- United States

- /

- Commercial Services

- /

- NYSEAM:DSS

Document Security Systems (NYSEMKT:DSS) Has Debt But No Earnings; Should You Worry?

The external fund manager backed by Berkshire Hathaway's Charlie Munger, Li Lu, makes no bones about it when he says 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. Importantly, Document Security Systems, Inc. (NYSEMKT:DSS) does carry debt. But the more important question is: how much risk is that debt creating?

When Is Debt A Problem?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. If things get really bad, the lenders can take control of the business. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. When we examine debt levels, we first consider both cash and debt levels, together.

Check out our latest analysis for Document Security Systems

How Much Debt Does Document Security Systems Carry?

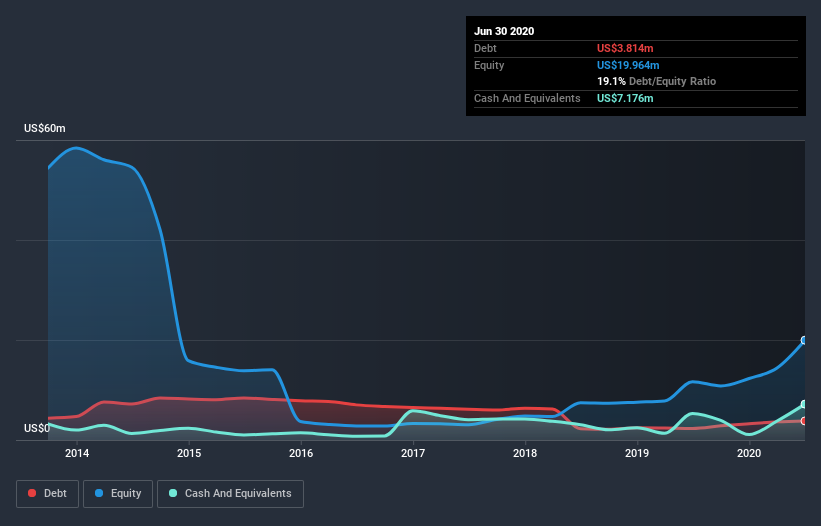

The image below, which you can click on for greater detail, shows that at June 2020 Document Security Systems had debt of US$3.81m, up from US$2.31m in one year. However, it does have US$7.18m in cash offsetting this, leading to net cash of US$3.36m.

How Strong Is Document Security Systems's Balance Sheet?

We can see from the most recent balance sheet that Document Security Systems had liabilities of US$2.83m falling due within a year, and liabilities of US$4.62m due beyond that. Offsetting this, it had US$7.18m in cash and US$2.45m in receivables that were due within 12 months. So it can boast US$2.17m more liquid assets than total liabilities.

This short term liquidity is a sign that Document Security Systems could probably pay off its debt with ease, as its balance sheet is far from stretched. Simply put, the fact that Document Security Systems has more cash than debt is arguably a good indication that it can manage its debt safely. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately the future profitability of the business will decide if Document Security Systems can strengthen its balance sheet over time. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Over 12 months, Document Security Systems made a loss at the EBIT level, and saw its revenue drop to US$18m, which is a fall of 5.9%. We would much prefer see growth.

So How Risky Is Document Security Systems?

We have no doubt that loss making companies are, in general, riskier than profitable ones. And in the last year Document Security Systems had an earnings before interest and tax (EBIT) loss, truth be told. Indeed, in that time it burnt through US$5.8m of cash and made a loss of US$2.8m. With only US$3.36m on the balance sheet, it would appear that its going to need to raise capital again soon. Even though its balance sheet seems sufficiently liquid, debt always makes us a little nervous if a company doesn't produce free cash flow regularly. There's no doubt that we learn most about debt from the balance sheet. However, not all investment risk resides within the balance sheet - far from it. Consider for instance, the ever-present spectre of investment risk. We've identified 5 warning signs with Document Security Systems (at least 2 which make us uncomfortable) , and understanding them should be part of your investment process.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

If you decide to trade Document Security Systems, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About NYSEAM:DSS

DSS

Operates in the product packaging, biotechnology, commercial lending, securities and investment management, and direct marketing businesses in the United States.

Slight risk with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives