- United States

- /

- Commercial Services

- /

- NYSE:WM

Waste Management (WM): Evaluating Valuation After Earnings Miss and Revised Outlook in Recycling, Healthcare Segments

Reviewed by Simply Wall St

Waste Management (WM) delivered its third-quarter results this week, falling short of Wall Street’s forecasts on both revenue and earnings. The company lowered its full-year revenue outlook because of continued headwinds in recycled commodity prices and its healthcare solutions segment.

See our latest analysis for Waste Management.

After the earnings miss, Waste Management’s share price slid, continuing a lackluster trend, down 12.4% over the last three months and sitting close to breakeven for the year. Big picture, the stock’s one-year total shareholder return of -5.7% contrasts with its impressive 81% five-year total return. This highlights long-term growth but fading recent momentum as the company navigates challenging recycled commodity prices and integration of new segments.

If you’re looking to spot what else might be building momentum, consider broadening your research and discover fast growing stocks with high insider ownership.

With momentum cooling and guidance now lowered, the big question is whether Waste Management’s recent slip has created an undervalued entry point or if the market is already accounting for its future prospects.

Most Popular Narrative: 18.7% Undervalued

Compared to the latest closing price, Waste Management’s fair value is set notably higher by the most widely followed narrative. This raises questions about what is powering these estimates. This gap opens up some intriguing possibilities for shareholders considering future returns.

The integration and optimization of WM Healthcare Solutions are on track to deliver significant synergies, anticipated to reach $250 million annually by 2027, positively impacting earnings. The continued focus on scaling the core business through acquisitions, with a robust pipeline and expected higher levels of solid waste M&A, could drive revenue growth.

Want to know what is fueling this bullish outlook? One key ingredient in this narrative is ambitious profit expansion, enabled by technology and new segments. Curious how big those gains could get? Find out the surprising projections behind the forecast and see why this valuation leans so high.

Result: Fair Value of $246.64 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, analysts note that a stalled integration of new acquisitions or economic pressures on key business segments could undercut Waste Management’s optimistic growth outlook.

Find out about the key risks to this Waste Management narrative.

Another View: Valuation by Multiples

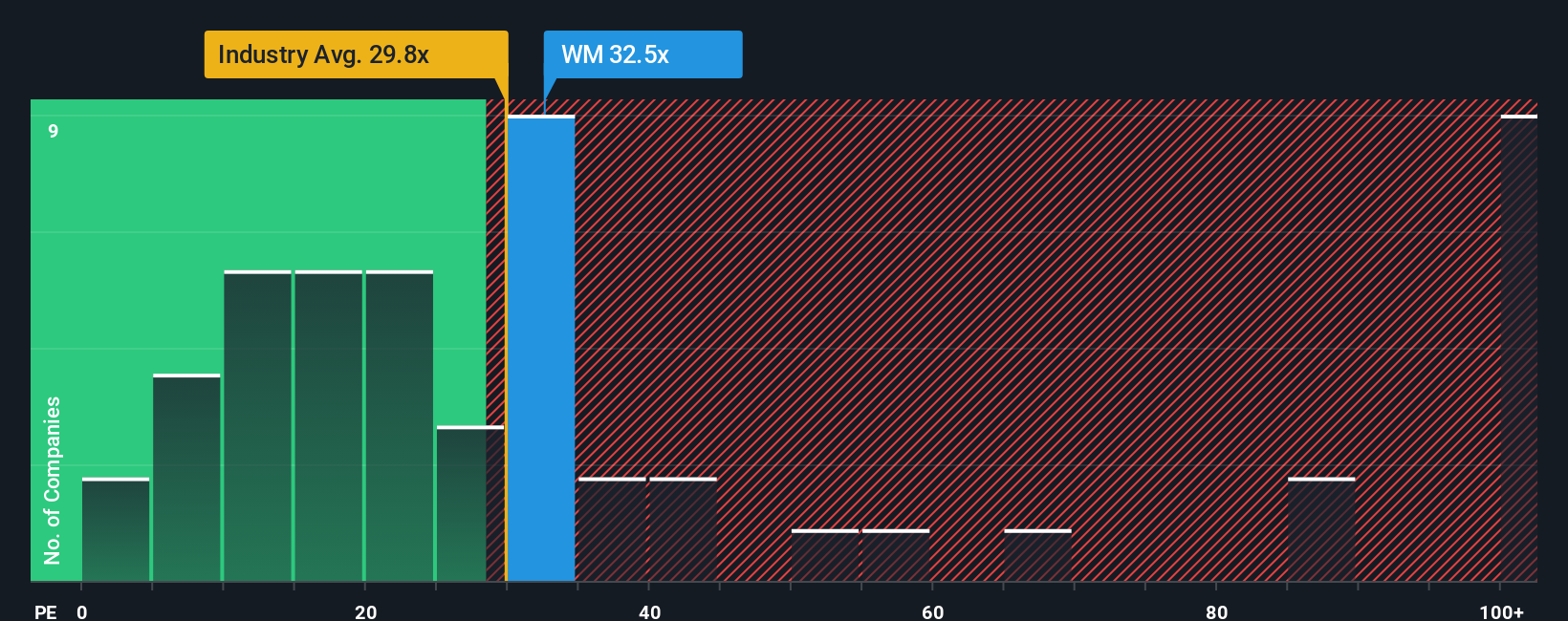

While analyst forecasts suggest Waste Management is undervalued, its price-to-earnings ratio tells a different story. At 31.5x, it is significantly higher than both the industry average of 22.3x and the broader market. This suggests investors may be factoring in a premium for stability, but also exposes downside risk if expectations slip. Could the market be too optimistic, or does Waste Management deserve this valuation?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Waste Management Narrative

If you want to look beyond the consensus and build your own understanding, you can explore the numbers and assemble your own perspective in just minutes with Do it your way.

A great starting point for your Waste Management research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Winning Ideas?

Stay ahead by tapping into fresh investment opportunities tailored to your goals. Here are three handpicked ways to find stocks with the potential to outperform:

- Capture the upside of high-yield assets and spot income opportunities by checking out these 24 dividend stocks with yields > 3% with attractive payouts above 3%.

- Pinpoint hidden potential by reviewing these 831 undervalued stocks based on cash flows that stand out for compelling value based on solid fundamentals.

- Take advantage of cutting-edge innovation and back your conviction in the future of medicine through these 34 healthcare AI stocks advancing healthcare with AI breakthroughs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Waste Management might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WM

Waste Management

Through its subsidiaries, provides environmental solutions to residential, commercial, industrial, and municipal customers in the United States, Canada, Western Europe, and internationally.

Established dividend payer and fair value.

Similar Companies

Market Insights

Community Narratives