- United States

- /

- Luxury

- /

- NasdaqGS:COLM

Columbia Sportswear (COLM) Is Down 8.2% After Profit Outlook Falls Short Despite Strong Global Sales – Has The Bull Case Changed?

Reviewed by Sasha Jovanovic

- Columbia Sportswear recently reported mixed third quarter results, with sales of US$943.43 million exceeding the prior year's quarter, but net income dropping to US$52.01 million and a downturn in diluted earnings per share.

- Despite international momentum, the company issued cautious guidance for the fourth quarter and full year 2025, highlighting lower expected margins, ongoing tariff pressures, and impairment charges affecting profitability.

- We'll examine how Columbia's reduced profitability outlook amid sustained international strength shapes its investment narrative going forward.

AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Columbia Sportswear Investment Narrative Recap

To be a Columbia Sportswear shareholder, you need to believe international growth can offset persistent U.S. underperformance while margin pressures and input cost volatility are managed. The latest quarterly results, with resilient sales but a sharp drop in profitability and a cautious outlook, make clear that the most important near-term catalyst, stabilizing U.S. revenue, remains uncertain, just as compressed margins from tariffs and impairments have become the biggest risk for the business. Among recent announcements, the company’s guidance for Q4 2025 and the full year stands out, as it highlights the negative impact of increased tariffs and impairment charges on both operating margin and earnings per share. Investors tracking catalysts and risks closely will find these revised targets especially relevant for understanding Columbia's immediate financial headwinds as it works to protect profitability and pursue growth abroad. In sharp contrast, investors should be aware of the ongoing impact of tariffs and shifting global trade policy, which can...

Read the full narrative on Columbia Sportswear (it's free!)

Columbia Sportswear is projected to reach $3.7 billion in revenue and $184.1 million in earnings by 2028. This outlook is based on an assumed annual revenue growth rate of 2.3% and an earnings decrease of $40.7 million from current earnings of $224.8 million.

Uncover how Columbia Sportswear's forecasts yield a $58.22 fair value, a 16% upside to its current price.

Exploring Other Perspectives

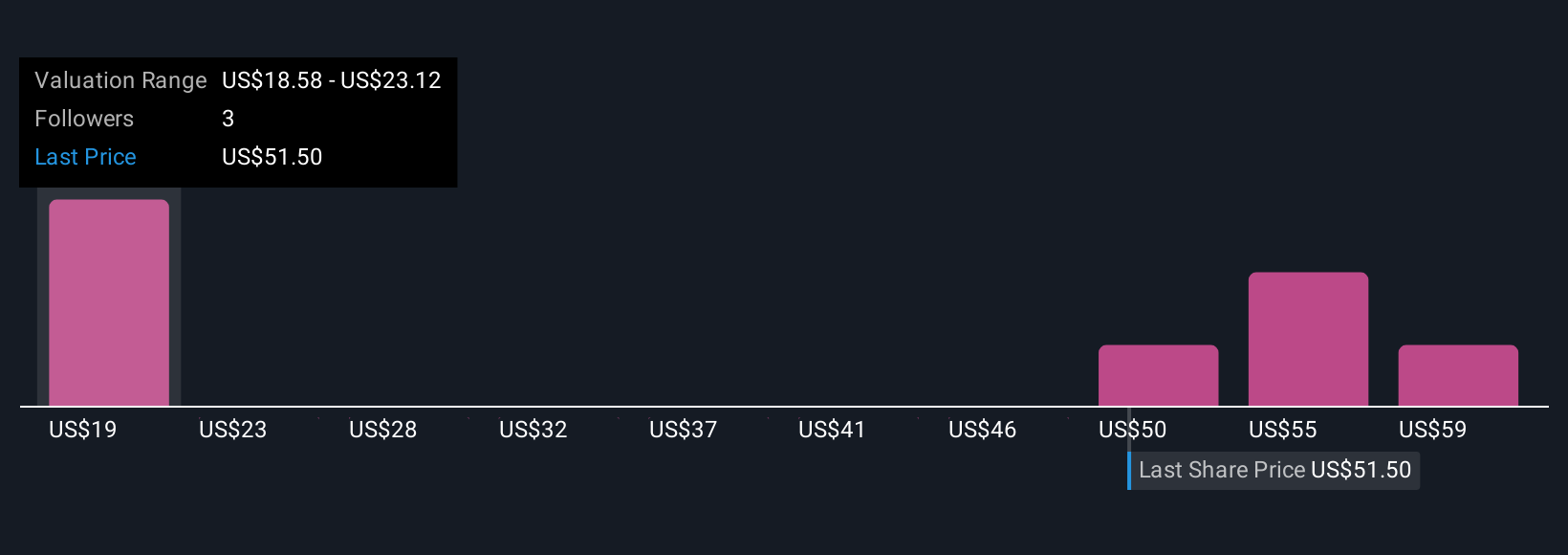

Four community estimates put Columbia’s fair value between US$18 and US$64 per share. While these opinions differ, margin pressures from rising tariffs could remain a critical issue for the company’s outlook. Compare your view with the range of perspectives in the Simply Wall St Community.

Explore 4 other fair value estimates on Columbia Sportswear - why the stock might be worth as much as 27% more than the current price!

Build Your Own Columbia Sportswear Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Columbia Sportswear research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

- Our free Columbia Sportswear research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Columbia Sportswear's overall financial health at a glance.

Seeking Other Investments?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Find companies with promising cash flow potential yet trading below their fair value.

- Rare earth metals are the new gold rush. Find out which 38 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:COLM

Columbia Sportswear

Designs, develops, markets, and distributes outdoor, active, and lifestyle products in the United States, Latin America, the Asia Pacific, Europe, the Middle East, Africa, and Canada.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives