

- Shares trade at $11.42, with a price-to-earnings ratio of 12.3x, much lower than both the industry average of 20.1x and analyst target price of $20.00.

- Analysts' consensus view sees the current undervaluation as an opportunity for patient investors, provided Escalade’s revenue and margins stabilize over time.

- The narrative acknowledges that analysts are projecting a gradual decline in revenues and stable margins, but still value the company well above current price levels based on longer-term improvement potential.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Escalade on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have your own angle on the data? Use your insights to build a fresh narrative in just a few minutes. Do it your way

A great starting point for your Escalade research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

See What Else Is Out There

Escalade’s margin improvements rely heavily on one-off gains and non-recurring items, raising questions about the sustainability of its profit growth and revenue stability.

If choppy financials and uneven earnings give you pause, use stable growth stocks screener (2114 results) to find companies that consistently deliver steady revenue and profit expansion through market cycles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Escalade might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:ESCA

Escalade

Manufactures, distributes, imports, and sells sporting goods in North America, Europe, and internationally.

6 star dividend payer with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives