- United States

- /

- Luxury

- /

- NasdaqGS:COLM

Columbia Sportswear (COLM): Reviewing Valuation After Revenue Beat and Lower Forward Earnings Guidance

Reviewed by Kshitija Bhandaru

Columbia Sportswear (COLM) just delivered a revenue increase over the past year, beating consensus estimates. However, their outlook for next quarter's earnings landed below what many had in mind. This contrast reveals both market optimism and emerging questions about profitability.

See our latest analysis for Columbia Sportswear.

Columbia Sportswear has seen momentum fade in its share price this year, with a year-to-date decline of 37.8% and a 1-year total shareholder return of -35.9%, despite headline-grabbing product launches and a beat on annual revenue. The mixed signals from new initiatives like the Bugaboot 1 reissue and the cautious outlook from management are weighing on market sentiment, as investors reassess growth prospects compared to rising risks.

If you’re curious to see what else is gaining traction beyond apparel and footwear, now is the perfect moment to broaden your perspective and discover fast growing stocks with high insider ownership

With the stock trading far below recent highs, is this a sign that shares are undervalued and due for a rebound? Or is the market already factoring in future headwinds and slower growth ahead?

Most Popular Narrative: 8.4% Undervalued

With Columbia Sportswear trading at $51.41 versus a fair value estimate of $56.12, the narrative signals a moderate discount. There is a mismatch between current sentiment and what the most followed valuation suggests, setting the stage for crucial forward-looking catalysts.

Rising input and compliance costs, along with tariff uncertainty and climate impacts, threaten margins and earnings visibility while increasing inventory and revenue risks. Market share erosion, digital underperformance, and weak emerging brand growth limit diversification and long-term top-line growth potential.

What’s really behind this “fair value” call? The narrative centers on a tight squeeze between pressured profit margins and just enough revenue gains, creating a financial balancing act with some bold expectations factored in.

Result: Fair Value of $56.12 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, strong momentum in international markets or successful digital transformation could challenge the current outlook and significantly increase Columbia’s growth beyond expectations.

Find out about the key risks to this Columbia Sportswear narrative.

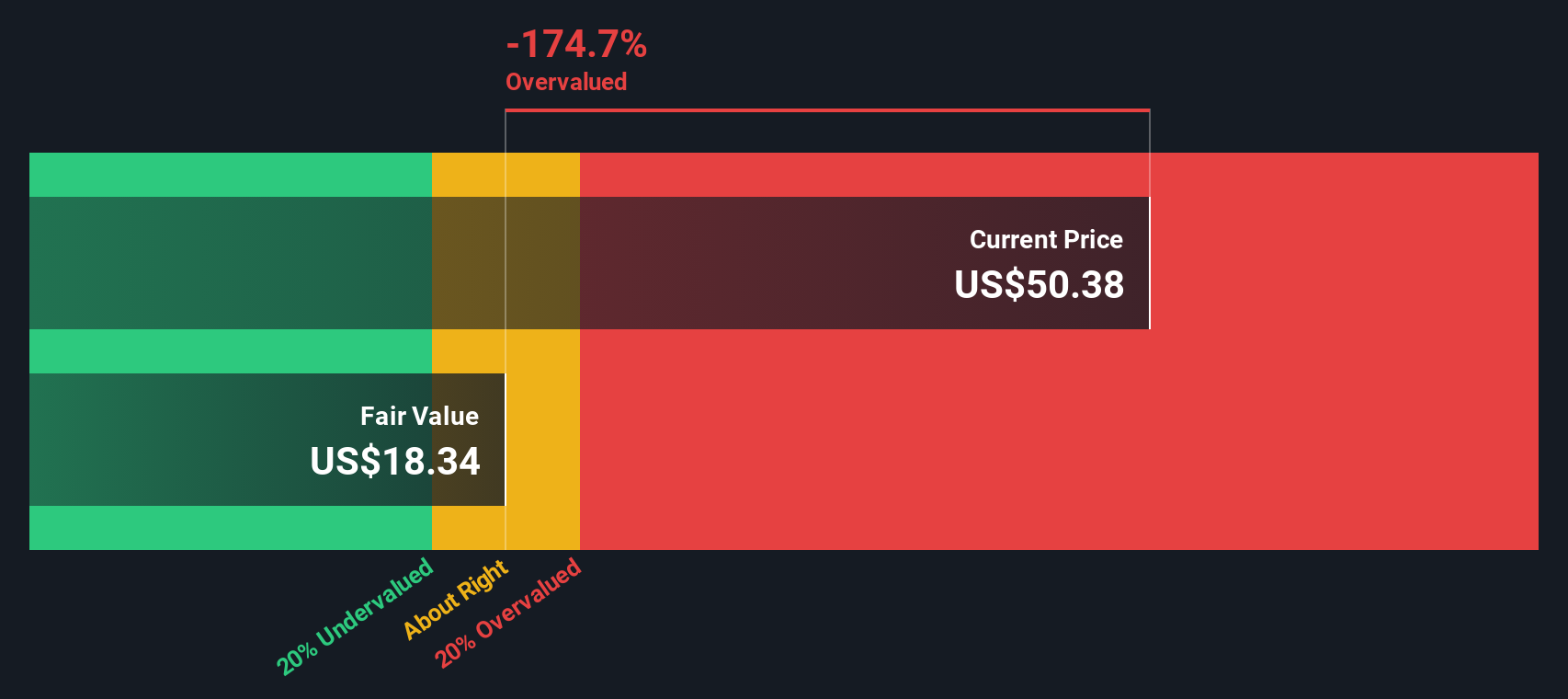

Another View: SWS DCF Model Challenges the Consensus

While analysts find Columbia Sportswear moderately undervalued, our DCF model arrives at a much lower fair value of $18.56. This means the current market price sits well above what discounted cash flow analysis suggests. Could the consensus be overlooking deeper risks, or is the market seeing more future upside than our DCF captures?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Columbia Sportswear for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Columbia Sportswear Narrative

If these perspectives do not align with your own, or you prefer hands-on analysis, you can easily shape your own conclusion from the data in just a few minutes. Do it your way

A great starting point for your Columbia Sportswear research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investing goes beyond one stock. Uncover unique opportunities and stay ahead of the crowd by searching through fresh ideas tailored to your goals using Simply Wall Street’s powerful Screener.

- Capture the upswing in medical innovation and see which companies are driving tomorrow’s health breakthroughs by starting with these 33 healthcare AI stocks.

- Tap into reliable income streams and steady performance by checking out these 18 dividend stocks with yields > 3% with yields tipping above 3%.

- Get ahead of the curve in disruptive technology and find out which enterprises are shaking up industries through these 26 quantum computing stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:COLM

Columbia Sportswear

Designs, develops, markets, and distributes outdoor, active, and lifestyle products in the United States, Latin America, the Asia Pacific, Europe, the Middle East, Africa, and Canada.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives