- United States

- /

- Consumer Durables

- /

- NasdaqGS:CVCO

Cavco Industries (CVCO) Is Up 8.8% After Strong Earnings and Board Expansion - What's Changed

Reviewed by Sasha Jovanovic

- Cavco Industries recently reported strong second-quarter and six-month financial results, with significant year-over-year growth in sales and net income, and completed two previously announced share repurchase programs totaling 223,609 shares for over US$108 million.

- Amid these financial updates, Cavco also expanded its Board by appointing Lisa L. Daniels, a seasoned leader with extensive audit and advisory expertise, as an independent director.

- We'll examine how Cavco's robust earnings growth enhances its investment narrative, especially in the context of elevated manufactured home demand.

AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Cavco Industries Investment Narrative Recap

To be a shareholder in Cavco Industries, you need to believe in the long-term resilience of manufactured housing demand, supported by persistent affordability challenges in traditional housing. While Cavco’s robust earnings report and recently completed share repurchase programs highlight strong operational results, the most important short-term catalyst remains housing demand, and the biggest risk continues to be exposure to rising tariffs on imported components. The recent updates do not significantly alter these critical business drivers in the near term.

Among the recent announcements, the completed share buybacks totaling over US$108 million stand out, as they demonstrate Cavco’s capital return activity during a period of strong net income growth. While this signals management confidence, the key near-term catalyst is still the underlying volume and pricing strength tied to affordable housing demand, rather than buyback activity itself.

However, investors should keep in mind that if future tariff hikes on imported components are passed through, the risk of margin compression and lower net earnings could become more immediate...

Read the full narrative on Cavco Industries (it's free!)

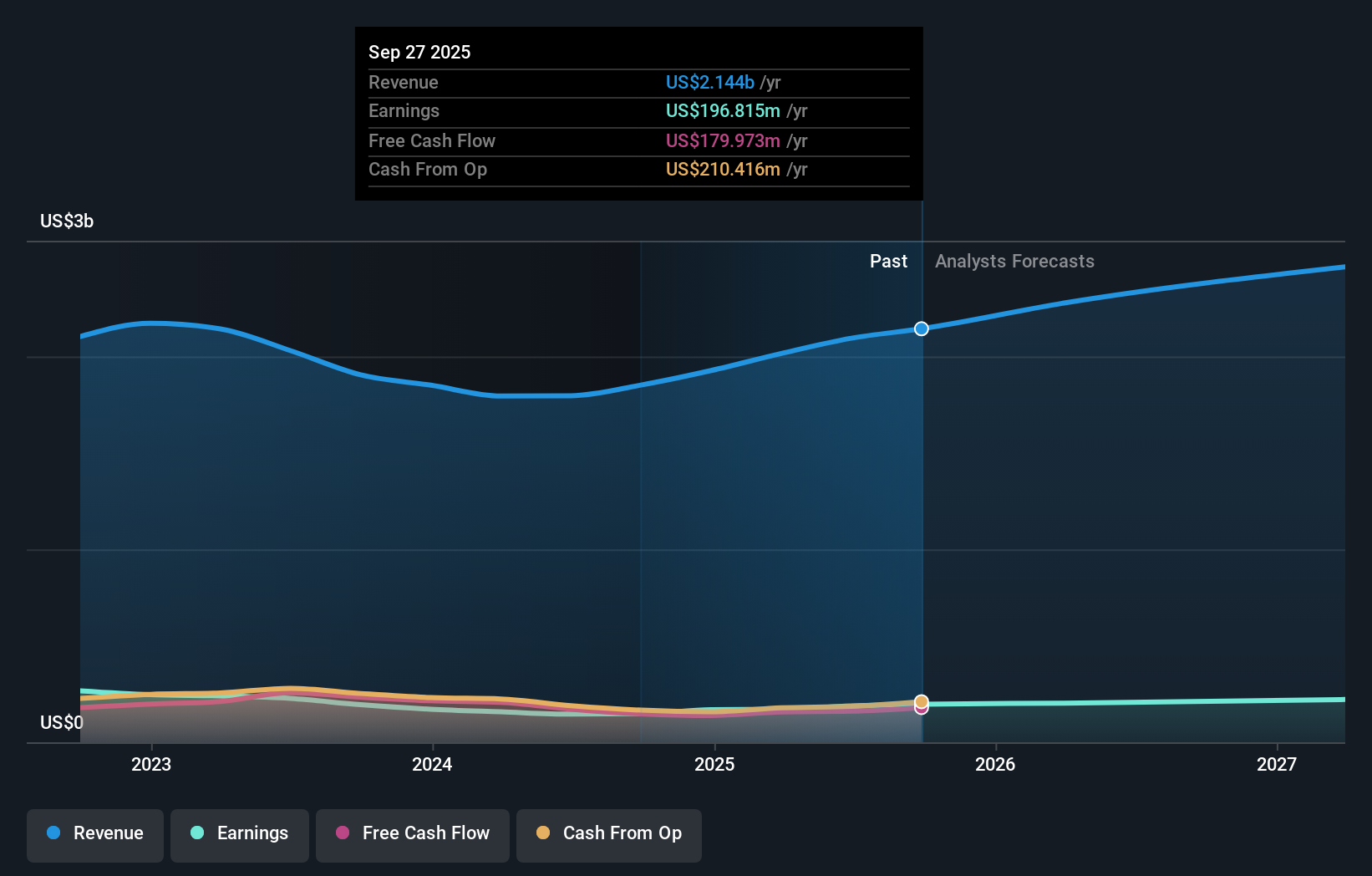

Cavco Industries is projected to reach $2.5 billion in revenue and $230.1 million in earnings by 2028. This outlook implies a 5.8% annual revenue growth rate and a $41.9 million increase in earnings from the current $188.2 million level.

Uncover how Cavco Industries' forecasts yield a $586.67 fair value, in line with its current price.

Exploring Other Perspectives

Simply Wall St Community members placed Cavco’s fair value anywhere from US$347,055 to US$586,667, with two distinct perspectives. These contrasting views highlight how ongoing input cost risks, such as tariffs, can shape consensus around future performance and valuation.

Explore 2 other fair value estimates on Cavco Industries - why the stock might be worth 40% less than the current price!

Build Your Own Cavco Industries Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Cavco Industries research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Cavco Industries research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Cavco Industries' overall financial health at a glance.

Looking For Alternative Opportunities?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Find companies with promising cash flow potential yet trading below their fair value.

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CVCO

Cavco Industries

Designs, produces, and retails factory-built homes primarily in the United States.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives