David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. As with many other companies The Dixie Group, Inc. (NASDAQ:DXYN) makes use of debt. But is this debt a concern to shareholders?

When Is Debt A Problem?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

Check out our latest analysis for Dixie Group

What Is Dixie Group's Debt?

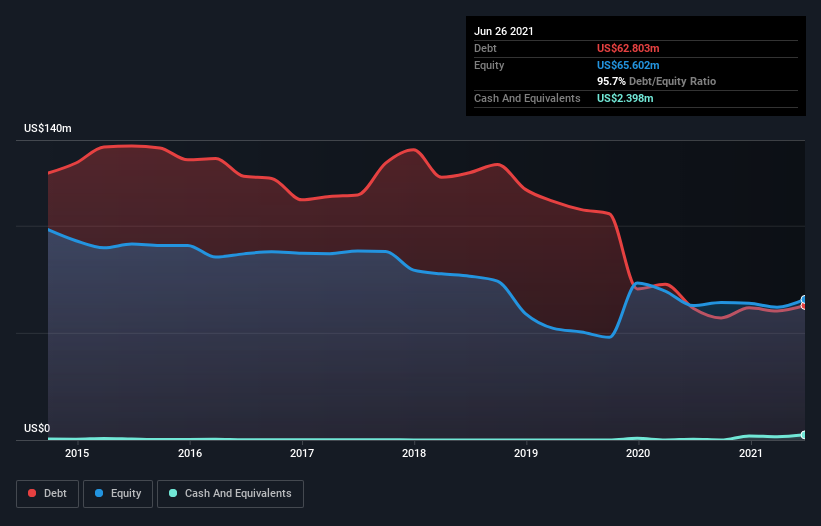

As you can see below, Dixie Group had US$62.8m of debt, at June 2021, which is about the same as the year before. You can click the chart for greater detail. However, it also had US$2.40m in cash, and so its net debt is US$60.4m.

How Healthy Is Dixie Group's Balance Sheet?

According to the last reported balance sheet, Dixie Group had liabilities of US$67.2m due within 12 months, and liabilities of US$113.2m due beyond 12 months. Offsetting these obligations, it had cash of US$2.40m as well as receivables valued at US$51.5m due within 12 months. So its liabilities total US$126.5m more than the combination of its cash and short-term receivables.

This deficit casts a shadow over the US$63.2m company, like a colossus towering over mere mortals. So we definitely think shareholders need to watch this one closely. At the end of the day, Dixie Group would probably need a major re-capitalization if its creditors were to demand repayment.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

While Dixie Group's debt to EBITDA ratio (2.9) suggests that it uses some debt, its interest cover is very weak, at 1.8, suggesting high leverage. It seems clear that the cost of borrowing money is negatively impacting returns for shareholders, of late. However, the silver lining was that Dixie Group achieved a positive EBIT of US$11m in the last twelve months, an improvement on the prior year's loss. When analysing debt levels, the balance sheet is the obvious place to start. But you can't view debt in total isolation; since Dixie Group will need earnings to service that debt. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. So it's worth checking how much of the earnings before interest and tax (EBIT) is backed by free cash flow. In the last year, Dixie Group's free cash flow amounted to 28% of its EBIT, less than we'd expect. That weak cash conversion makes it more difficult to handle indebtedness.

Our View

On the face of it, Dixie Group's interest cover left us tentative about the stock, and its level of total liabilities was no more enticing than the one empty restaurant on the busiest night of the year. Having said that, its ability to grow its EBIT isn't such a worry. We're quite clear that we consider Dixie Group to be really rather risky, as a result of its balance sheet health. For this reason we're pretty cautious about the stock, and we think shareholders should keep a close eye on its liquidity. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately, every company can contain risks that exist outside of the balance sheet. Be aware that Dixie Group is showing 5 warning signs in our investment analysis , and 1 of those is a bit concerning...

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

If you decide to trade Dixie Group, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About OTCPK:DXYN

Dixie Group

Manufactures, markets, and sells floorcovering products to residential customers in North America and internationally.

Good value with mediocre balance sheet.

Similar Companies

Market Insights

Weekly Picks

Ferrari's Intrinsic and Historical Valuation

Investment Thesis: Costco Wholesale (COST)

Undervalued Key Player in Magnets/Rare Earth

Recently Updated Narratives

Investing in the future with RGYAS as fair value hits 228.23

The global leader in cash handling

Wolters Kluwer - A Fundamental and Historical Valuation

Popular Narratives

The "Sleeping Giant" Stumbles, Then Wakes Up

Undervalued Key Player in Magnets/Rare Earth

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion

I'm exiting the positions at great return! WRLG got great competent management. But, 100k oz gold too small in today environment. They might looking for M/A opportunity in the future, or they might get take over by Aris Mining, I don't know. But, Frank Giustra stated he's believed in multi-assets, so that's my speculation. Anyhow, I want to be aggressive in today's gold price. I'm buying Lahontan Gold LG with this as exchange. Higher upside, more leverage. WRLG CEO is BOD's of LG, that's something. This will be my last update on WRLG, good luck!

<b>Reported:</b> Revenue growth: 2024 → 2025 sharp increase of approx. 165%. Assuming moderate annual growth of 40%, a fair value in three years would be approx. $170. Given the customer base and the story, this should be possible. I find the most valuable “property” particularly interesting, as it solves the electricity problem.