- United States

- /

- Luxury

- /

- NasdaqGS:CROX

Crocs (CROX): Assessing Valuation Following Third Quarter Sales and Profit Decline

Reviewed by Simply Wall St

Crocs (CROX) just shared its third quarter numbers, and the headline is a dip in both sales and net income compared to last year. Management also signaled that revenue could fall again next quarter.

See our latest analysis for Crocs.

Despite a wave of share buybacks and a fresh round of revenue guidance, Crocs shares have struggled this year. The year-to-date share price return stands at -28.7% and the 12-month total shareholder return is -23%. Ongoing concerns about sales momentum are weighing on the stock, but long-term holders remain well ahead with a 41% five-year total return.

If you’re keeping an eye out for companies with high growth potential and strong insider conviction, now is a great time to broaden your search and discover fast growing stocks with high insider ownership

With Crocs trading about 14% below consensus analyst targets and a five-year return still strong, the question is whether these challenges have set up a buying opportunity or if the market is already pricing in future growth.

Most Popular Narrative: 10.7% Undervalued

With Crocs last closing at $78.43 and the most widely followed narrative assigning a fair value estimate of $87.83, bulls see some upside potential from here. The narrative’s future assumptions shape a story that goes well beyond short-term headwinds.

The company is experiencing robust international growth, particularly in Asia and Europe, where brand engagement, product localization, and new retail formats are driving a higher portion of revenue mix overseas. As international now represents over half of Crocs Brand sales and continues to deliver mid-teens to 30%+ growth, this ongoing global expansion is likely to significantly boost future revenue and diversify earnings away from a more volatile North American consumer environment.

What’s fueling this valuation? Analysts are betting on a shift toward international dominance and see rapid margin expansion, all underpinned by ambitious profit growth and eye-catching reductions in shares outstanding. The full narrative reveals the bold forecasts making this number possible. Explore it to see the exact strategies and outcome scenarios the community is banking on.

Result: Fair Value of $87.83 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing demand pressures in North America and intensifying global trade barriers could present challenges for Crocs as it seeks to meet growth and margin expectations.

Find out about the key risks to this Crocs narrative.

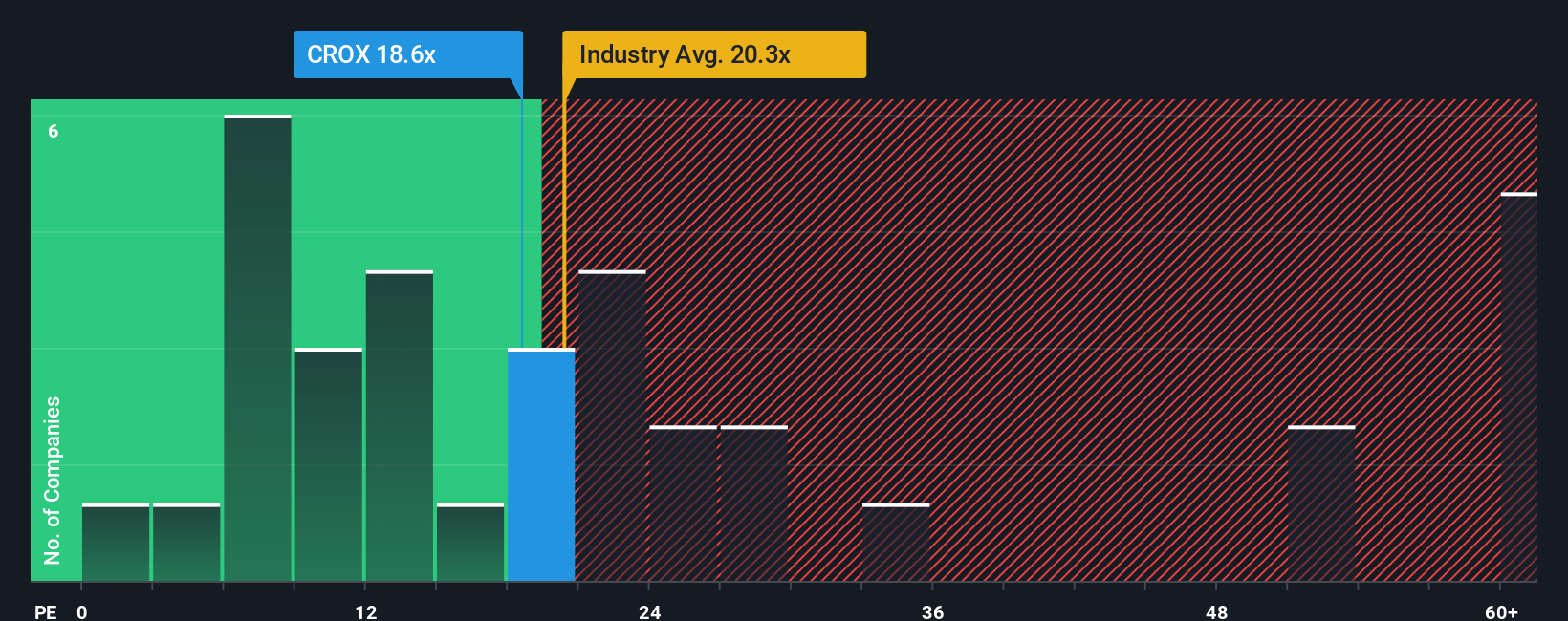

Another View: Market Multiples Tell a Different Story

Looking at Crocs through the lens of its price-to-earnings ratio paints a more cautious picture. With a P/E of 22.3x, Crocs trades higher than both its peer average of 21.5x and the US Luxury industry average of 18.5x. This suggests the market sees more risk or growth potential than its closest rivals. However, this is still far below the fair ratio of 58.6x, which models say the market could ultimately value it at. Does this gap signal an undervalued opportunity, or are investors right to be wary in an uncertain environment?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Crocs Narrative

If you’d rather dig into the details yourself and present your own perspective, you can build a personalized narrative in just a few minutes. Do it your way

A great starting point for your Crocs research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors are always one step ahead. Don’t sit on the sidelines while others spot opportunities based on powerful data-driven research from Simply Wall Street’s suite of stock screeners.

- Capture strong yield growth as you uncover reliable income opportunities with these 17 dividend stocks with yields > 3%, built for consistent returns above 3%.

- Tap into innovations transforming the healthcare sector by finding tomorrow’s leaders using these 32 healthcare AI stocks, which is poised for breakthroughs.

- Aim for market-beating value by targeting under-the-radar companies with these 862 undervalued stocks based on cash flows, highlighting stocks trading below their true potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CROX

Crocs

Designs, develops, manufactures, markets, distributes, and sells casual lifestyle footwear and accessories for men, women, and children under the Crocs and HEYDUDE Brands in the United States and internationally.

Reasonable growth potential and fair value.

Similar Companies

Market Insights

Community Narratives